11/5/2024 Mid-Day Fertilizer Market Update

International

- Biggest discussion point today remains on the Belarusian commentary about cutting potash production rates due to the current low pricing

- Personally, I'm not as worried if it is just Belarus that makes a cut...but if they get Russia to do the same

- 2023 potash exports

- Canada - 23M

- Russia - 11M

- Belarus - 5.2M

- However, if we go back to 2021 before the world went haywire

- Canada - 21.6M

- Russia - 10M

- Belarus - 10M

- Belarus has continued to make gains this year to return to normal export levels so a 10% cut is real tonnage...but still come back to thinking they need "help"

- On the urea side, the market continues its normal progressions thru the India tender

- Keep in mind that offers are due Monday

- Hopefully that means we get offer info on Monday as well

- Paper trades today

- December Egypt Urea Paper - $355 / $355

North America

- Another NOLA urea physical barge traded this morning at $312 after hearing of a couple at $310 directly

- This continues to reflect a hefty discount to world replacement values

- Today, that is no big deal

- There are plenty of weeks/months between now and spring

- However, eventually we will need to call tonnages

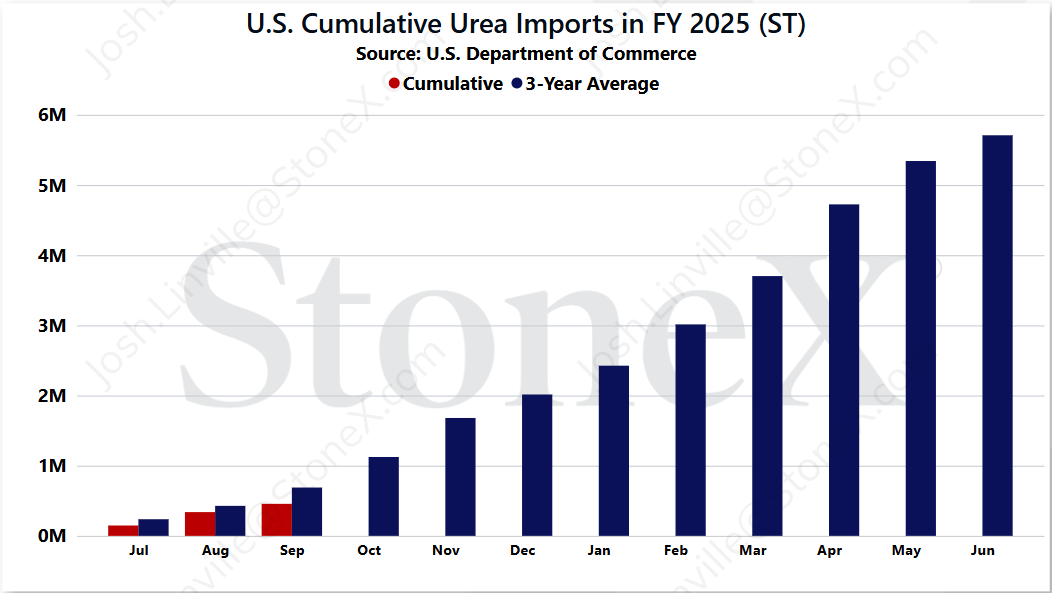

- Speaking of imports, you likely saw Mike's flash report of U.S. September trade data

- Urea imports were only 118K tons

- The yearly cumulative total sits at 456K

- Now, some folks are going to point to the 3-year average of imports and show how far behind we are

- They are not wrong...but the 3-year average is wrong

- We are forecasting a "need" of around 5.1 to 5.2M tons needed to be imported

- That is vs the 3-year average of 5.7M

- Just something to keep in mind on conversations

- We have plenty of time...but need to get started at some point

- Paper trades today

- December NOLA Urea Paper - $318 / $318

- January NOLA Urea Paper - $322 / $322

- Physical trades today

- November NOLA Urea Physical - $312

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.