10/14/2024 Mid-Day Fertilizer Market Update

I learned an important lesson Friday.

When you have T-Mobile for your cell service and also have T-Mobile for your home internet...you have no backups when they have an outage.

My apologies for Friday call issues. That is on me.

International

- RCF appears to have closed the urea purchase tender, securing approximately 567K tons

- As expected, only 50K ton was secured for the west coast

- The rest of the awards were for east coast destinations

- So what is next?

- Highly likely that we will see another purchase tender announcement in the coming weeks

- There should be a big focus on west coast offers/ports/etc.

- Also likely that this next tender will encompass most of the remainder of 2024

- If this tender is successful, we could see a situation where the ending 2024/beginning 2025 story is "sellers are sold out"

- We have seen this be a very comfortable and supportive story in the past for manufacturers

- However, do not lose sight of what a Chinese urea export return would do

- Usually when we think we have the market figured out, something humbles us quickly

- But a lot of the factors are supporting price ideas today

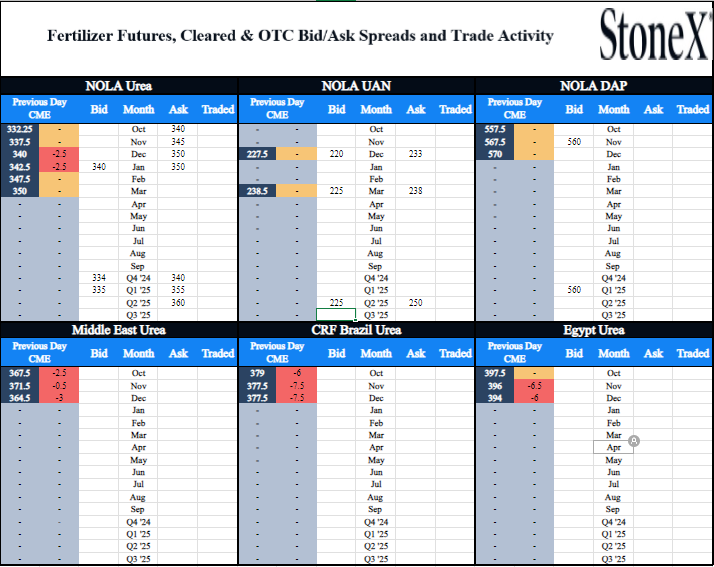

Paper trades today

- None observed

North America

- Grain prices have been under attack this morning

- Dec '24 corn values are down almost 6-cents

- Dec '25 corn values are down 7.5-cents

- This is obviously money directly out of the farmers pocket and should have us slightly concerned (again) about coming fall demand

- Hopefully this is a short term situation and we recover

- Harvest appears to be moving quickly which is a win for fall application

- With crops looking like they will be out of the way, it leaves a wide open window for fertilizer to run

- Now, this can shift quickly if weather turns too cold/wet too early

- However, that currently isn't the case so we remain optimistic

- Sounds like Mosaic production is either back or very close to returning after Hurricane Milton

- They still need to allow their people to get back on their feet at home

- Once that is done, restarts should resume

- Sure, production/supply has been lost and we cannot get that back

- But the worst case scenario did not play out and for that we should be grateful

- I watched a video that showed what would have happened if the storm was only 35 miles north

- Let's just say if it played out, we are discussing a wholly different story this morning

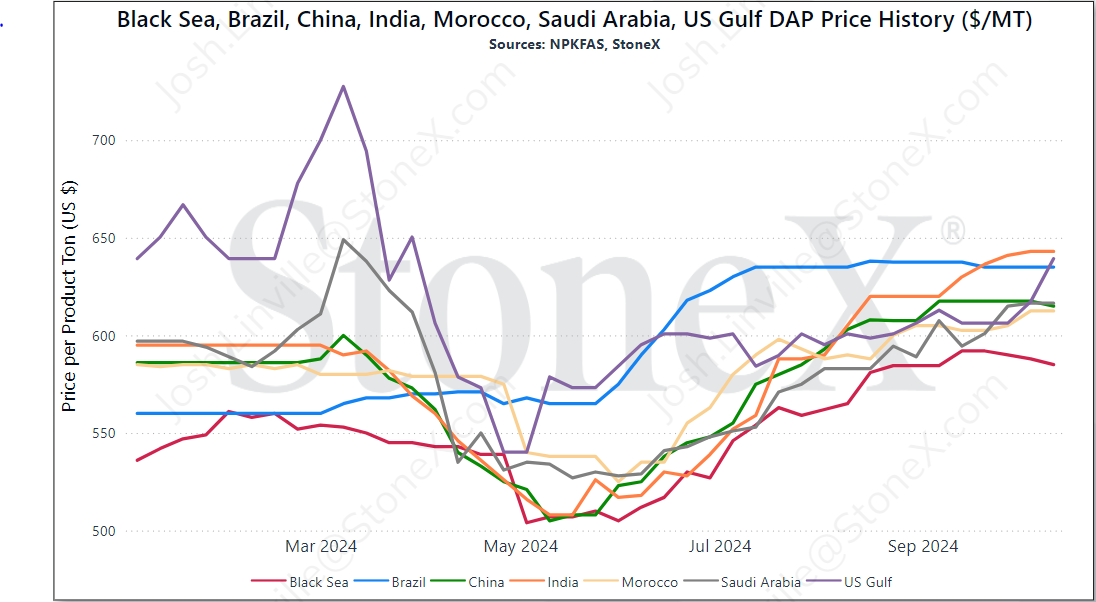

- Last thing to point out. Recently we have talked about NOLA phosphate being "cheap" vs other global buyers

- We have watched DAP values rise on the back of Milton

- NOLA DAP is now in line with Brazil and India in terms of FOB pricing

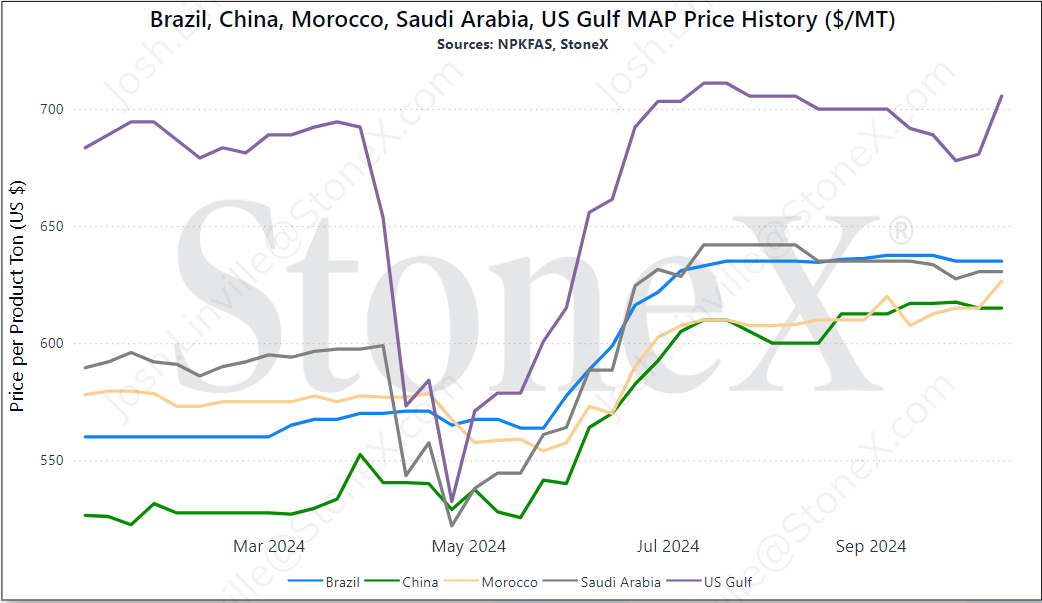

- NOLA MAP is still a significant premium vs the world as it has been

- We can see NOLA DAP move to a world premium as it has happened before, but this takes a bit of the edge off in terms of upside potential

- Paper trades today

- None observed

- Physical trades today

- Prompt NOLA Urea Physical - $311

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.