10/10/2024 Mid-Day Fertilizer Market Update

International

- Always count on a twist in most India tenders!

- As expected, it appears that the west coast awards will be limited to the shockingly low value offer of 50K tons

- All other west coast offers effectively said no

- I'm guessing there was a lot of laughing at even the consideration of matching the L1

- I also thought the East coast would struggle to get awards

- Maybe this thing would end with 150 - 250K secured but offers have been more willing to participate

- So far, it looks like approximately 500K tons of offers have agreed to match the L1 to participate

- If this holds true, that 500K will be on the lowest end of early expectation ranges but on the highest end of recent expectations

- So what does this mean/how can it be interpreted?

- First, I think we see another purchase tender very shortly (next few weeks/1st week November) where the focus is on the west coast

- Shipment period likely grabs the remainder of 2024

- If successful, this "should" take care of any excessive inventories left in the western world

- Then Q1 starts with very comfortably sold manufacturers who are well aware of spring preparations for Northern Hemisphere markets

- What are the dangers in this scenario?

- I still think it is China

- There are few to no firm indications that they are returning in Q4

- There have been rumors but thus far, no substance behind them

- But, if the rumors do come true and we see wave after wave of exports, it is going to hurt the market psyche of the marketplace

- Would be much harder to maintain a bullish attitude if they return, even if the fundamentals point to a tight marketplace

- So like most times, watch China

Paper trades today

- November Middle East Urea Paper - $370 / $372

North America

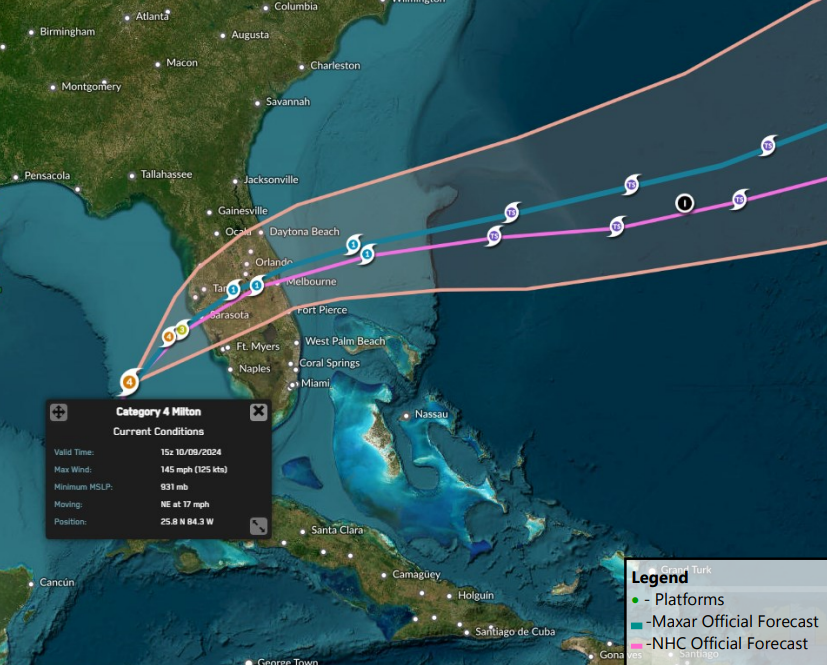

- While it is too early to make a definitive call, it looks like Florida phosphate dodged a huge bullet by the slimmest of margins

- This storm has been tracking east with Tampa dead in its crosshairs

- Storm surge was expected to be 10 - 15' high

- Insane winds as it came ashore as a Cat 4 hurricane was expected to flatten everything in its path

- ...then at the last minute it shifted just south

- Rather than slamming directly into Tampa (or worse, just north of Tampa), the storm shifted south and made landfall around the Sarasota area

- While there will certainly be cleanup, it appears the worst stayed away

- Now, the cleanup is still the part that worries me

- How long will it take for roads to be cleared?

- How long before electric/water/etc. is returned to normal?

- How long before properties and homes are back to normal?

- All of these lead to one thing: how long before workers return to work?

- The phosphate facilities could be largely untouched but without workers, it doesn't matter.

- At this point, there will be production loss if only for the plants being stopped in preparation for the storm.

- How long they are offline will determine how bad this hurts.

- Regardless of the damage/production loss, phosphate values have been on the rise with NOLA DAP barges now in the upper $570's/lower $580's

- NOLA DAP, from a destination perspective, has been "cheap" vs competitors such as Brazil and India

- We have continued to see N.A. inventories "tight" compared to normal

- And now we are believing a surge in demand will be coming as farmers find better yields and slightly improved grain values

- Not to say economics are phenomenal, but you have to agree they are better than they were weeks ago

- We still expect fall demand destruction...but maybe not to the same degree we originally thought

- Paper trades today

- None observed

- Physical trades today

- December NOLA Urea Physical - $343

- January NOLA Urea Physical - $343

- Prompt NOLA DAP Physical - $579

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.