10/9/2024 Mid-Day Fertilizer Market Update

International

- Continues to look like India is going to fall well short of secured tonnage expectations

- Originally, it had been a wide range of estimates

- Some as low as 500K

- Some as high as 1M

- Given the ridiculous west coast L1 value, we can say with a large amount of certainty that India will only secure 50K for that coast

- The east coast was a bit tighter on offered values (because there was not a ridiculously low value set), but still question of how many tons will be purchased

- RCF has countered all east coast offers which doesn't fill us with confidence that higher priced offers are relenting

- Several have speculated that India will end with 150 - 250K secured

- So what would a 150 - 250K secured scenario look like?

- Very likely we see a quick turnaround tender announcement

- Shipment window should encompass the remainder of 2024

- This "should" wipe out any remaining excess tonnages for 2024

- That puts global manufacturers on the front foot heading into 2025

- Star the year low on inventories

- Northern Hemisphere spring demand will be forced forward

- Puts them in the drivers seat

- Of course, anything can happen (*cough, cough* China) but this is the POV today

- Continue to hear India purchasing more phosphate from the world

- Surprising, we are not seeing values rally as originally feared (thank goodness)

- Seems that CFR values remain in the $640's

- However, that can change in a hurry

Paper trades yesterday

- None observed

Paper trades today

- November Middle East Urea Paper - $370 (no open interest so no settlement to compare)

North America

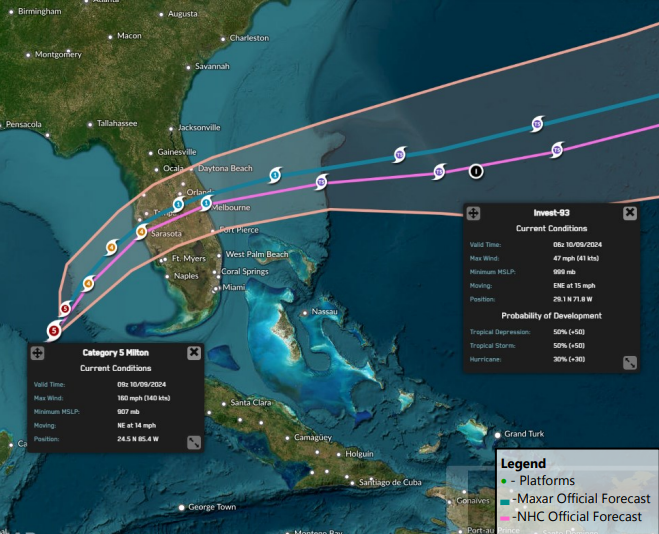

- We continue to monitor Hurricane Milton

- At the moment, it looks like the eye will be going just south of Tampa...though Tampa is still in the range of possibilities

- Whether a direct Tampa shot or not, damage is going to be severe

- The south of these storms have the storm surge while the north have the winds

- If the hurricane does go south, I'm really worried about the impact on infrastructure outside the facilities there

- Facilities can be fine but that doesn't matter if electric/water is out and/or your work force is at home cleaning up

- Every day the plants are down is tonnage the N.A. market is losing

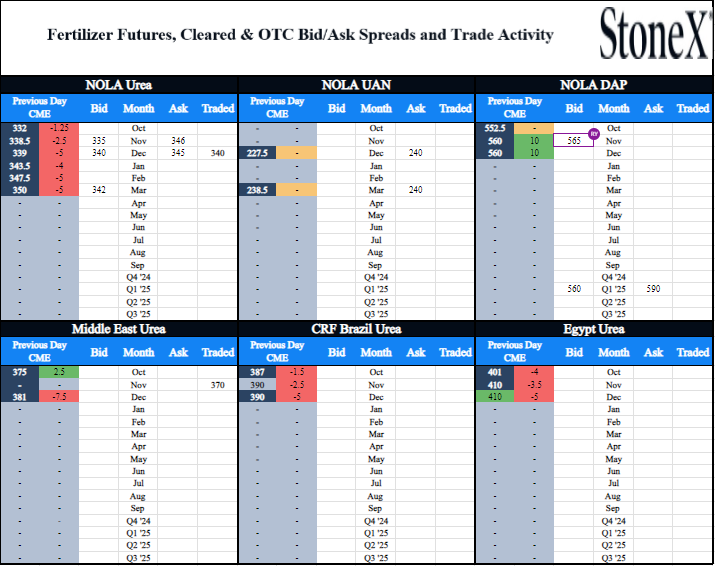

- Paper trades yesterday

- December NOLA Urea Paper - $340 / $338 / $338

- March NOLA Urea Paper - $350

- Paper trades today

- December NOLA Urea Paper - $340 / $340 ($1 HIGHER than settlement)

- Physical trades yesterday

- October NOLA Urea Physical - $331

- November NOLA Urea Physical - $333

- Physical trades today

- Loaded NOLA Urea Physical - $332

- November NOLA Urea Physical - $334 / $335

- Loaded NOLA DAP Physical - $582.50

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.