10/7/2024 Mid-Day Fertilizer Market Update

International

- Talk of the town continues to be the India urea purchase tender offer information

- Still trying to wrap my head around that L1 west coast offer

- This is going to be tough for India

- I never want to use terms like "impossible" because there is always a chance, but whatever the term is for just below impossible, I would use that for India's chance of having any other west coast offers drop their price to sell

- Just hard to see this trend resulting in any significant tonnage

- Literally won't be surprised if they only secure the west and east coast L1's

- Needless to say, we need to be on India urea purchase tender watch already...

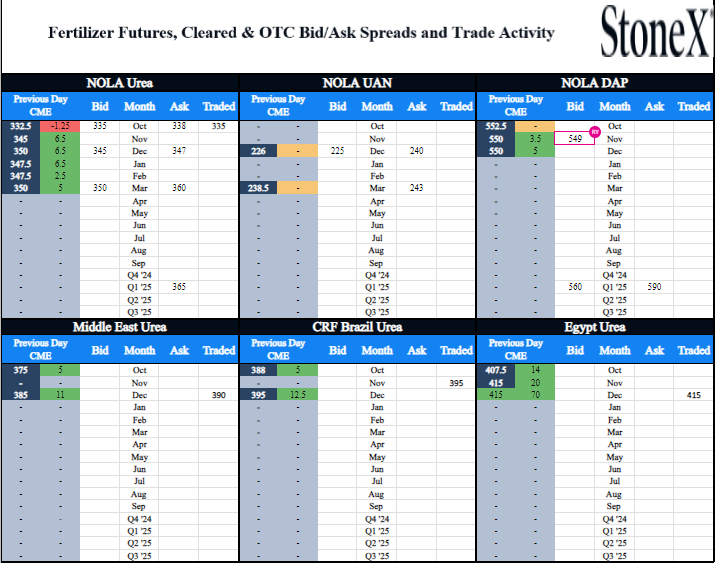

Paper trades today

- December Middle East Urea Paper - $390 ($5 HIGHER than settlement)

- November CFR Brazil Urea Paper - $395 (no open interest)

- December Egypt Urea Paper - $415 (same price as Friday sale)

North America

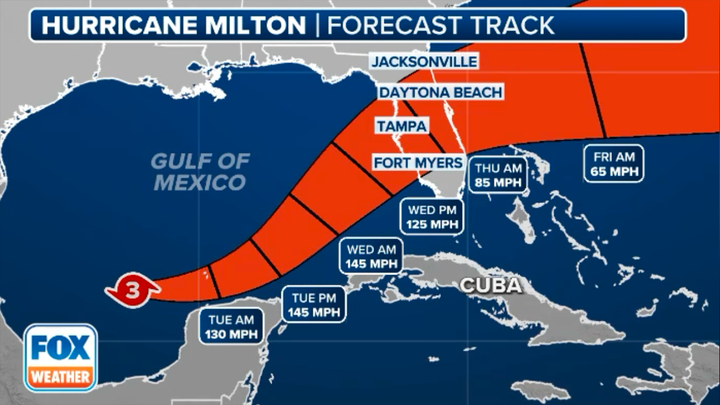

- All NA eyes should be on Hurricane Milton

- Hurricane Helene caused a decent amount of damage, and that was just a glancing blow

- This hurricane can be much, much worse

- This thing is taking a direct west to east shot at Tampa

- It is also rapidly growing with expectations of it being a Cat 4 or 5 by landfall

- Obviously the public devastation could be huge

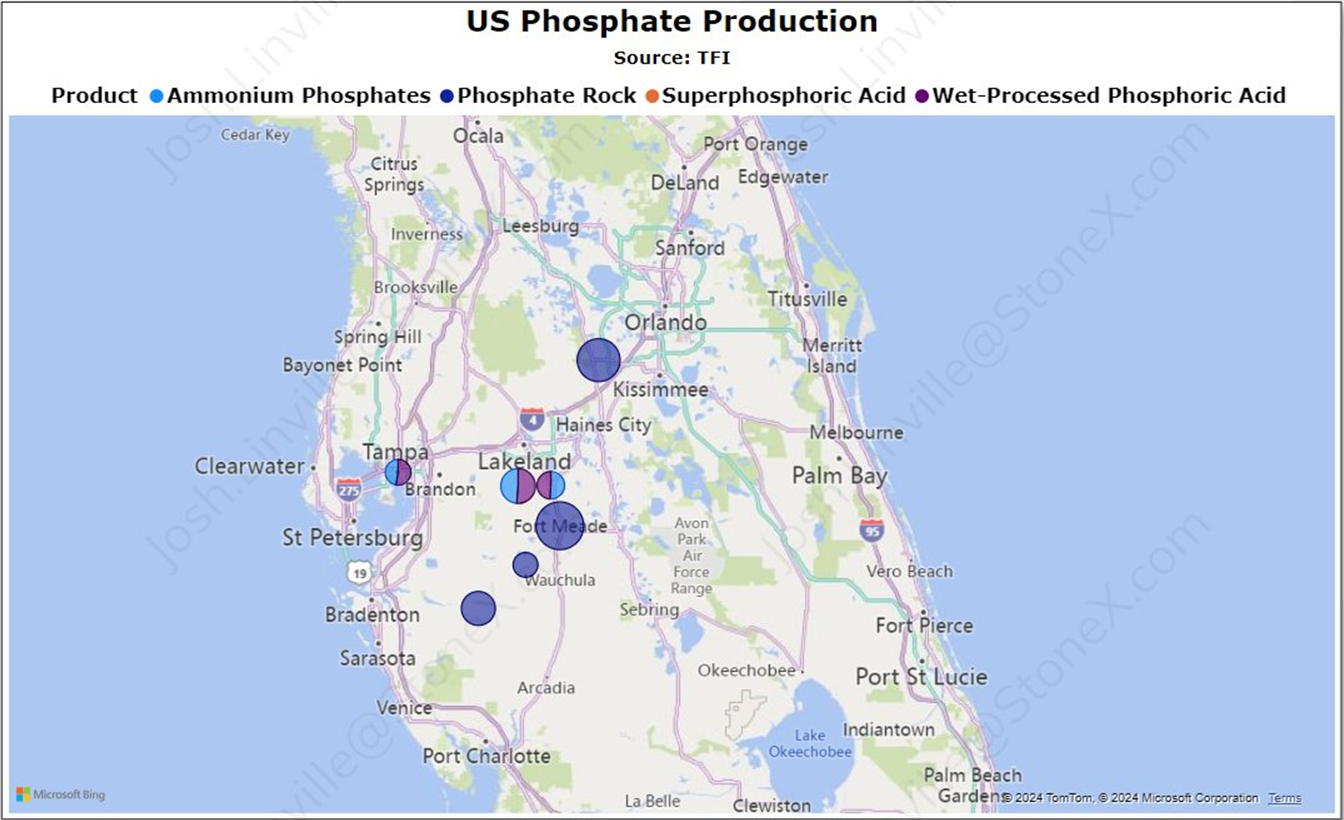

- But we need to consider the fertilizer POV

- With so much of Florida's phosphate production based on the projected path of this storm, this could hurt

- Even if the facilities are largely unscathed, think about the workers

- Their focus needs to be on their homes/families/friends/etc.

- If their attention is focused on that for weeks, then the facility sits idle

- Then think of what could happen from an infrastructure POV

- Water, electricity, etc. can all be impacted by this storm

- There are a lot of layers to this...and fall season is right around the corner

- Paper trades today

- October NOLA Urea Paper - $335 ($2.50 HIGHER than settlement)

- Physical trades today

- Loaded NOLA MAP Physical - $625

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.