FX Weekly Overview: Key Events of the Week

- Bearish factors

- The perception of a more flexible stance by Donald Trump regarding import tariffs boosts global appetite for riskier assets, which tends to weaken the dollar globally.

- Possible advances in peace negotiations between Russia and Ukraine could contribute to a reduction in geopolitical risk perception, which tends to weaken the dollar globally.

- Bullish factors

- The FOMC minutes are expected to reinforce a cautious stance and raise expectations that US interest rates will remain higher for longer, thereby strengthening the dollar globally.

- The IBC-Br is expected to indicate a slowdown in the Brazilian economy in December, which may result in more moderate increases in the basic interest rate (Selic) and contribute to weakening the real.

The week in review

The week was marked by the perception that Donald Trump was adopting a more flexible and negotiable stance regarding import tariffs, after the US president proposed tariffs on steel and aluminum only for March and “reciprocal tariffs” only for April.

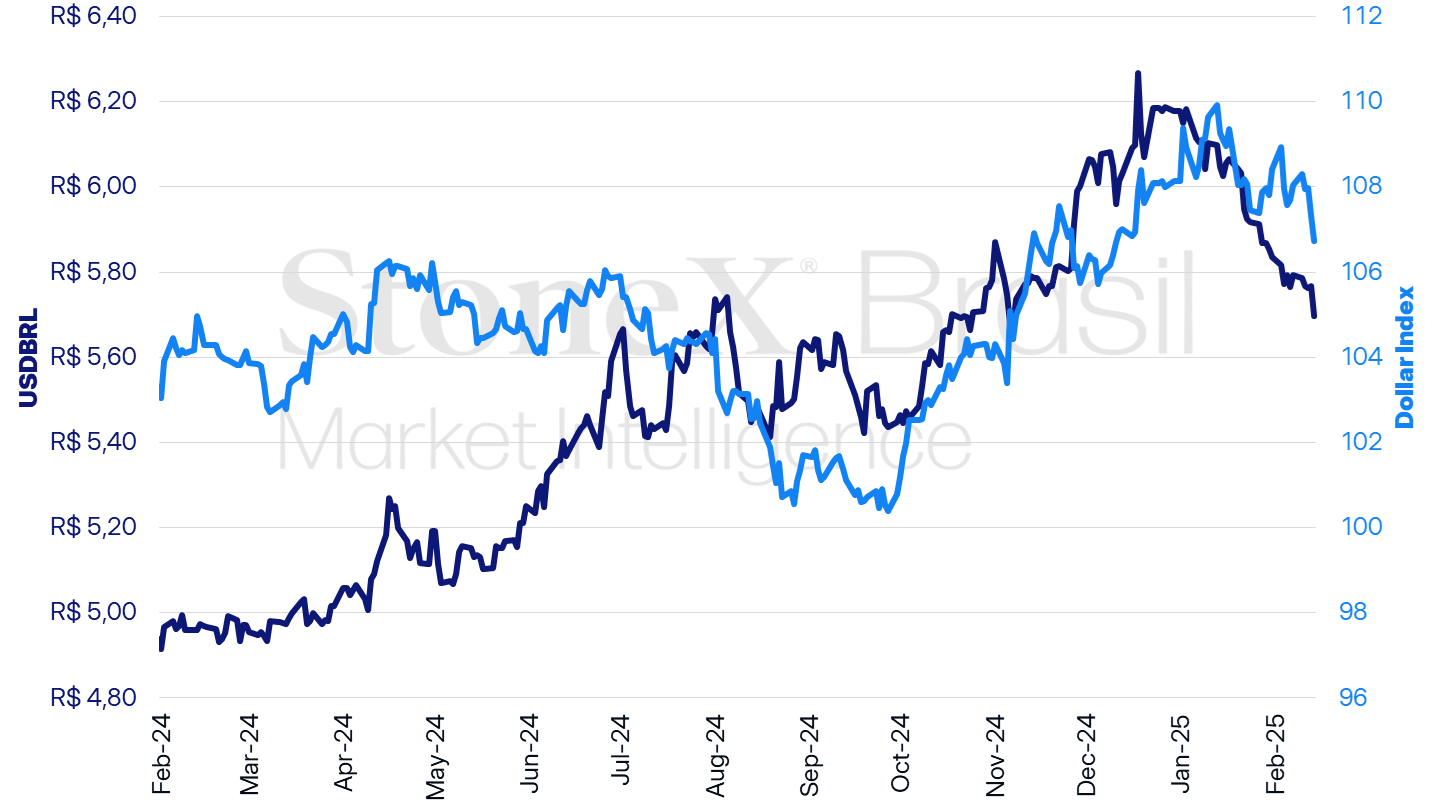

The USDBRL ended this Friday’s session (14) at 5.6974, a weekly decline of 1.6%, a monthly decline of 2.4% and an annual decline of 7.8%. Meanwhile, the dollar index closed Friday’s session at 106.7 points, with changes of -1.2% for the week, -1.6% for the month and -1.3% for the year.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Preparation: StoneX.

KEY EVENT: Uncertainty about US Tariff Barriers

Expected impact on USDBRL: bearish

Last week, the dollar weakened significantly against other currencies due to the perception that US President Donald Trump is adopting a more flexible and open-to-negotiation stance than anticipated regarding the imposition of import tariffs on other economies. Firstly, no import surcharge has been imposed so far except on Chinese products, whose tax increased by 10%. The proposed tariffs on Colombia were suspended indefinitely, those on Canada and Mexico are suspended until March 1, the proposals on steel and aluminum are scheduled for March 12, and the so-called “reciprocal tariffs” will not take effect before April 1. Additionally, some interpret that Trump is using tariff threats not only to reduce the US trade deficit or to attract foreign factories to produce on US soil, but also to obtain concessions on other priority issues such as immigration and national security.

Consequently, investors believe that many countries may negotiate with the United States to mitigate or cancel the increase in import taxes on their exports, thereby reducing part of the gains accumulated by the US dollar since October, driven, among other factors, by the expectation of the effects of an aggressive US trade defense stance, such as a possible inflationary boost due to more expensive imports and a potential negative impact on the economic growth of other economies. Evidently, it is likely that the US government will apply new trade barriers to other economies or sectors in the coming months, as the president mentions the topic almost daily and has already proposed several surcharges, albeit with a longer implementation timeframe. However, the perception of a more moderate stance by Trump is expected to continue to hurt the overall performance of the dollar in the short term.

FOMC Minutes

Expected impact on USDBRL: bullish

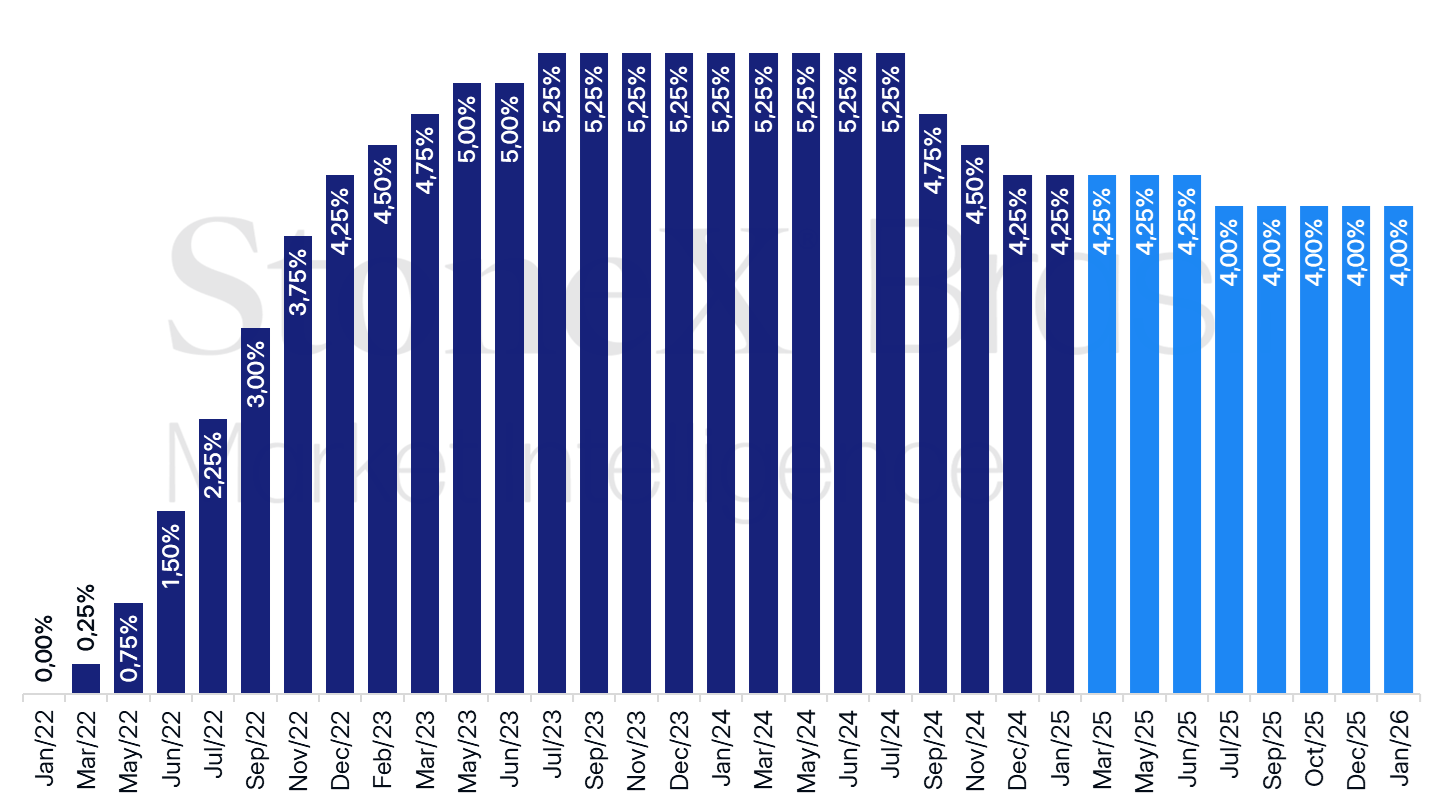

In a week marked by weaker US economic indicators, special attention was given to the release of the minutes from the latest monetary policy decision by the Federal Open Market Committee (FOMC) of the Federal Reserve (Fed), which halted a series of interest rate cuts by keeping rates unchanged in the range of 4.25% to 4.50% per annum. The document is expected to reinforce the Committee’s cautious stance by arguing that there is no rush for further rate reductions since the risks of a weakening labor market and of more resilient inflation are more balanced. Moreover, ambiguous readings of recent economic indicators favor a more patient stance by the Fed, which is expected to monitor the evolution of employment, production, and price data in the coming months to gather further insights into the country’s outlook. Consequently, the expectation is that the FOMC will avoid signaling its next steps and reinforce investors’ bets that US interest rates will remain at elevated levels for a longer period, which supports yields on dollar-denominated bonds and tends to strengthen the dollar globally.

USA: Historical Data and Interest Rate Outlook – February 14, 2025

Source: CME FedWatch Tool. Preparation: StoneX. Refers to the most likely bet in the interest rate futures market on the indicated date.

IBC-Br

Expected impact on USDBRL: bullish

In Brazil, the main economic highlight of the week is expected to be the release of the Central Bank’s Economic Activity Index (IBC-Br) for December, whose estimates indicate relative stability compared to the previous month after a 0.1% advance in November. Considered a monthly preview of GDP, the IBC-Br is expected to offer new signals for evaluating the performance of the Brazilian economy, especially after the release of below-expectation results in the retail and services sectors. The assessment of Brazil’s economic resilience becomes particularly relevant following the inclusion of “incipient signs” of a slowdown in the latest Monetary Policy Committee (Copom) decision communiqué. However, last Wednesday (12), Central Bank President Gabriel Galípolo stressed the need for caution in evaluating this slowdown, noting the volatility of short-term statistics, which "sometimes signal trends that do not materialize." In this context, the IBC-Br stands as an important indicator for the Central Bank’s upcoming decisions. If its results corroborate the slowdown trend indicated by recent data, they are expected to increase perceptions that the monetary authority will adopt a more moderate stance in its cycle of raising the basic interest rate (Selic), which in turn could contribute to weakening the real.

Negotiations between Russia and Ukraine

Expected impact on USDBRL: bearish

Last week, the announcement that US President Donald Trump had called the presidents of Russia, Vladimir Putin, and Ukraine, Volodymyr Zelensky, to initiate peace negotiations between the two countries benefited European assets. Although the dialogues are still in their early stages, they raised investors’ hopes that the nearly three-year conflict might end, a topic that was part of Trump’s campaign promises. Consequently, any advances in peace negotiations during the week could help improve investors’ appetite for riskier assets, which would favor a strengthening of the real.

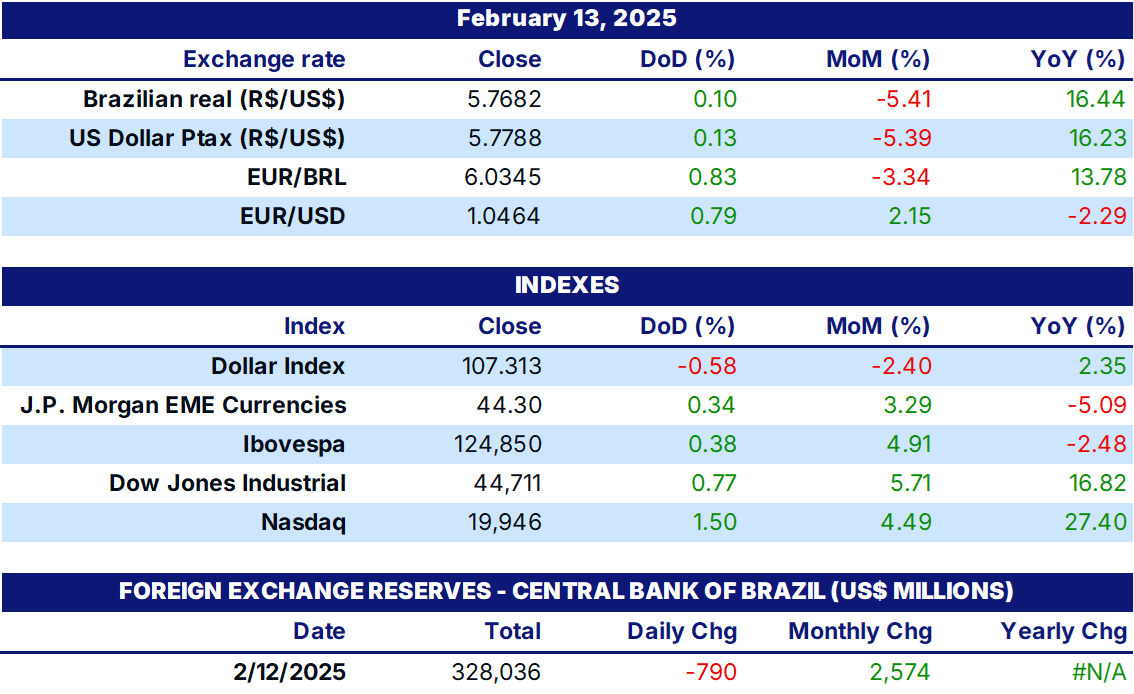

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.