FX Weekly Overview: Key Events of the Week

- Bearish factors

- US inflation and retail data could reinforce a soft landing perception of the American economy, increasing bets on interest rate cuts by the Federal Reserve and weakening the dollar.

- Acceleration in January’s core CPI may solidify expectations of firm hikes in the basic interest rate (Selic), which helps attract foreign investment and tends to strengthen the real.

- Acceleration in Chinese inflation could partially improve growth expectations for the country in 2025, favoring the performance of currencies from primary product exporting countries, such as the real.

- Bullish factors

- Uncertainty over the possibility of US import tariffs on its trading partners may lead to increased global risk aversion, favoring the performance of the US dollar.

The week in review

The week was marked by the strengthening of emerging market currencies against the dollar after the suspension of new US import tariffs on Mexico and Canada reduced fears of a "trade war" between the United States and its trading partners.

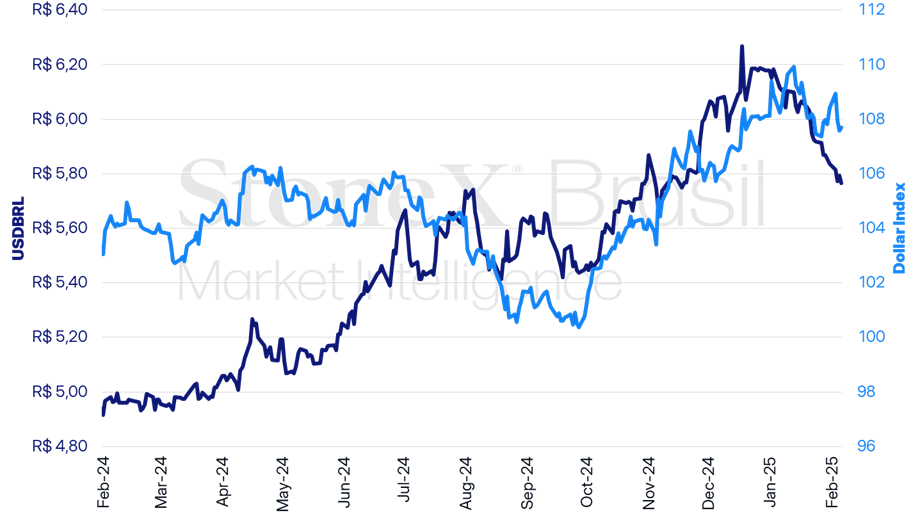

The USDBRL ended this Friday's session (07) at 5.7927, a weekly decline of 0.7%, a monthly decline of 0.7% and an annual decline of 6.2%. Meanwhile, the dollar index closed Friday's session at 108.0 points, with changes of -0.3% for the week, -0.3% for the month and -0.1% for the year.

USDBRL and Dollar Index (points)

Source: Refinitiv. Preparation: StoneX.

KEY EVENT: US Economic Data

Expected impact on USDBRL: bearish

After a series of stronger economic data, the latest indicators have been ambiguous. The Employment Situation Report, for example, showed a net creation of 143,000 jobs in January, below the median projection of 168,000, but it surprised with a slight drop in the unemployment rate to 4.0% and with wage gains higher than expected. In this context, the release of the US Consumer Price Index (CPI) and January retail sales will be key for adjusting investor expectations regarding the trajectory of US interest rates.

The median projections for the CPI indicate a moderate new rise, with a monthly increase of 0.3% for both the headline measure and its core, which excludes volatile components such as food and energy. Although this core projection represents a slight increase compared to the 0.2% recorded in December, it would be more moderate than the 0.4% reading seen in January 2024, a month when inflation is usually driven by seasonal factors. Additionally, the median estimate for retail sales points to a slowdown from +0.4% in December to 0.0% in January. If confirmed, both projections would reinforce an interpretation of a "soft landing" for the US economy, which could contribute to increasing bets on interest rate cuts by the Federal Reserve in 2025 and, consequently, weaken the dollar globally.

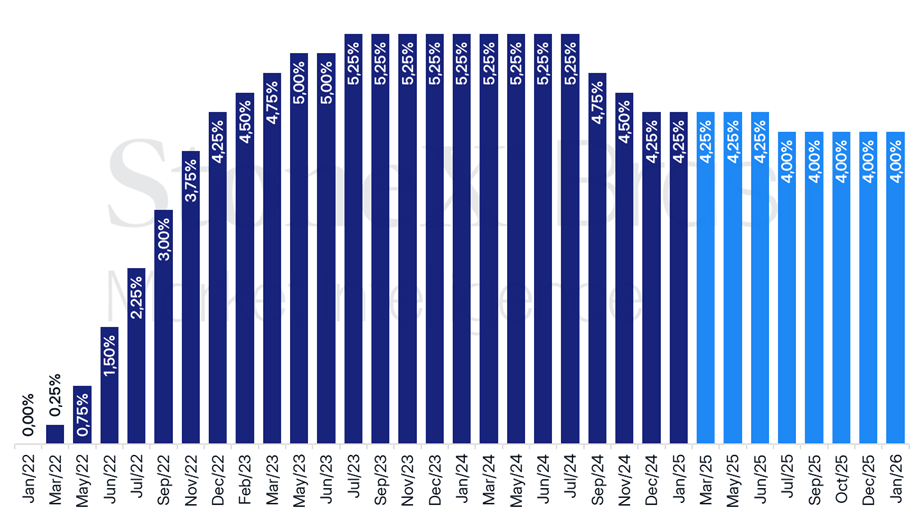

USA: Historical Data and Interest Rate Outlook – February 07, 2025

Source: CME FedWatch Tool. Preparation: StoneX. Refers to the most likely bet in the interest rate futures market on the indicated date.

Uncertainty about US Tariff Barriers

Expected impact on USDBRL: bullish

The first three weeks of Donald Trump’s new administration in the US were marked by significant volatility in global financial markets due to high uncertainty about the country's economic policies, particularly regarding the imposition of import tariffs on other countries. On one hand, the suspension of surcharges on Colombian, Canadian, and Mexican products, along with what was seen as moderate retaliation by China, created an impression of a more flexible and negotiable stance by the US government, helping to reduce fears of a "trade war" between the United States and its trading partners. On the other hand, these fears are periodically reinforced by nearly daily comments from Trump on the subject, as well as by unexpected new announcements, such as his statement on Friday (07) that the US will impose "reciprocal tariffs" on several economies without specifying which ones. As a result of these ambiguities and uncertainties regarding the imposition of tariffs on other economies, investors tend to operate more cautiously and with a lower appetite for risk, which can hurt the performance of emerging market currencies like the real.

Economic Data for Brazil

Expected impact on USDBRL: bearish

In Brazil, investors' focus is expected to shift to the release of the National Broad Consumer Price Index (IPCA) for January and its effects on inflation and interest rate expectations. The median projection for the indicator points to a monthly increase of around 0.16% and a 12‑month cumulative increase of 4.58%, which would indicate a slowdown compared to December, although it still remains above the 4.5% ceiling set by the Central Bank. This slowdown is largely influenced by the so‑called "Itaipu energy bonus." In January, the country's largest hydroelectric power plant enabled a discount of up to R$ 49 on residential and rural electricity bills for consumers using less than 350 kilowatt-hours (kWh) per month in 2023. The relief in electricity costs is expected to be further reinforced by the adoption of the green tariff flag, reinstated in December after a period with yellow and red flags due to lower rainfall. Given that these price-reducing factors are largely transitory, the market tends to focus on the core of the indicator, which excludes volatile components such as food and energy. If a less favorable inflation composition scenario is confirmed, particularly in less volatile goods, it could reinforce expectations for firm increases in the basic interest rate (Selic) by the Central Bank, supporting the prospect of a widening Brazilian interest rate differential and contributing to a stronger real.

On the other hand, investors should monitor the release of economic activity indicators throughout the week, such as the Monthly Trade Survey (PMC) and the Services Survey (PMS), to better gauge the Central Bank's monetary policy path. Last week, the minutes from the latest interest rate decision by the Monetary Policy Committee (Copom) pointed to a scenario of still "adverse" short‑term inflation, and its projections in the baseline scenario (considered most likely) indicated that the ongoing inflation target would be missed as early as June this year. Additionally, the Committee warned that there are "incipient signs" that the Brazilian economy might be slowing down, but that "caution and restraint are needed in the recent analysis of activity data." In this context, the indicators released throughout this week should serve as a thermometer for investors to assess the next steps of the Central Bank, particularly regarding how the Committee views the resilience of the domestic economy and potential inflationary risks.

Inflation in China

Expected impact on USDBRL: bearish

Finally, this Saturday (08), China will release its inflation data for January. According to the median market estimates, a new deflation in the Producer Price Index (PPI) is projected, with a 12‑month change of -2.1% compared to -2.3% in December. Meanwhile, the Consumer Price Index (CPI) is expected to accelerate its 12‑month cumulative increase to 0.4%, up from 0.1% in the previous month. If confirmed, these estimates could improve expectations for Chinese economic growth in 2025, favoring the performance of currencies from countries exporting primary products, such as the real. However, this effect is expected to be minimized due to investor doubts about the extent of the actual impacts of the recent economic stimulus measures promoted by the Chinese government, as well as potential adverse impacts resulting from more intense trade disputes with the United States, especially following the imposition of a 10% import tariff on Chinese products by US President Donald Trump.

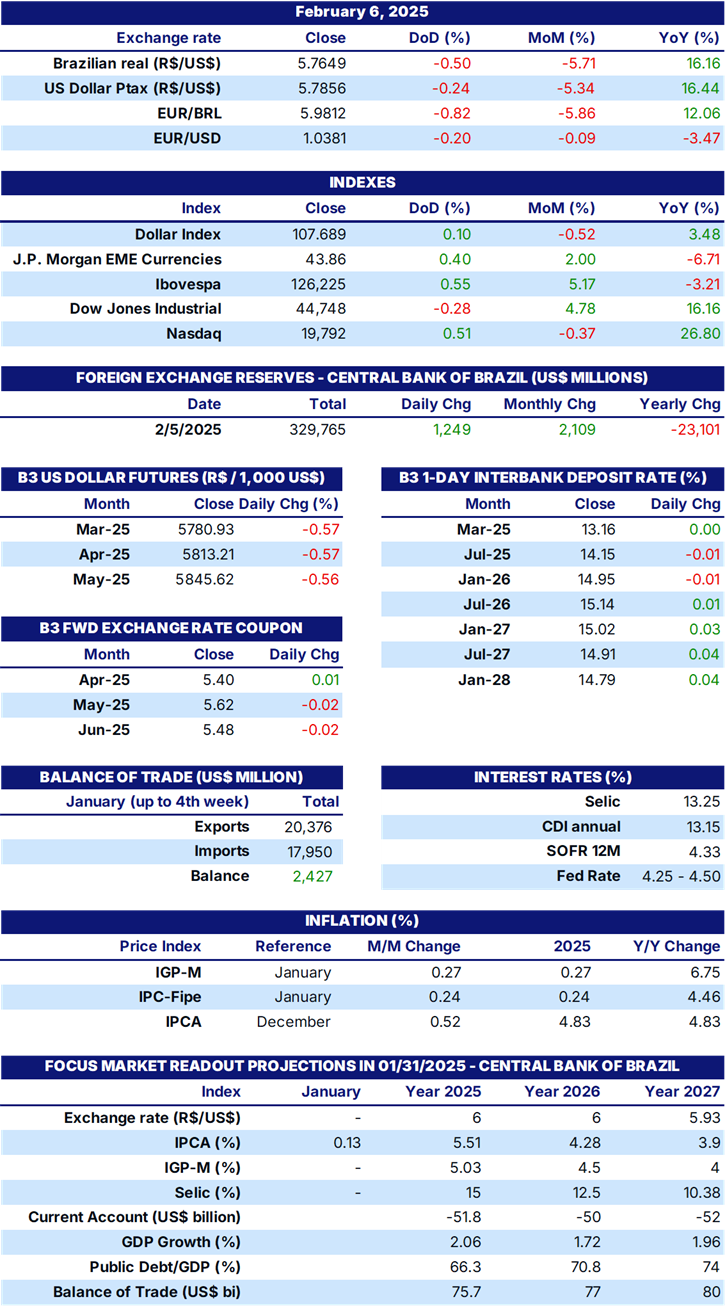

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.