FX Weekly Overview: Key Events of the Week

- Bearish factors

- Possible easing of the elevated risk premium associated with domestic assets before Congress approves the fiscal package in the final days of 2024.

- Bullish factors

- US labor market data and productive activity are expected to remain robust in January, reinforcing the perception that the Federal Reserve will be cautious in its cycle of interest rate cuts and contributing to the strengthening of the dollar.

- The possible imposition of US import tariffs on Mexican and Canadian products could result in increased global risk aversion, favoring the performance of the US dollar.

- The minutes of the Monetary Policy Committee (Copom) could reinforce the expectation that the Central Bank may be more cautious in its cycle of interest rate hikes (Selic), which could hinder the attraction of foreign investment and weaken the real.

The week in review

The week was marked by monetary policy decisions in Brazil and the US, with both central banks adopting a somewhat more measured stance than anticipated. Additionally, the uncertainty regarding new US import tariffs supported the performance of the real.

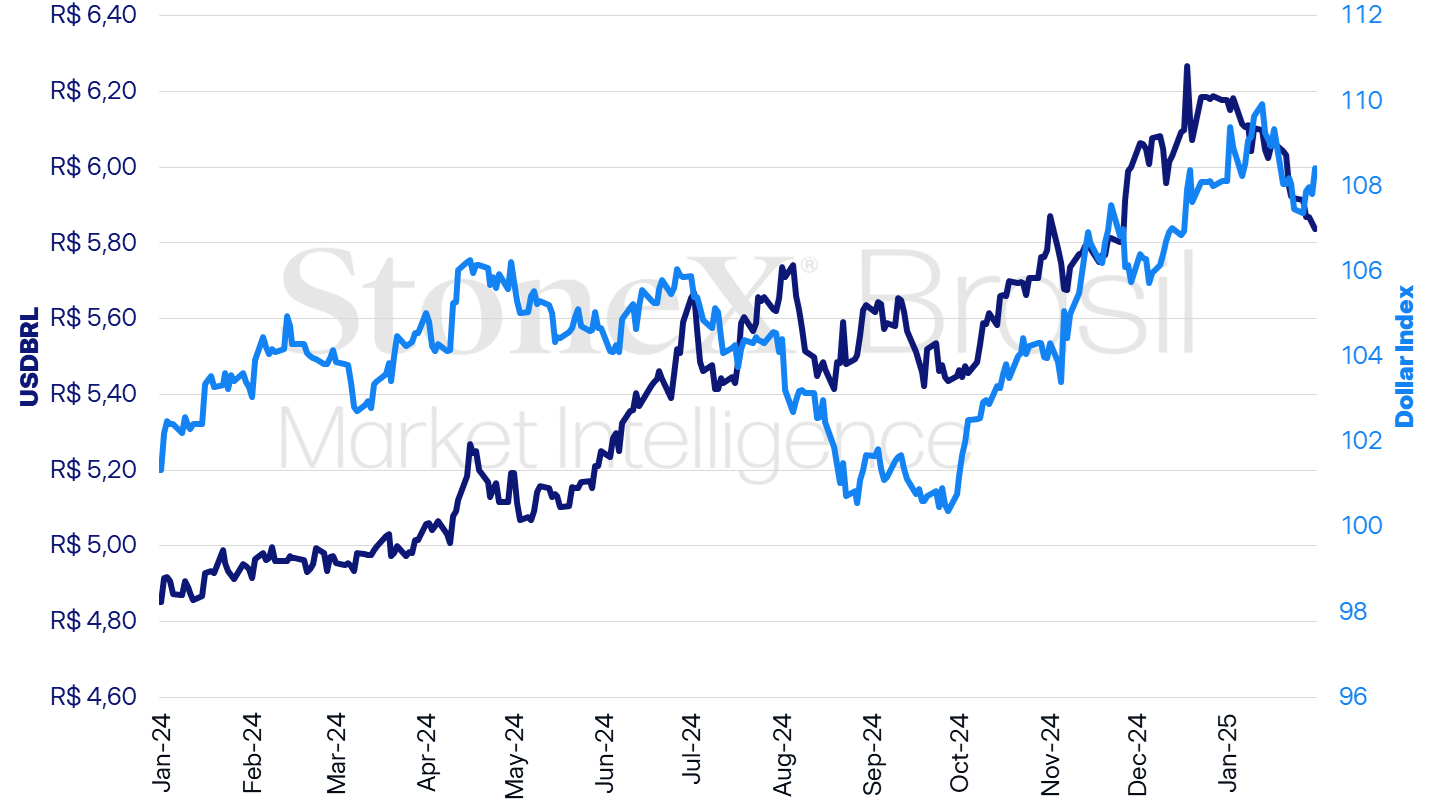

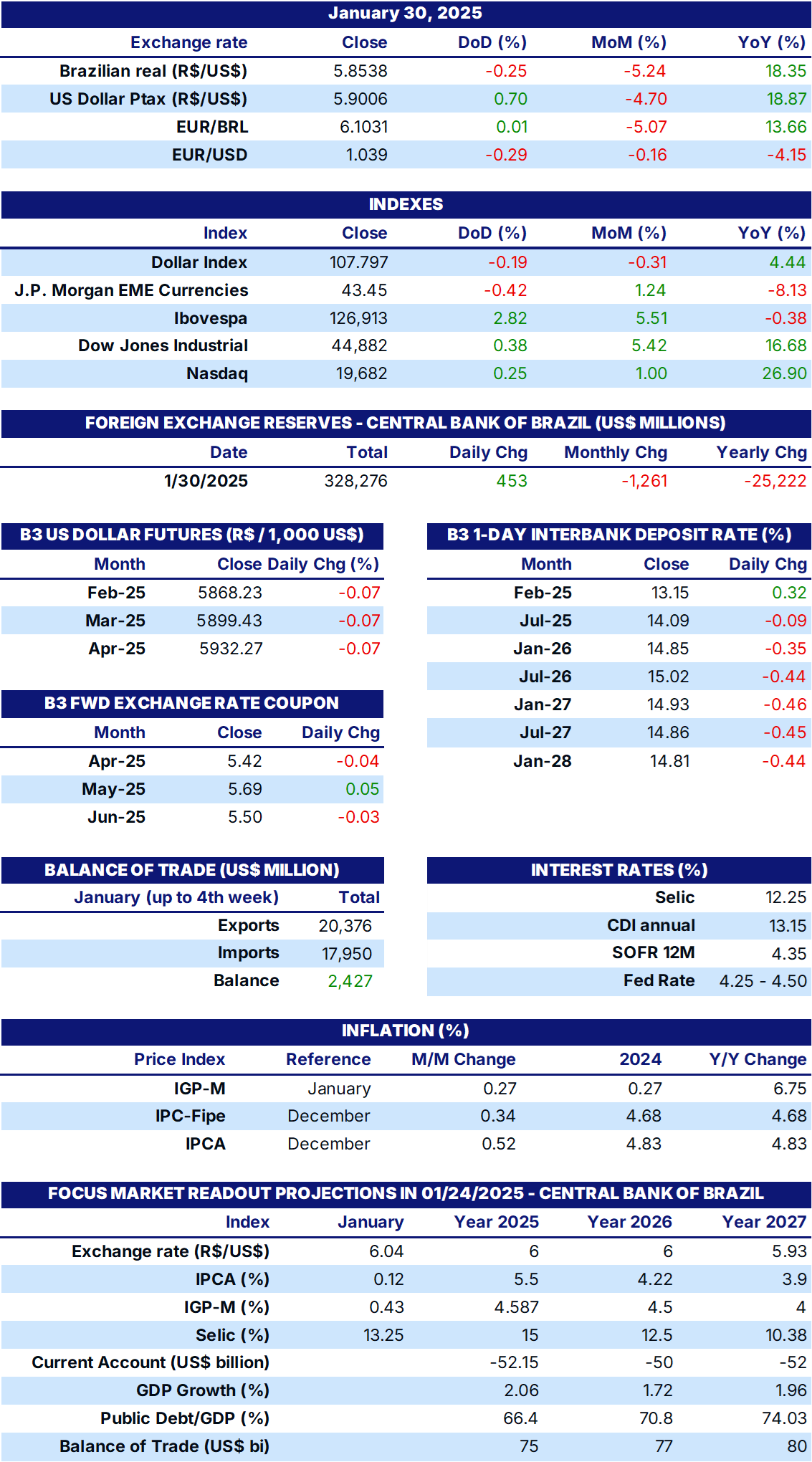

The USDBRL ended this Friday's session (31) at 5.8355, a weekly decline of 1.4%, a monthly decline of 5.5% and a yearly decline of 5.5%. Meanwhile, the dollar index closed Friday's session at 108.4 points, with a weekly change of +0.9%, +0.3% for the month and +0.3% for the year.

USDBRL and Dollar Index (points)

Source: Refinitiv. Design: StoneX.

KEY EVENT: US Labor Market Data

Expected impact on USDBRL: bullish

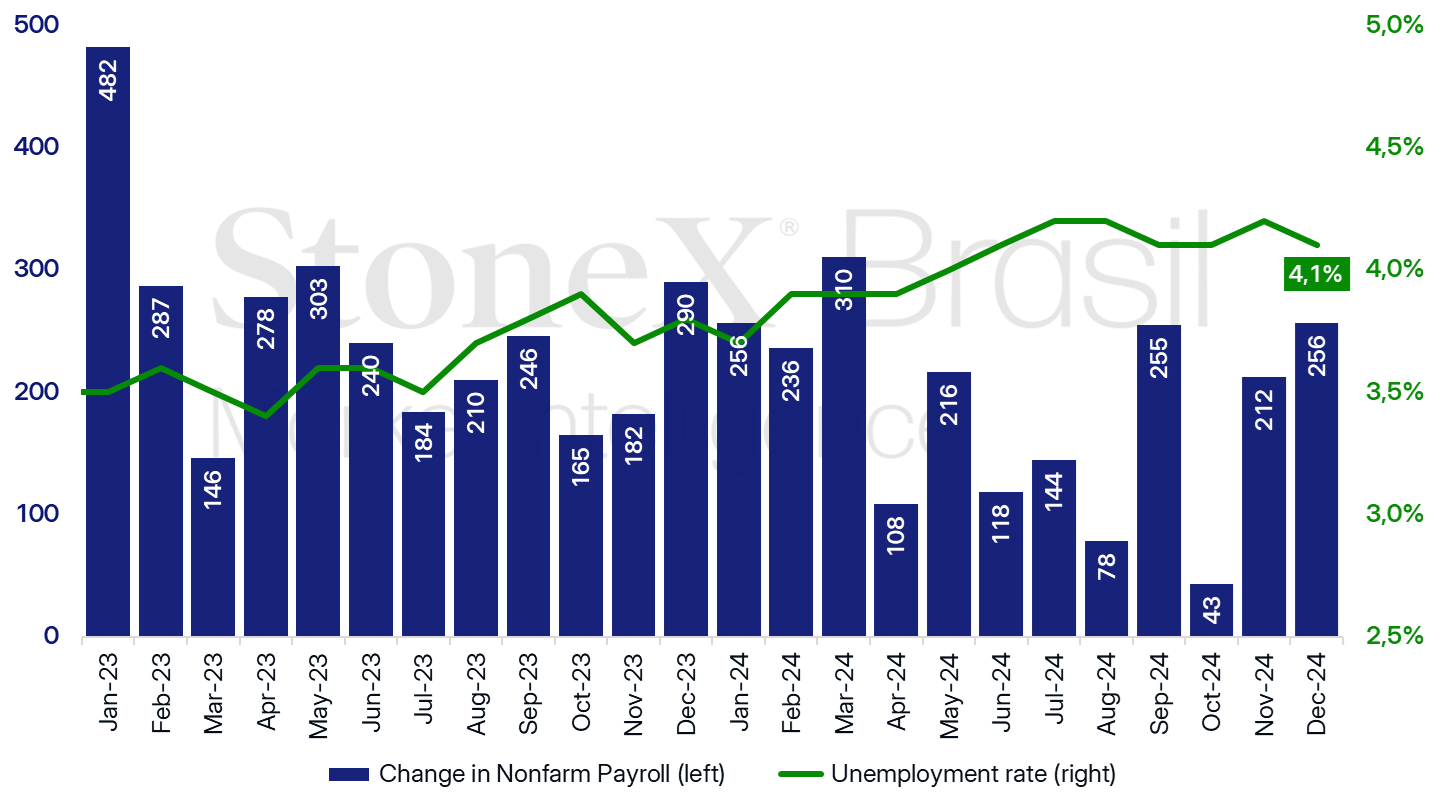

After the labor market surprised in December with a net creation of 256,000 jobs against a median projection of 160,000, analysts expect a slowdown in January, with a net addition of 170,000 new jobs. Some high-frequency indicators suggest that the labor market remained robust in the first month of the year, but temporary factors such as the wildfires in California and an intense cold wave in the eastern part of the country may have dampened job creation. Meanwhile, forecasts for the Services Purchasing Managers' Index (PMI) indicate that its expansion pace will be maintained, rising from 54.1 points in December to 54.3 points in January.

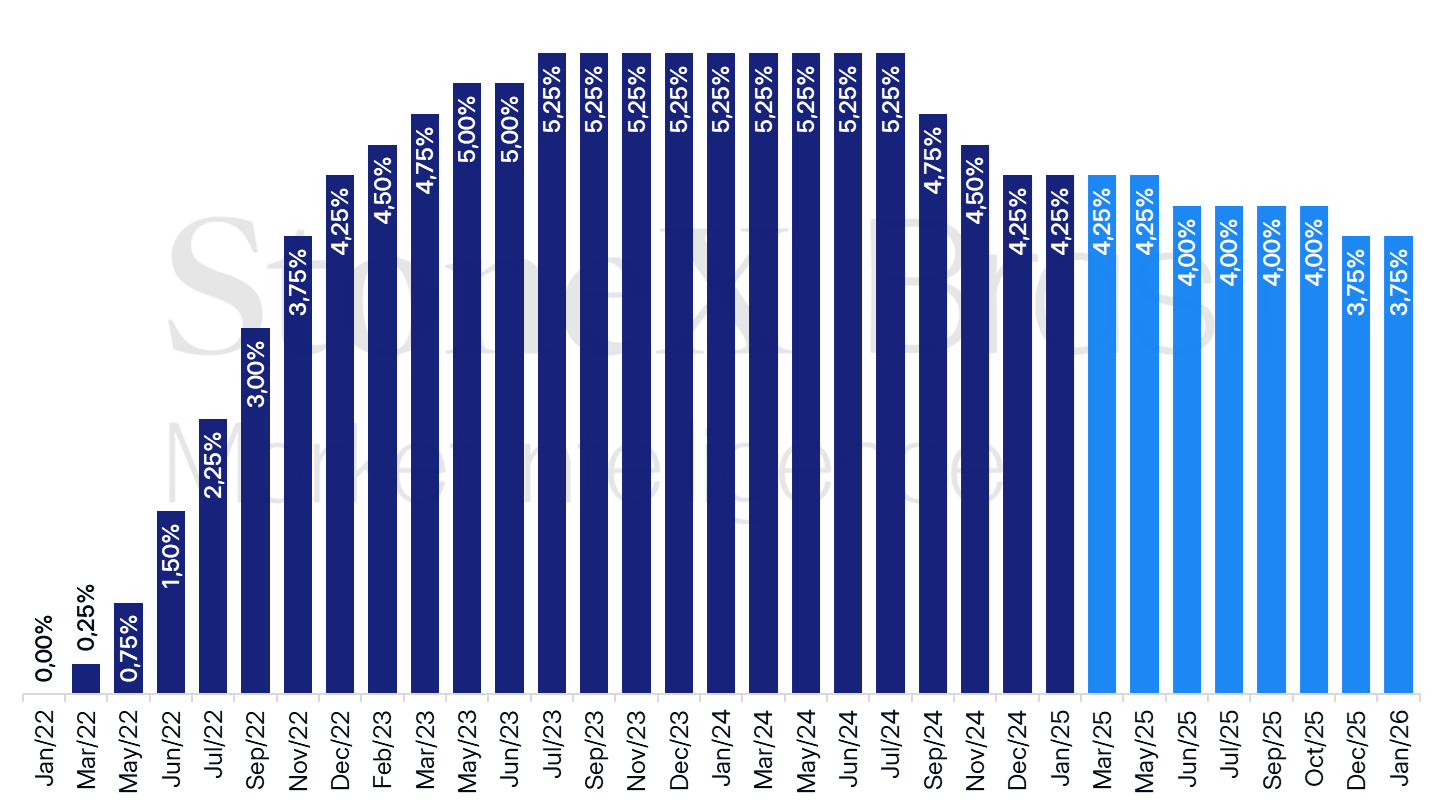

If these projections are confirmed, they could reinforce the view that the Federal Reserve (Fed) will have limited room for further interest rate cuts in 2025, which tends to favor the strengthening of the US dollar. Last week, investor expectations for further cuts increased slightly after the Fed's Federal Open Market Committee (FOMC) kept its interest rate unchanged, within the range of 4.25% p.a. to 4.50% p.a., in line with analysts' expectations. On one hand, the Committee Chair, Jerome Powell, contested the possibility of a cut in March and argued that the FOMC may be patient, given that the current interest rate level is less restrictive than it has been in recent months and the economy remains resilient. However, he also stated that he expects inflation in the country to continue moderating gradually, which would allow the cycle of rate cuts to continue.

USA: Historical Data and Interest Rate Outlook – January 31, 2025

Source: CME FedWatch Tool. Preparation: StoneX. Refers to the most likely bet in the futures interest rate market on the indicated date.

Change in Total Urban Employment (thousands of people) and Unemployment Rate (%) in the United States

Source: U.S. Bureau of Labor Statistics (BLS), Federal Reserve Bank of St. Louis. Preparation: StoneX.

Tariff Barriers in the USA

Expected impact on USDBRL: bullish

Last week, uncertainty regarding US trade policy caused significant volatility in global asset markets. The week nearly began with a “trade war” between the USA and Colombia following a disagreement over the deportation of Colombian immigrants, but an agreement was reached on Sunday, avoiding the imposition of a 25% surcharge on Colombian products. The following days saw further ambiguous statements from US President Donald Trump regarding the possibility of new import tariffs both for some countries and for specific sectors.

However, in the last two days, fears that the US government might increase these tariffs escalated after Trump told reporters that he would impose a 25% surcharge on Canadian and Mexican products and a 10% surcharge on Chinese products starting February 1. The US President also denied reports that the government would delay the implementation of these tariffs until March 1. The implementation of these tariffs could reduce investors’ appetite for risky assets and decrease expectations for interest rate cuts by the Federal Reserve in 2025 due to inflationary effects, both favoring the performance of the dollar globally. Conversely, if the USA opts not to apply these tariffs, a weakening of the US dollar could be observed.

Copom Meeting Minutes

Expected impact on USDBRL: bullish

In Brazil, investors’ attention is expected to turn to the minutes of the Central Bank’s monetary policy decision from last Wednesday (29). In the meeting, the Committee unanimously decided to raise the base interest rate (Selic) from 12.25% p.a. to 13.25% p.a., in line with analysts’ expectations, and signaled another increase of 1.00 percentage point for the March decision, leaving subsequent steps open. In general, the minutes are expected to clarify the committee’s perception of the current risk balance of the Brazilian economy, especially after adopting a more cautious tone in the decision statement. In the document, the Central Bank indicated that the inflation risk balance remains adverse, asymmetric and with a bullish bias; however, the inclusion of a downside risk factor due to a national economic slowdown caught investors’ attention, who interpreted it as a sign of greater uncertainty than anticipated and as a possible indication that the monetary authority intends to pursue a less aggressive cycle of Selic hikes. In this sense, given the absence of forward guidance beyond the next meeting and the inclusion of downside factors for economic activity, the minutes may reinforce the expectation that the widening of the interest rate differential will not accelerate in the short term, which could hinder the attraction of foreign investments to the country and contribute to the weakening of the real.

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.