FX Weekly Overview : Key Events of the Week

- Bearish drivers

- Donald Trump's softer stance on the imposition of import tariffs should favor the performance of risky assets such as commodities and emerging market currencies including the BRL.

- Copom is expected to raise the benchmark Selic rate by 1.0 p.p., reinforcing the prospect of higher interest rates for longer in Brazil, which should help attract foreign investment and strengthen the BRL.

- Bullish drivers

- The FOMC's rate decision should reinforce the perception that the Federal Reserve will be cautious in its rate cutting cycle, which favors the profitability of dollar-denominated bonds and contributes to the global strengthening of the currency.

- The European Central Bank is expected to cut its interest rate by 0.25 percentage point, which will tend to weaken the euro and indirectly contribute to the global strengthening of the currency.

The week in review

The week was marked by a global weakening of the US currency after the new US president, Donald Trump, took a less aggressive stance than expected on the application of import tariffs against other countries, which favored the performance of risky assets such as commodities and currencies of emerging countries.

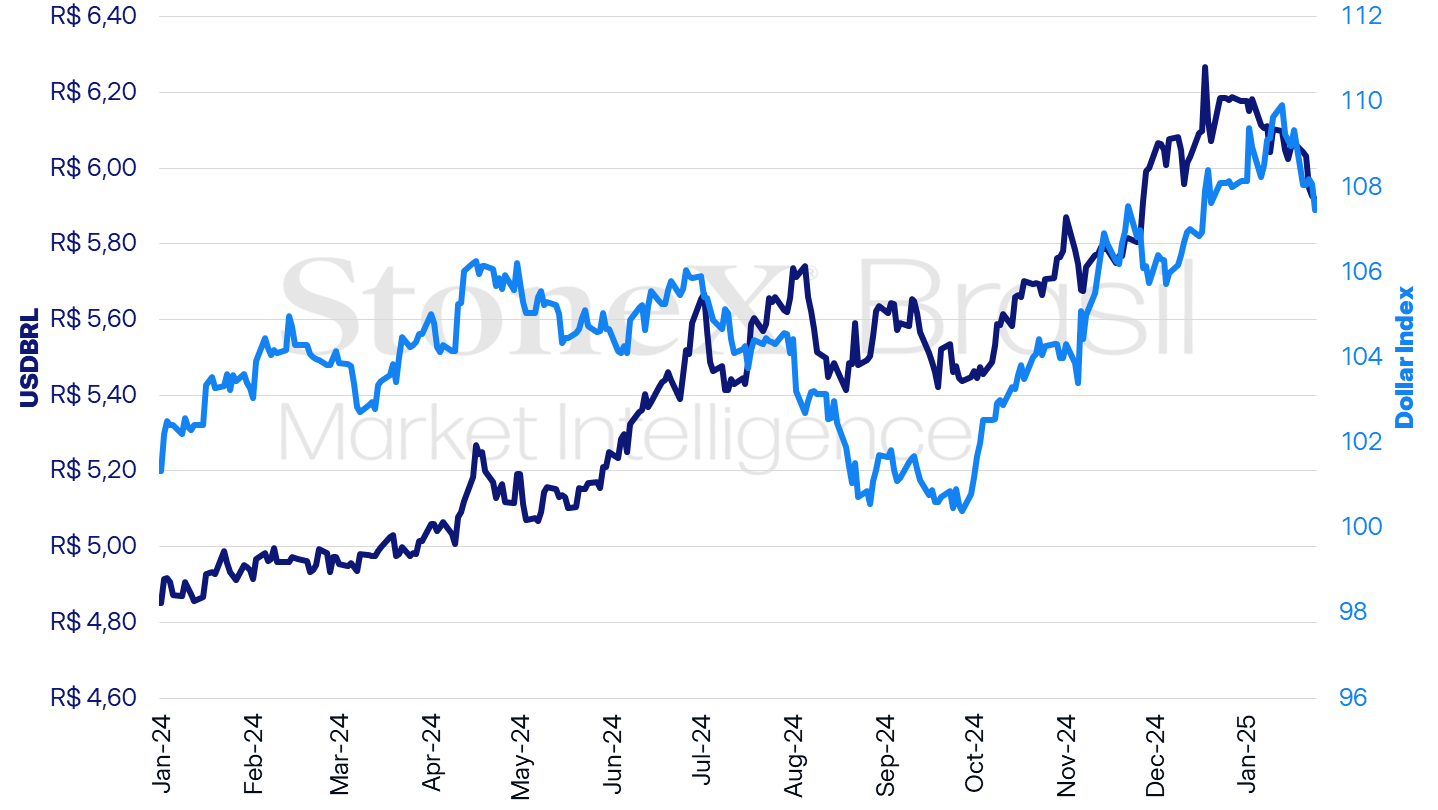

The dollar's interbank market value closed at BRL 5.9182 on Friday, marking a 2.4% decline for the week, 4.2% for the month, and 4.2% for the year. The dollar index closed Friday's trading session at 107.4 points, down 1.7% for the week, 0.6% for the month, and 0.6% for the year.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

KEY EVENT: FOMC monetary policy decision

Expected Impact on USDBRL: Bullish

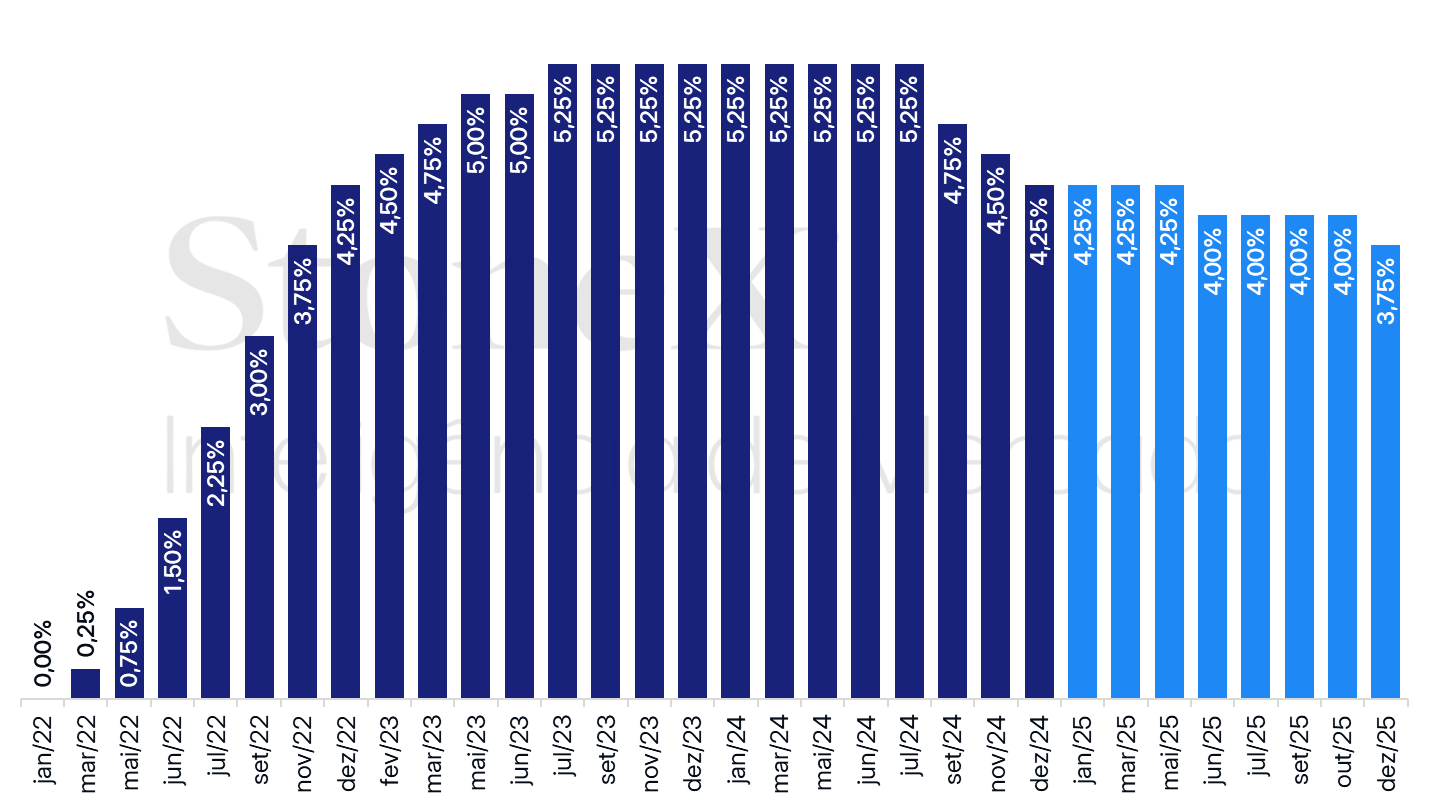

On Wednesday (29), the Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) is expected to maintain the current range of the basic interest rate, keeping it between 4.25% and 4.50% p.a., thus pausing the sequence of rate reductions that began with the September decision. This pause is indicative of a scenario where economic data has strengthened, there are lower risks of a sudden weakening of the job market, and inflation is stabilized at a level far from the Fed's target of 2% per year.Given the high probability of interest rates remaining unchanged, investors should focus their attention on the Committee's statement and the press conference by its chairman, Jerome Powell, for indications as to the future path of interest rates. The FOMC is expected to affirm its ability to adopt a patient and cautious approach in conducting monetary policy, given the slowing pace of inflation relative to target and the resilience of economic activity. The FOMC is expected to resume interest rate cuts only after gaining greater confidence that inflation continues to stabilize. It is noteworthy that the median of the projections for the core Personal Consumption Expenditure Price Index (PCE) for December, excluding the volatile food and energy components, is expected to show another moderate increase on Friday (31). As the PCE is used by the Fed to verify its inflation target, the December figures should help to partially reduce concerns that US inflation is resilient and persistent.

In addition, the expectation of an inflationary impact from the possible economic policies of Donald Trump's administration should also reinforce the FOMC's cautious stance, although the Committee should mention that these possible measures will not affect monetary policy decisions until there are more concrete details about their content and timing. At the press conference following the latest decision, Fed Chairman Jerome Powell noted that members of the Federal Reserve have already begun to assess the potential impact of these proposals, such as tariff increases, tax cuts and changes to immigration policy. Trump's recent statements regarding his desire to lower interest rates could also add to the scenario of uncertainty, although the president does not have the autonomy to interfere in the decision and Powell has already addressed the Federal Reserve's autonomy in similar situations in the past. In this way, the FOMC's decision is likely to reinforce investors' perception that the Federal Reserve should slowly reduce its interest rate, which could push up US Treasury yields and strengthen the dollar globally.

US: Interest Rate History and Expectations - January 24, 2025

Source: CME FedWatch tool. Design: StoneX. Refers to the most likely bet in the interest rate futures market on the date indicated.

Reversal of the "Trump Trade"

Expected Impact on USDBRL: Bearish

The dollar weakened across the board last week, falling to its lowest level since December 18, after President-elect Donald Trump surprised most investors with a softer stance on US trade policy. As one of his key campaign promises, there were fears that Trump would raise import taxes on his first day in office. However, the president has chosen to threaten the imposition of these surcharges without ordering any immediate action, giving the impression that they are being used as a negotiating tactic with other global economies.

Trump's first week in office also increased the level of volatility and uncertainty in financial markets, as investors remained on tenterhooks waiting for more concrete signs of US economic policy. While the US President has at times mentioned the possibility of imposing a 25% surcharge on products from Mexico and Canada and a 10% surcharge on Chinese products, he has also said that he would "prefer not to impose" tariffs on China and that a trade agreement could be reached between the world's two largest economies. Of course, Trump can still raise import taxes, and it is possible that this will happen in the coming months, which would have some inflationary effects and may require a more hawkish stance from the Federal Reserve. However, the lack of concrete measures in these first days should continue to improve the appetite for risky assets and favor the performance of commodities and emerging market currencies.

Copom's interest rate decision

Expected Impact on USDBRL: Bearish

The Central Bank's Monetary Policy Committee (Copom) is expected to raise the benchmark interest rate (Selic) from 12.25% p.a. to 13.25% p.a. in its decision on Wednesday (29), as signaled in December. While in that decision the committee pointed out that the two more intense rate hikes were justified by the worsening of the future inflation scenario, which is "less uncertain and more unfavorable" and with "bullish asymmetry" after the "materialization of inflationary risks", this scenario seems to have worsened even more since the last decision, with an intense depreciation of the exchange rate, a continuous rise in inflationary expectations and a serious crisis of credibility of Brazil's fiscal policy among investors. The announcement of the decision should again be firm in relation to the inflationary risks facing Brazil and reinforce the prospect of a rapid rise in the Selic rate. In addition, investors will be looking for a change in the forward guidance, which was two consecutive 1.00 p.p. hikes at the last meeting. The prospect of higher policy rates for a longer period of time raises expectations for domestic bond yields, which may encourage the entry of foreign investment and contribute to the appreciation of the BRL.

ECB interest rate decision

Expected Impact on USDBRL: Bullish

The European Central Bank (ECB) is expected to cut its key interest rate from 3.00% p.a. to 2.75% p.a. amid a noticeable slowdown in economic growth. Investors will be looking for comments from ECB President Christine Lagarde on expectations for US economic policy and how this could affect the European macroeconomic scenario. A possible increase in US import taxes on the European Union is likely to further damage the performance of the single currency bloc, widening the contrast with US growth and reducing the attractiveness of European assets, which tends to strengthen the dollar globally.

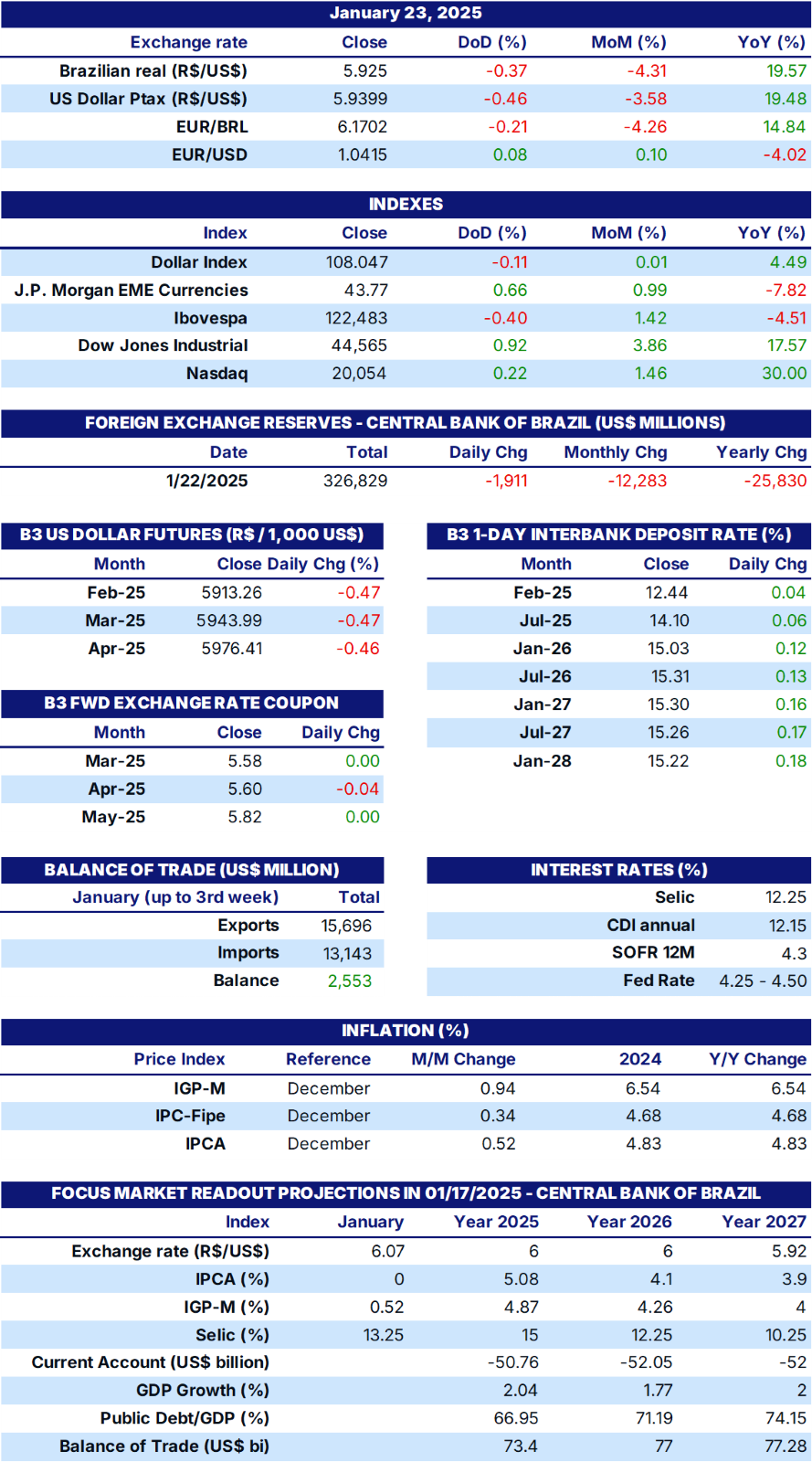

ECONOMIC INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.