FX Weekly Overview : Key Events of the Week

- Bearish Factors

- Bullish Factors

- Trump’s inauguration raises expectations for measures on tariffs, immigration, and taxes in the US, potentially accelerating US Treasury yields and strengthening the dollar globally.

- IPCA-15 may heighten inflation expectations in Brazil, keeping risk premiums high for investors and negatively impacting the real’s performance.

- Interest rate hikes by the Bank of Japan could weaken currencies used for “carry trade” operations, contributing to a depreciation of the real.

The week in review

The week was marked by softer-than-expected US inflation readings, leading to a broad weakening of the US dollar after six consecutive weeks of gains. Meanwhile, investors awaited Donald Trump’s inauguration as US president.

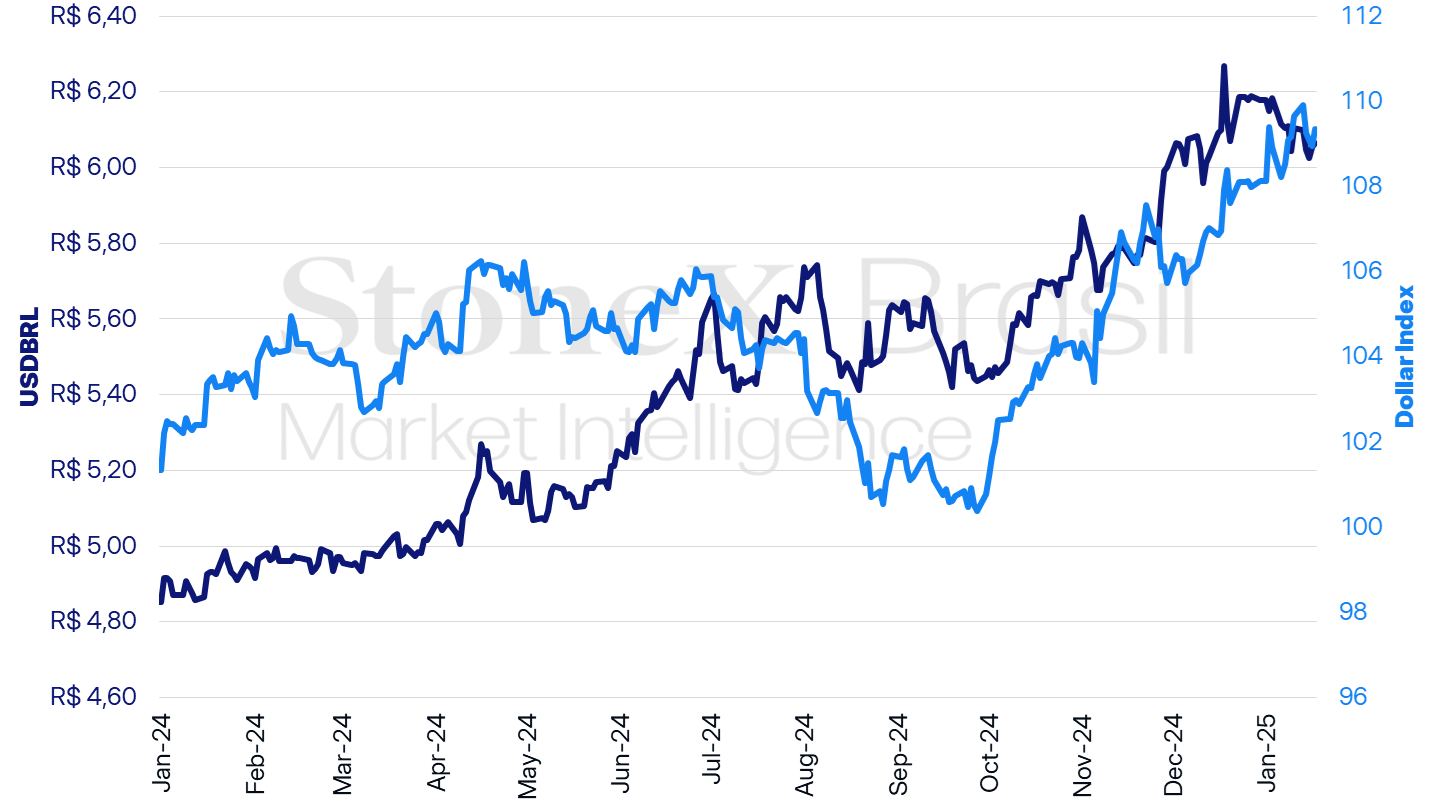

The USDBRL closed last Friday (10) at BRL 6.0650, a weekly drop of 0.6%, a monthly decline of 1.8%, and an annual decrease of 1.8%. Meanwhile, the dollar index ended Friday’s session at 109.3 points, a weekly variation of -0.3%, monthly growth of +1.1%, and annual increase of +1.1%.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Prepared by: StoneX.

KEY EVENT: Donald Trump’s Inauguration

Expected Impact on USDBRL: Bullish

In a week with a lighter schedule for economic indicators, global asset markets are expected to react to Donald Trump's inauguration as President of the US on Monday (20). During the electoral campaign, Trump stated he would implement a series of measures on his first day in office through the signing of executive orders, directives that depend solely on the President. Based on these promises, analysts expect the US to broadly increase its import tariffs, impose restrictions on immigration, and reduce corporate taxes. Even so, significant doubts remain about the potential changes under the new administration, such as the intensity and specifics of the measures, the speed of their implementation, and the legal frameworks to be used for support.

One of the most frequently mentioned economic promises during the campaign was a widespread increase in import tariffs, with a 60% tax on Chinese products and at least 10% on goods from other economies worldwide (in some statements, the incoming President even promised rates of 20% and 25% on other countries). Tariffs on China could be implemented relatively quickly, as the legal instruments for their enactment have been in place since Trump’s first “trade war” in 2018. However, imposing tariffs on other countries faces more complex bureaucratic and legal barriers, though reports from the American press suggest that the new administration is considering declaring a national economic emergency to provide legal backing for the measure.

The tariff hikes are expected to raise the cost of imported goods and could lead to inflationary pressures. Additionally, the incoming President has promised to close US borders and launch a mass deportation program, which could also create inflationary pressures by restricting the labor supply in a workforce with a high participation rate and low unemployment. Moreover, Trump has pledged to extend corporate tax cuts for another ten years, through 2035, a move that could widen the fiscal deficit and accelerate public debt levels, although approval of this proposal in Congress may take several months. The potential for inflationary pressures and accelerated public debt strengthens the interpretation that the Federal Reserve may adopt a more restrictive stance to counter these impacts. This outlook reduces investor bets on interest rate cuts, drives up US Treasury yields, and boosts the dollar's performance. Similarly, the prospect of higher profitability for US companies attracts foreign capital to the country's stock markets, further contributing to the global strengthening of the US dollar.

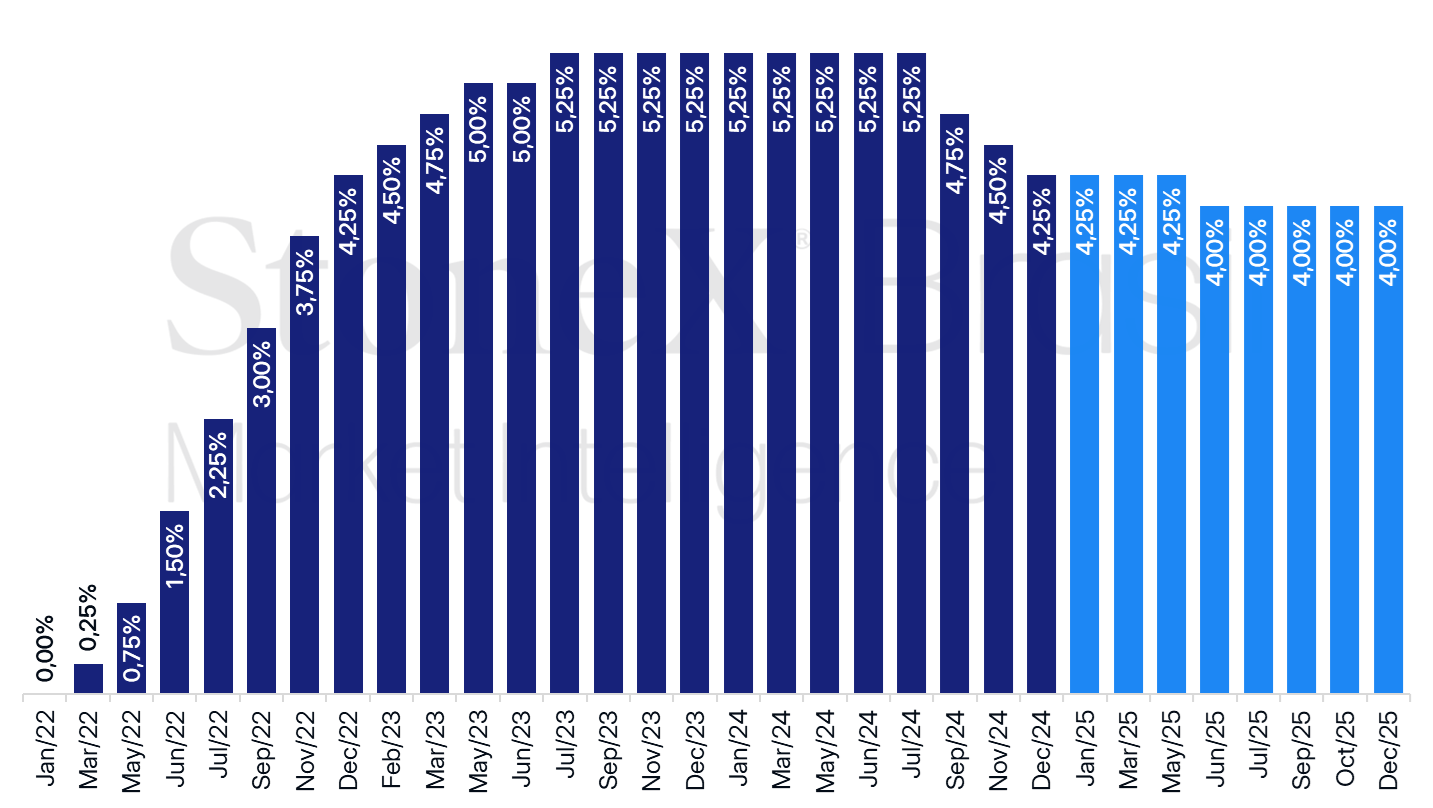

US: Interest Rate History and Expectations – January 17, 2025

Source: CME FedWatch Tool. Prepared by: StoneX. Reflects the highest probability interest rate futures market bet for the indicated date.

January IPCA-15

Expected Impact on USDBRL: Bullish

In Brazil, attention is focused on the release of the January Broad Consumer Price Index 15 (IPCA-15) and its effects on inflation and interest rate expectations in the country. Projections point to a deflation of approximately 0.1% compared to December, driven primarily by the so-called Itaipu energy bonus. In January, the country’s largest hydroelectric plant is expected to generate a discount of up to BRL 49 on residential and rural electricity bills for consumption below 350 kilowatt-hours (kWh) per month in 2023, potentially benefiting about 78 million Brazilians. This relief in electricity costs should be further reinforced by the adoption of the green tariff flag, which resumed in December after a period under yellow and red flags. However, considering that these price reliefs are largely temporary, the market is likely to focus on the core inflation index, which excludes volatile components such as food and energy. If a less favorable inflationary composition is confirmed, particularly in less volatile goods, it could increase market agents' risk aversion to the domestic scenario, reducing the attractiveness of Brazilian assets and contributing to the weakening of the real.

Japan’s Interest Rate Decision

Expected Impact on USDBRL: Bullish

Most analysts anticipate that the Bank of Japan (BoJ) will raise its benchmark interest rate from 0.25% per annum to 0.50% per annum during its monetary policy decision this Friday (24). This expectation has been fueled by statements from the institution’s president, Kazuo Ueda, and one of its directors, Ryozo Himino, indicating that the BoJ will consider this possibility in its discussions. If this rate hike materializes, it could strengthen the yen, thereby negatively impacting the performance of currencies commonly used for “carry trade” operations, such as the Brazilian real and the Mexican peso. Since the yen is frequently used by financial market operators as a “funding” currency for these operations, an appreciation of the Japanese currency reduces the returns on such transactions and encourages market participants to unwind their positions.In practical terms, investors often borrow in the Japanese financial system, taking advantage of its low interest rates, and convert the funds into reais to invest in the higher-yielding Brazilian financial system. When these positions are unwound, there is a substantial selling of reais to repay the original Japanese loans, which weakens the Brazilian currency.

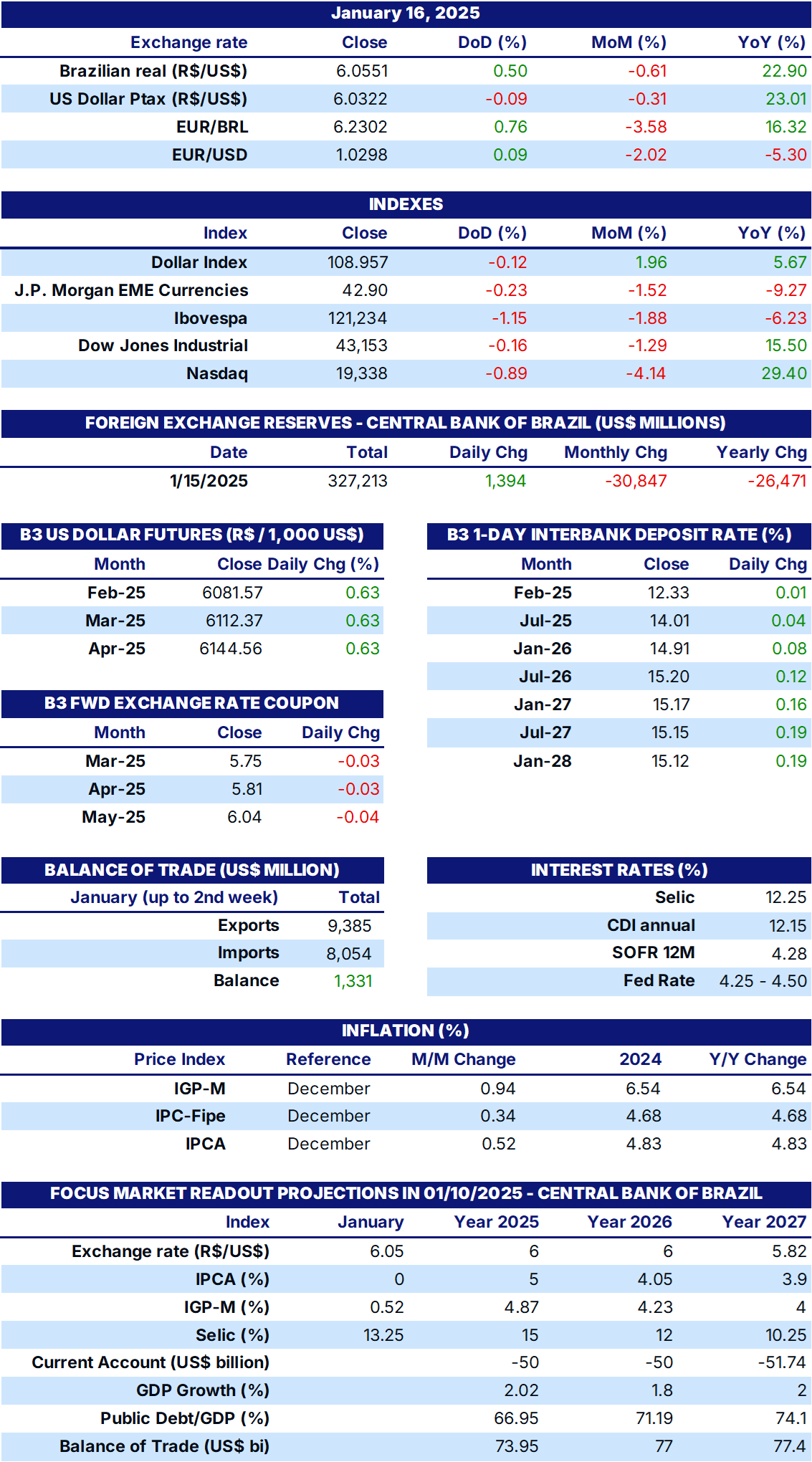

ECONOMIC INDICATORS TABLE

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA; and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.