FX Weekly Overview: The week's main events

- Bearish Factors

- The announcement of measures to cut expenses in Brazil may reduce the risk premium required for Brazilian assets, strengthening the real.

- A heated new reading for the IPCA-15 is expected to reinforce the perspective of a stringent cycle of Selic rate hikes, attracting foreign investment and strengthening the real.

- Bullish Factors

- The FOMC minutes, October’s PCE, and effects of Trump's election are likely to reinforce expectations of slower rate cuts in the US, strengthening the dollar globally.

The week in review

The week was once again marked by the global strengthening of the dollar, driven by reduced expectations of rate cuts by the Federal Reserve due to anticipated effects of potential policy changes by the new Trump administration and the release of stronger-than-expected US economic data. In Brazil, the prolonged uncertainty surrounding the federal government's expense-cutting package contributed to the weakening of the real.

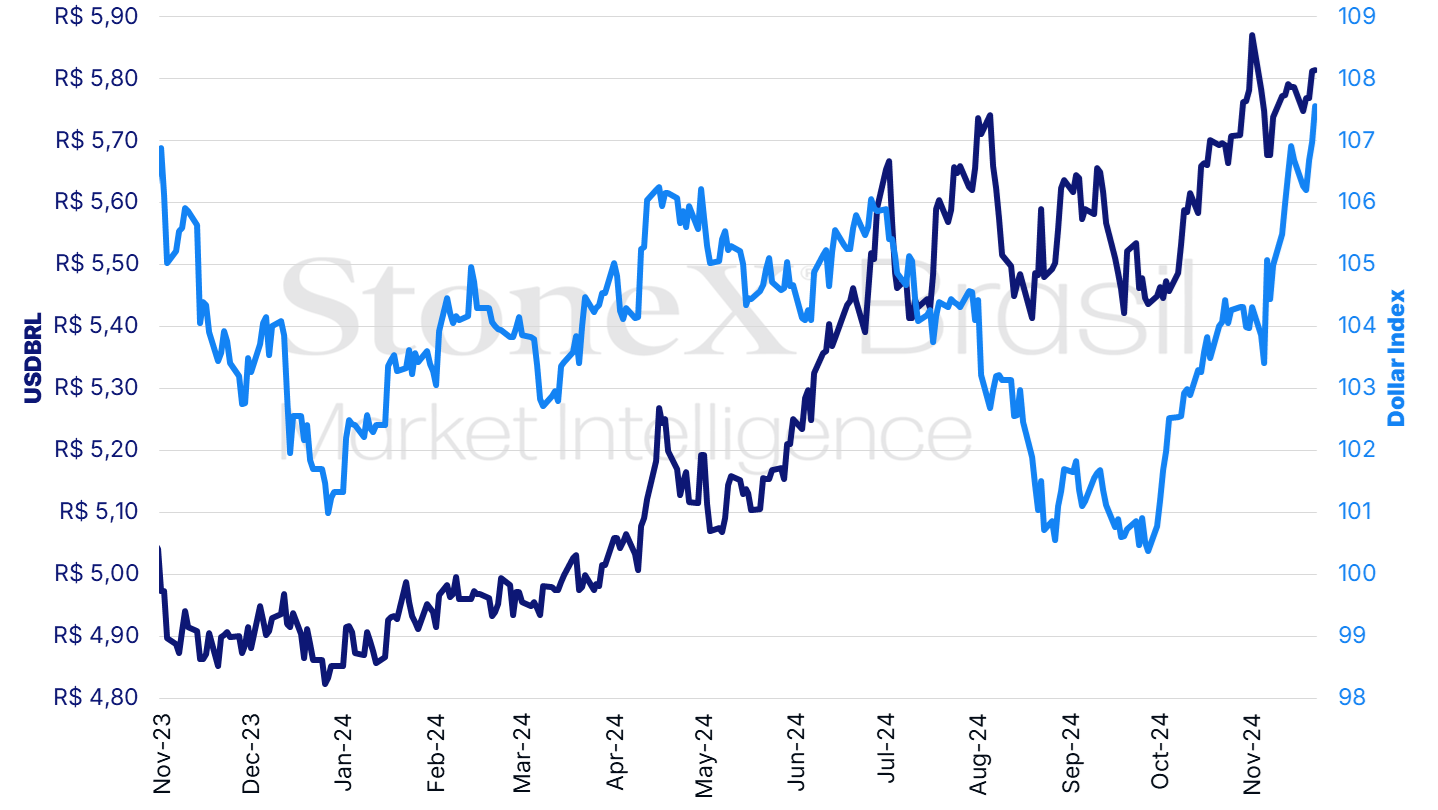

The USDBRL ended Friday's session (22) at R$ 5.814, with a weekly gain of 0.5%, a monthly increase of 0.6%, and an annual gain of 19.8%. Meanwhile, the dollar index closed Friday’s session at 107.5 points, with a weekly variation of +0.8%, a monthly gain of +3.4%, and an annual increase of +6.1%.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Prepared by: StoneX.

KEY EVENT: Expense-Cutting Package

Expected Impact on USDBRL: Bearish

After four weeks of uncertainty, Finance Minister Fernando Haddad stated that the promised package of measures to reduce federal expenses is expected to be announced next Monday or Tuesday. Haddad told journalists, “On Monday morning, we will present the draft of the acts [expense-cutting package] to the president, which has already been drafted by the Civil House. We will finalize the wording of one or two details, including the agreement made with [the Ministry of Defense]. (...) At the end of the meeting, we will be ready to announce [the package]. We will do it either on Monday or Tuesday, depending on the decision of the communications team.”

In recent weeks, the executive branch’s delay in announcing the package has reinforced a perception among investors that the government is showing little urgency or importance in addressing public spending adjustments. This perception has heightened risk premiums for Brazilian assets and negatively impacted national asset performance, including the real exchange rate and futures interest rate contracts (DI). Moreover, various rumors about the package’s size and composition circulated during these weeks of uncertainty, leading to increased volatility in asset performance.

Additionally, there are growing doubts about the feasibility of legislative approval this year, further worsening risk perception. These measures will be sent to Congress as a Proposed Constitutional Amendment (PEC), requiring approval in two rounds by at least 2/3 of congress members in both the House of Representatives and the Senate. However, successive delays in formalizing these proposals make it unlikely that this process will be completed before the parliamentary recess from December 22 to February 2. This increases the likelihood that votes on the issue will occur only from February onward, delaying any proposed changes by several months.

Despite these caveats, the package’s announcement may help ease the pessimistic environment among investors and improve expectations for Brazil's public accounts evolution, which, in turn, tends to reduce required risk premiums, strengthening the real.

US Interest Rate Expectations

Expected Impact on USDBRL: Bullish

In a week shortened by the Thanksgiving holiday on Thursday, the Federal Reserve’s FOMC meeting minutes should again reflect the Committee's cautious stance, reaffirming the central bank’s attentiveness to data and the broadening of options for future decisions. Since the November 7 decision, Fed members have argued there is no urgency for rate cuts, as risks of a sharp economic slowdown have lessened and are more balanced against inflation persistence risks in the US. Additionally, recent US data shows a more robust economy, further supporting the view that the Fed will proceed cautiously and gradually with rate cuts.

In this context, the Personal Consumption Expenditures (PCE) Index, the Fed's preferred inflation gauge, is expected to show the same moderate increase as in September, with a 0.2% rise in the headline index and a 0.3% increase in the core index, excluding volatile food and energy components. If confirmed, this projection would reinforce the view that US price stabilization is slowing, reducing the urgency for Fed rate cuts.

Finally, investors anticipate that economic policy changes under Donald Trump’s new administration may lead to higher inflationary pressures and accelerated public debt growth in the US. This outlook supports the view that US interest rate cuts will be slower and less significant than previously anticipated. These factors are reducing investor expectations for rate cuts, boosting US Treasury yields, and benefiting the dollar.

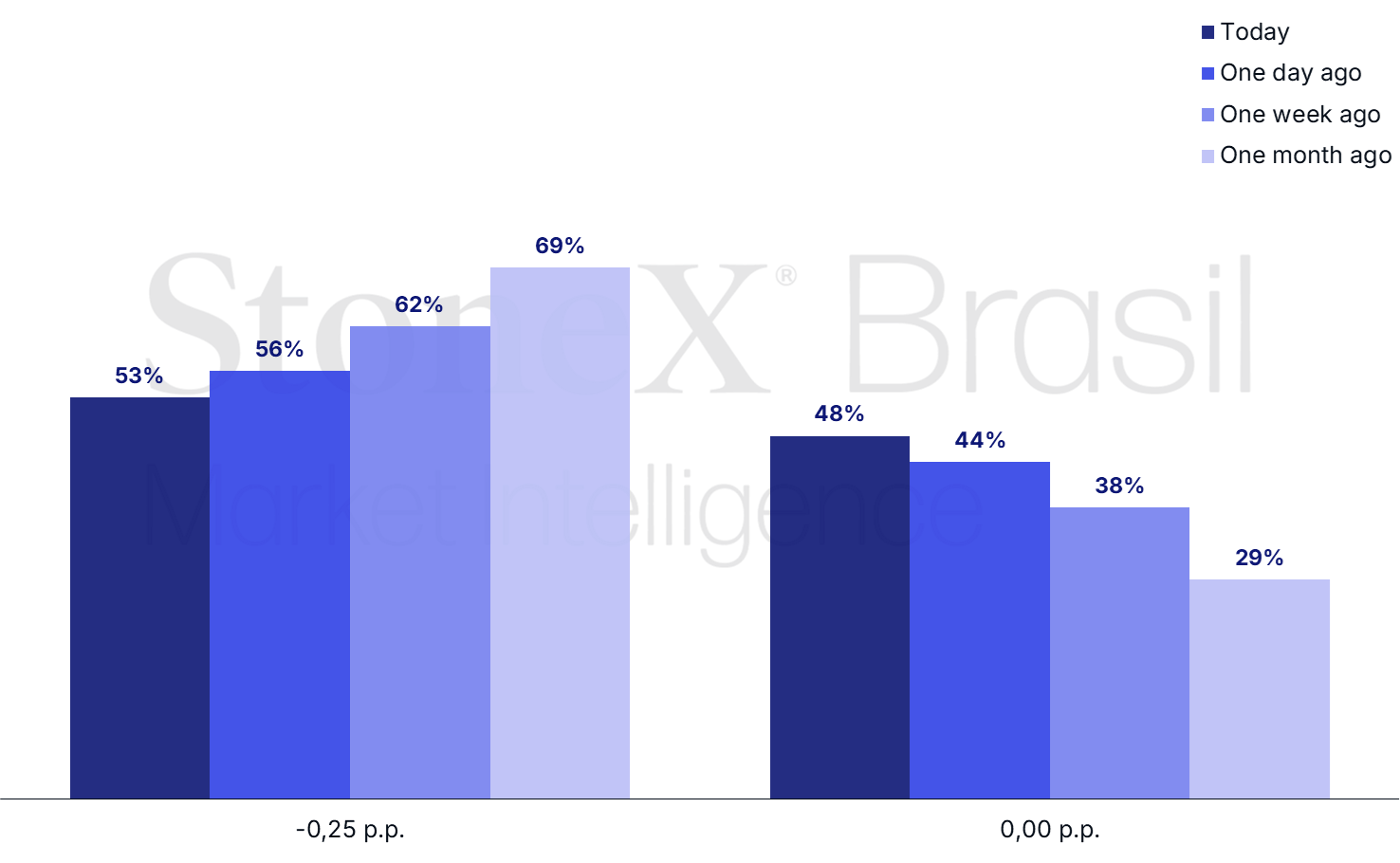

Forecast for the Federal Reserve Interest Rate Decision on December 18

Source: CME FedWatch Tool. Prepared by: StoneX. Futures market probabilities for November 22, 2024.

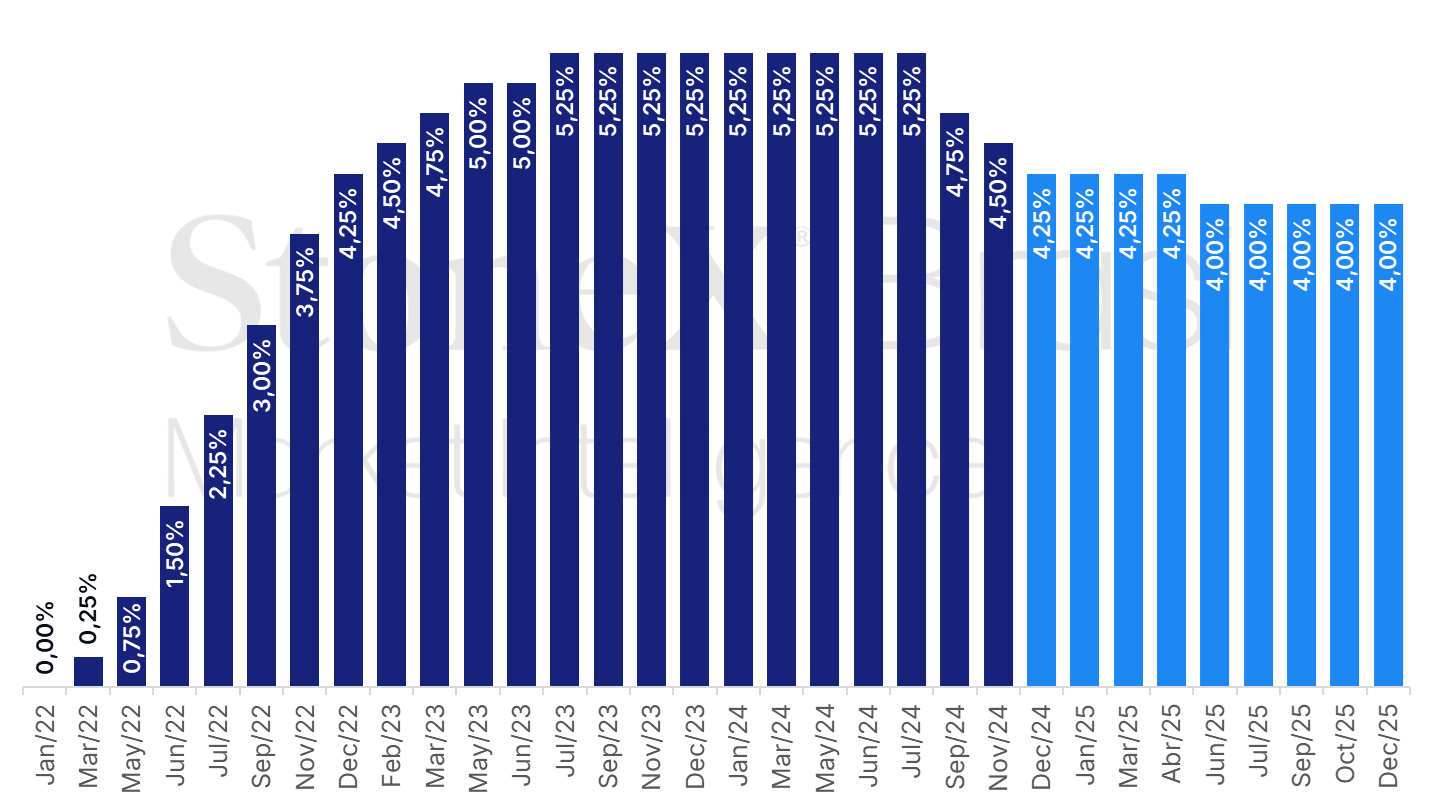

US: Interest Rate History and Outlook – November 22, 2024

Source: CME FedWatch Tool. Prepared by: StoneX. Refers to the most likely futures market bet on the indicated date.

IPCA-15

Expected Impact on USDBRL: Bearish

Projections for the Broad Consumer Price Index-15 (IPCA-15) show a heated new reading, moving from a 0.54% increase in October to approximately 0.50% in November. The recent reacceleration of the IPCA, worsening inflation expectations among investors, pessimism regarding fiscal adjustments, and better-than-expected performance in economic growth and the labor market have led to a stricter stance by the Central Bank's Monetary Policy Committee (Copom). This has consolidated expectations for firm hikes in the Selic rate in the coming months, favoring the attractiveness of domestic securities and encouraging foreign investment, strengthening the real.

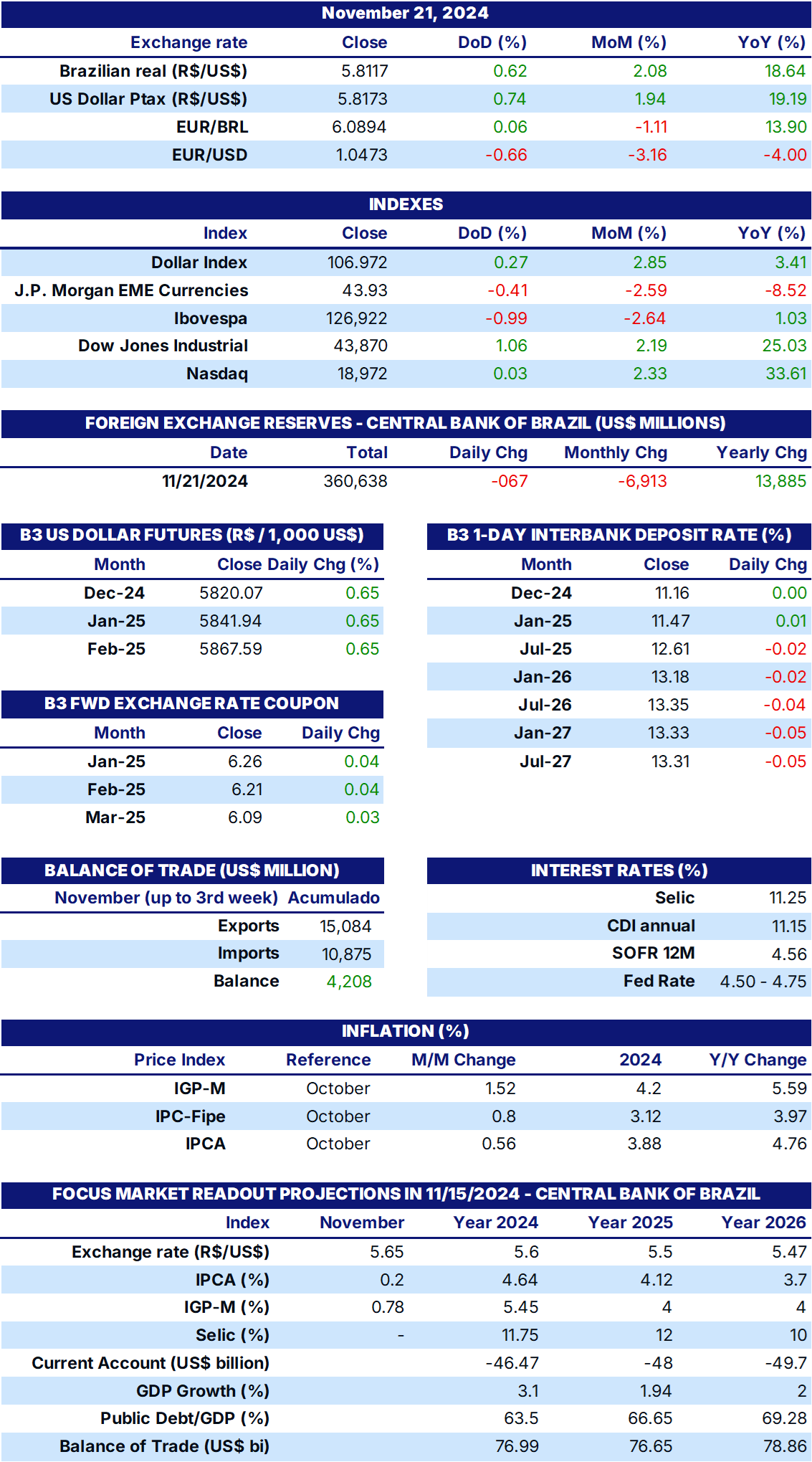

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.