FX Weekly Overview: Key Events of the Week

- Bearish Factors

- Expectations for the announcement of spending cuts in Brazil may reduce fiscal risk perception of Brazilian assets and strengthen the real.

- Bullish Factors

- The extension of the "Trump trade" is expected to continue increasing expectations for economic growth, inflation, and interest rates in the US, strengthening the dollar globally.

The week in review

The week was marked by the dollar's global strength trend, as bets on Federal Reserve rate cuts diminished due to continued position adjustments following Donald Trump's significant election victory and the release of higher-than-expected inflation data in the US. In Brazil, the prolonged uncertainty over the federal government's spending cut package contributed to the weakening of the real.

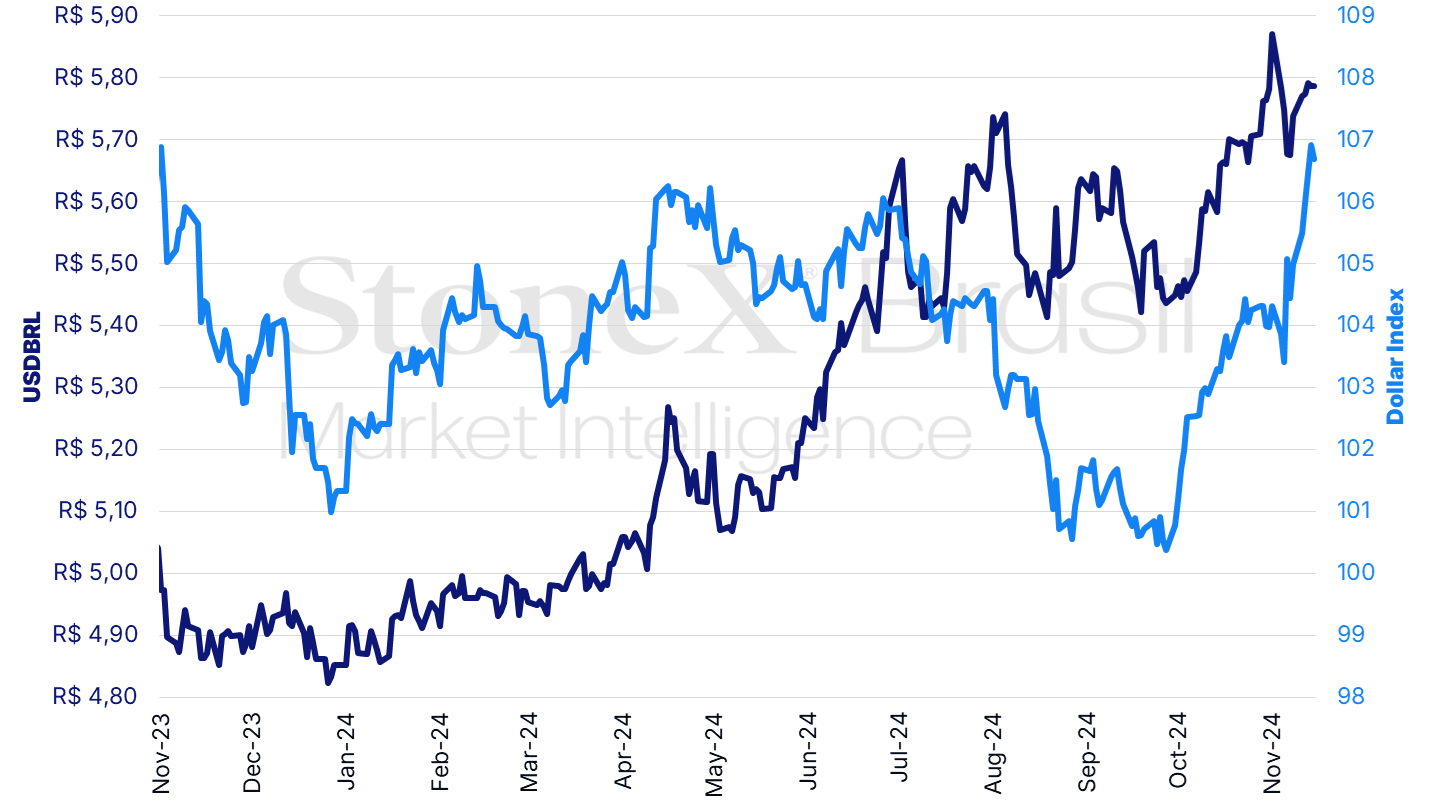

The interbank market dollar ended this Friday's (15th) session higher, quoted at R$5.738, with a weekly gain of 0.8%, a monthly gain of 0.1%, and an annual gain of 19.0%. Meanwhile, the dollar index closed Friday's trading session at 106.7 points, showing a weekly variation of +1.6%, a monthly variation of +2.6%, and an annual variation of +5.3%.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Prepared by: StoneX.

KEY EVENT: Continuation of the "Trump Trade"

Expected impact on USDBRL: bullish

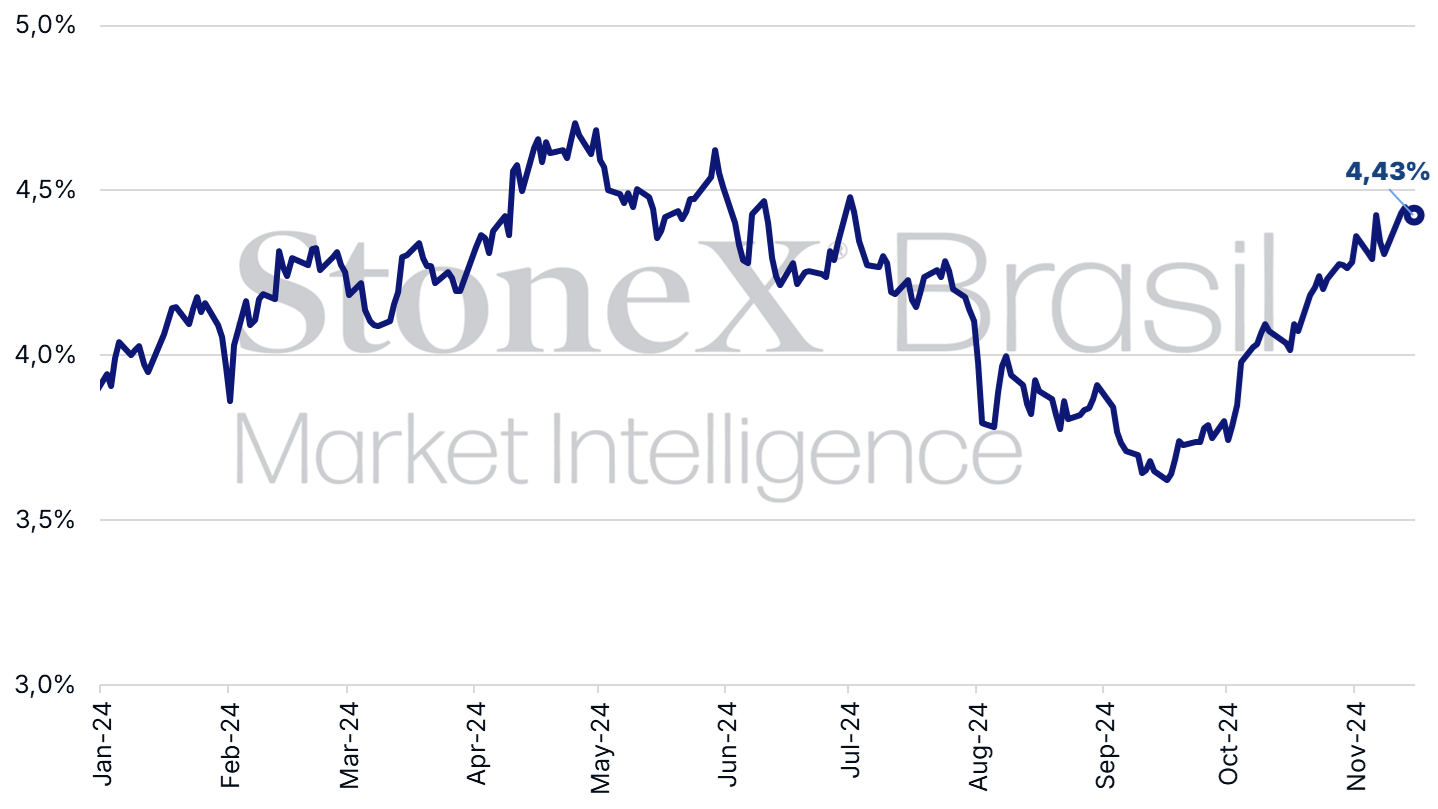

Donald Trump's significant election victory and the Republican majority in the Senate and House continue to reverberate in global financial markets. The dollar index, which weighs the US dollar's value against a basket of advanced economy currencies, rose for the seventh consecutive week due to the extension of the so-called "Trump Trade," that is, the adjustment of investor portfolios to the potential effects of measures by the new Trump administration. For instance, increased import tariffs and restrictions on immigrant entry could create inflationary pressures by raising the costs of imported goods and limiting the labor supply in a labor market with high participation and low unemployment rates. Additionally, corporate tax cuts may boost the profitability of US companies and stimulate investment and growth, while simultaneously increasing the already high fiscal deficit. Potential inflationary pressures and accelerated public debt reduce investor bets on Federal Reserve rate cuts, pushing US Treasury yields higher and benefiting the dollar's performance. Similarly, the prospect of higher profitability for companies attracts foreign capital to the country's stock markets, further strengthening the global performance of the US dollar.

US 10-Year Treasury Yield (% p.a.)

Source: Refinitiv. Prepared by: StoneX.

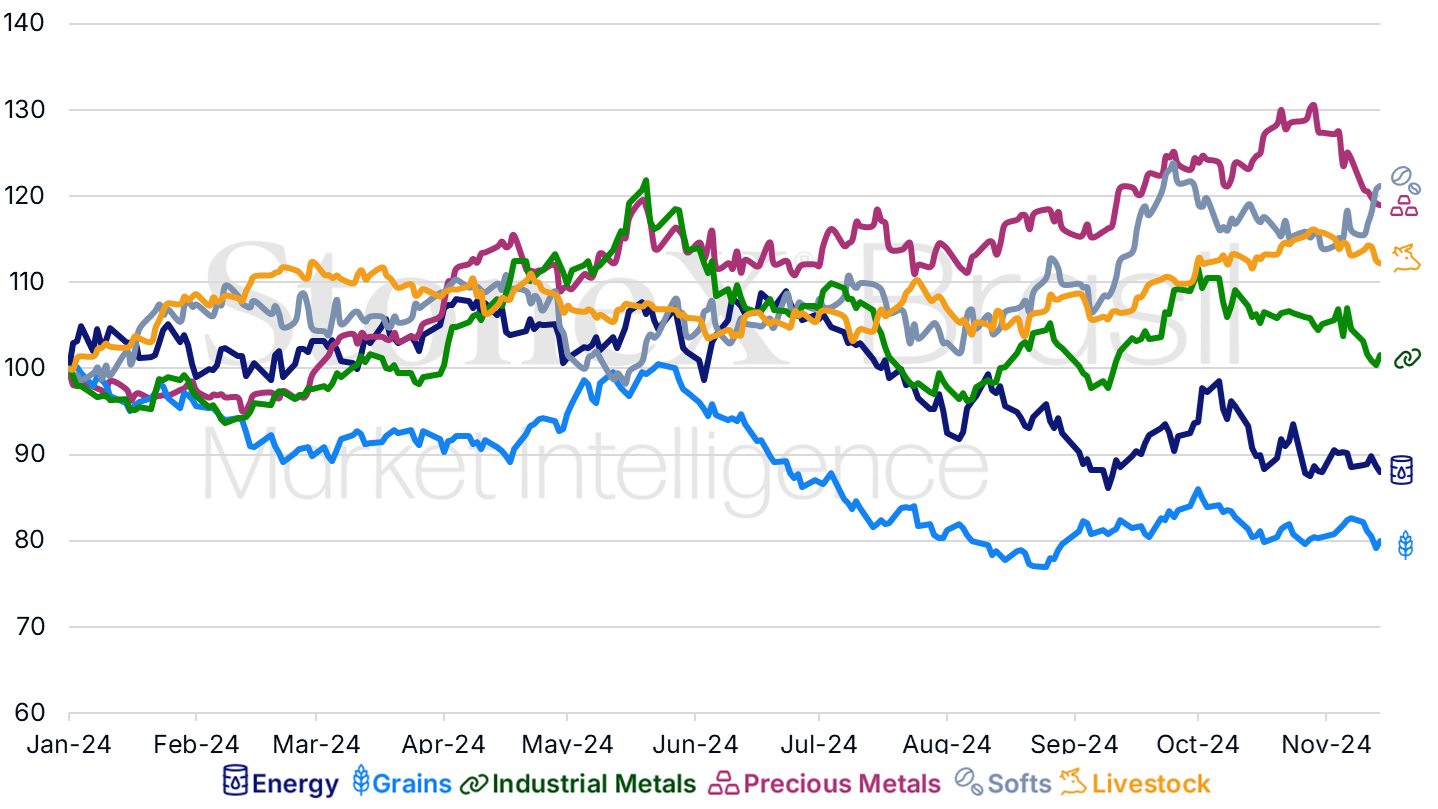

The continuation of the "Trump Trade" has particularly impacted commodity performance due to fears that an escalation in tariff wars between countries could harm international trade and reduce global economic growth potential. These concerns were heightened after a Financial Times report stated that Trump had invited Robert Lighthizer to again head US foreign trade, though this information has not yet been officially confirmed or denied. Lighthizer, known as an "arch-protectionist," was one of the architects of the trade war during Trump's first administration, strongly advocating tariff barriers for the US. Unlike other campaign promises, modifying import taxes can be executed via executive action, allowing the new president greater freedom and speed if he chooses to implement them.

Performance of Bloomberg Commodity Index Subindices (Jan/24 = 100)

Source: Refinitiv. Prepared by: StoneX.

Public Spending Cut Package

Expected impact on USDBRL: bearish

Investors are still awaiting the promised public spending reduction package for the fourth consecutive week, but there are indications that this may finally occur this week. Last week, Brazilian President Luiz Inácio Lula da Silva continued meeting with his economic team ministers and requested the inclusion of the Ministry of Defense in the measures. Additionally, Lula met with Senate President Rodrigo Pacheco (PSD-MG), and Finance Minister Fernando Haddad met with House Speaker Arthur Lira (PP-AL) to discuss the matter. Press reports also stated last week that the Finance Ministry presented Congress with a spending cut package worth R$70 billion for the next two years—around R$30 billion in 2025 and the rest the following year. Although the information has not been officially confirmed, investors are increasingly optimistic that the package will be larger than initially anticipated and could significantly impact fiscal risk perceptions, favoring a strengthening of the real.

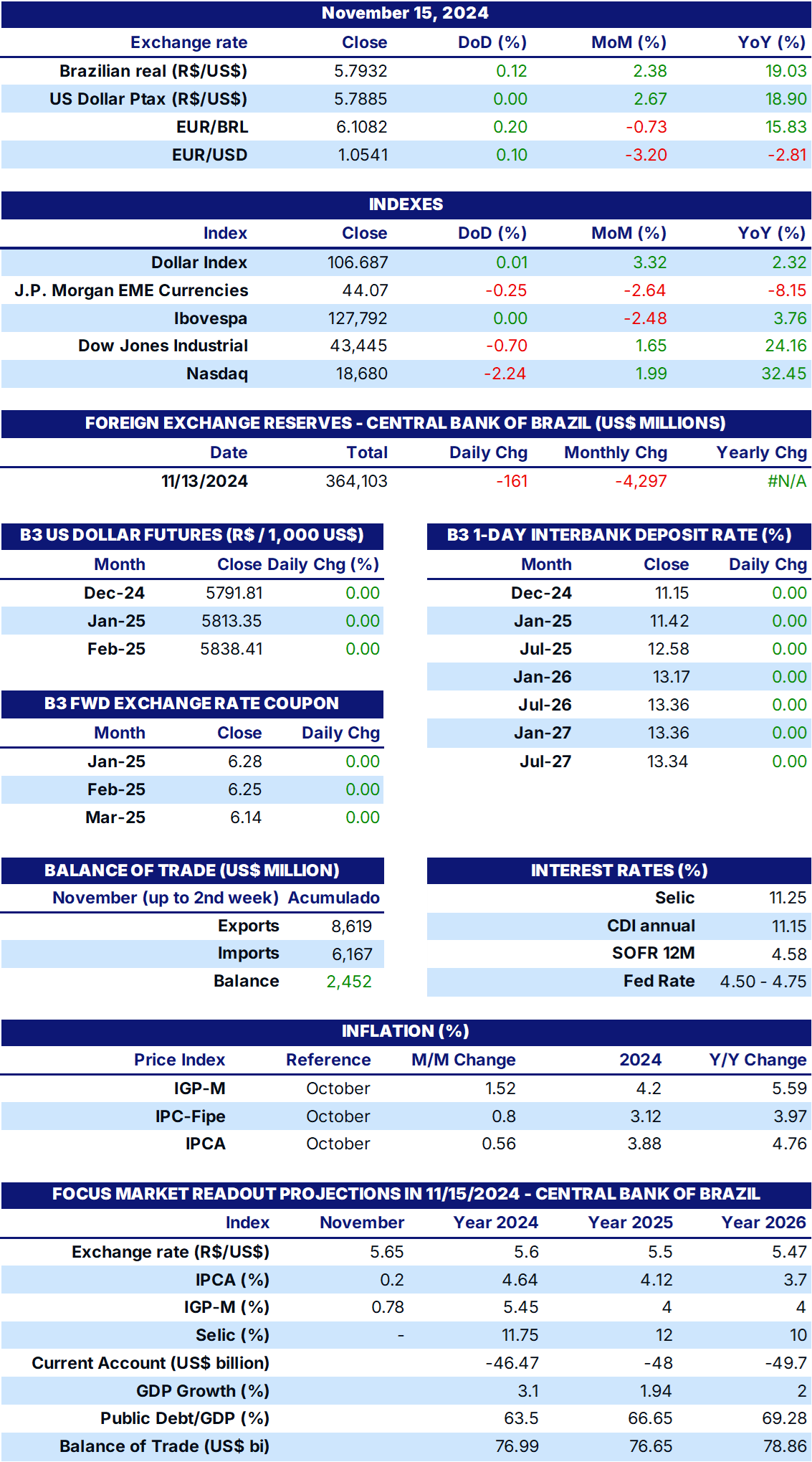

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA, and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.