FX Weekly Overview: The week's main events

- Bearish Factors

- Anticipation of announcements regarding spending cut measures in Brazil could reduce perceived fiscal risks of Brazilian assets and strengthen the real.

- Copom meeting minutes should reinforce expectations for firm Selic rate hikes, favoring the outlook for the Brazilian interest rate differential and contributing to the strengthening of the real.

- Bullish Factors

- A strong victory for Donald Trump is expected to further increase expectations for economic growth, inflation, and interest rate levels in the US, strengthening the dollar globally.

- Moderate increases in US inflation and retail sales in October should reinforce the perception that the Federal Reserve will be cautious in its rate-cutting cycle, favoring the yield on dollar-denominated securities and contributing to the strengthening of the currency.

- Industrial production and retail sales in China may reinforce perceptions of a slowdown in domestic demand, potentially affecting the performance of risk assets such as commodities and currencies of primary goods exporting countries like the real.

The week in review

The week was marked by a broad appreciation of the dollar against other currencies after Donald Trump's strong victory in the US presidential election boosted expectations for economic growth, inflation, and interest rate levels in the country. However, the real was one of the few currencies that strengthened against the dollar amid expectations of an announcement of fiscal adjustment measures in Brazil.

The dollar traded in the interbank market interrupted a five-week upward streak and ended Friday's session (08) down, quoted at R$ 5.738, a weekly change of -2.3%, -0.8% for the month, and +18.3% for the year. Meanwhile, the dollar index closed Friday’s session at 105.0 points, with a weekly gain of 0.7%, a monthly gain of 1.0%, and an annual gain of 3.7%.

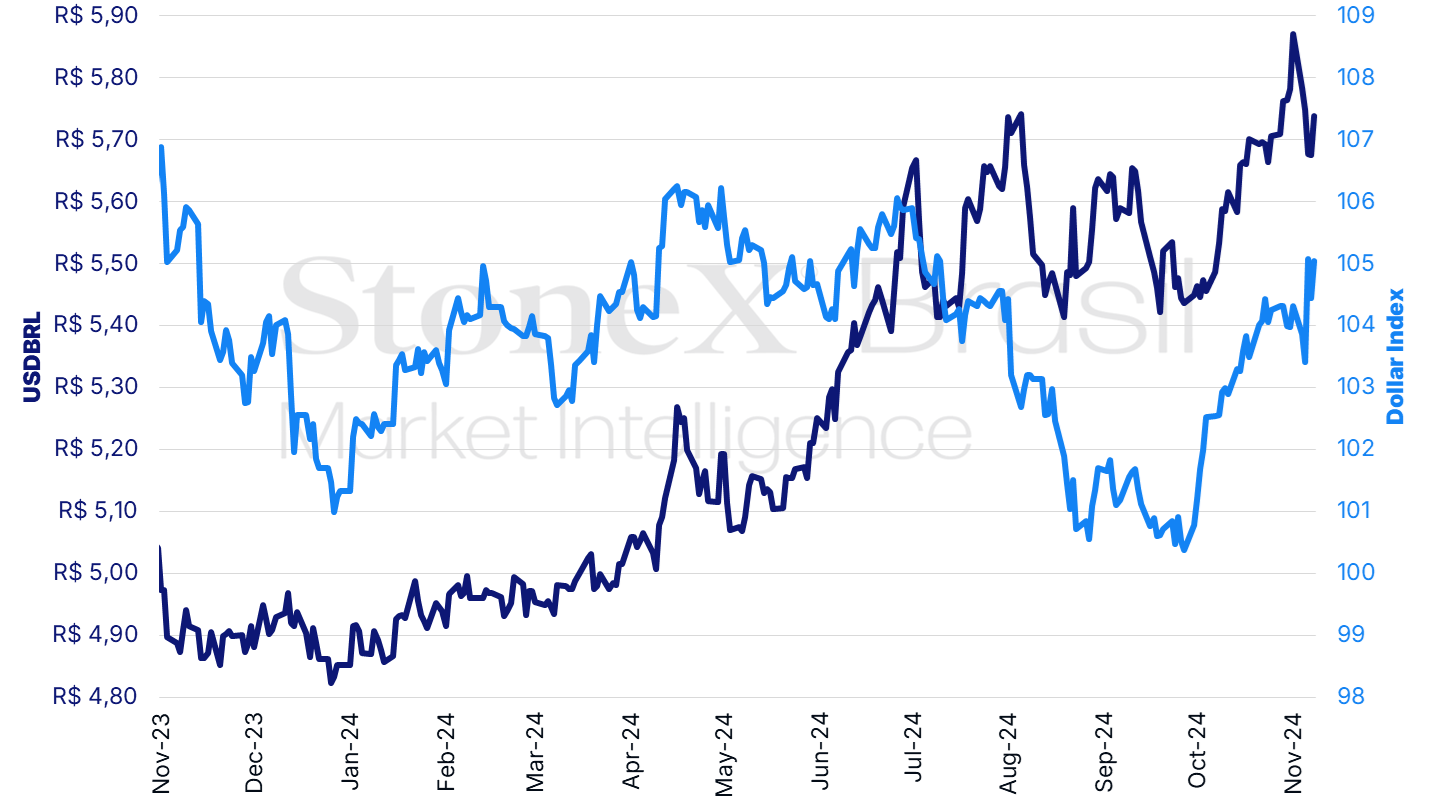

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Prepared by: StoneX.

Key Event: Public Spending Cut Package

Expected Impact on USDBRL: bearish

Last week, the federal government sought to halt the deep investor confidence crisis in relation to fiscal policy management due to the perception that the Presidential Palace showed little urgency and importance towards the need to reduce public expenses. The Finance Minister, Fernando Haddad, canceled an overseas trip to focus on potential spending cut measures, while President Luiz Inácio Lula da Silva held several meetings with ministers from the Budget Committee (Civil House, Finance, Planning and Budget, and Management and Public Service Innovation) and with ministers from areas that could be affected, such as Social Security, Social Development, Education, Health, and Labor. This move helped sustain the value of the real during a week of significant losses for emerging market currencies.

Although the government accelerated discussions and signaled to investors that the announcement of these measures should occur soon, investors' expectations remain high to learn more about the proposed actions, their impact size, the likelihood of Congressional approval, and the implementation timeline. Thus, the demand for risk premiums by financial market operators may increase if the Executive delays the announcement. Similarly, risk premiums may rise again if the announced measures are not perceived as concrete and effective steps to balance public accounts. Nonetheless, investors remain optimistic about the possibility of a significant spending cut package announcement this week, which could reduce fiscal risk perception and contribute to the strengthening of the real.

Trump's Election Effects

Expected Impact on USDBRL: bullish

In October, the release of hotter-than-expected economic data in the US and anticipation of potential effects from a Donald Trump victory led to a reduction in investor bets on interest rate cuts by the Federal Reserve (Fed). This perception that rates will decline more slowly in the US boosted Treasury yields to their highest level since late July and supported the global dollar performance. This trend strengthened after Trump’s strong victory and the likely Republican control of the Legislature (currently holding a Senate majority and projected to gain a House majority), which significantly altered investor expectations regarding the dollar.

Based on campaign promises made by Trump, analysts expect the US government to implement widespread tariff increases on imports, impose immigration restrictions, and cut corporate taxes, thereby widening the fiscal deficit. These measures may result in future inflationary pressures, as they are likely to increase the cost of imported goods, restrict the labor supply in a job market with high participation rates and low unemployment, and accelerate public debt levels. This, in turn, would require a stricter Federal Reserve stance to counteract these impacts, potentially leading to more cautious interest rate cuts, supporting the strength of the US dollar. Additionally, potential US protectionist trade policies and retaliations from other countries could impact currencies of primary goods-exporting nations like the real.

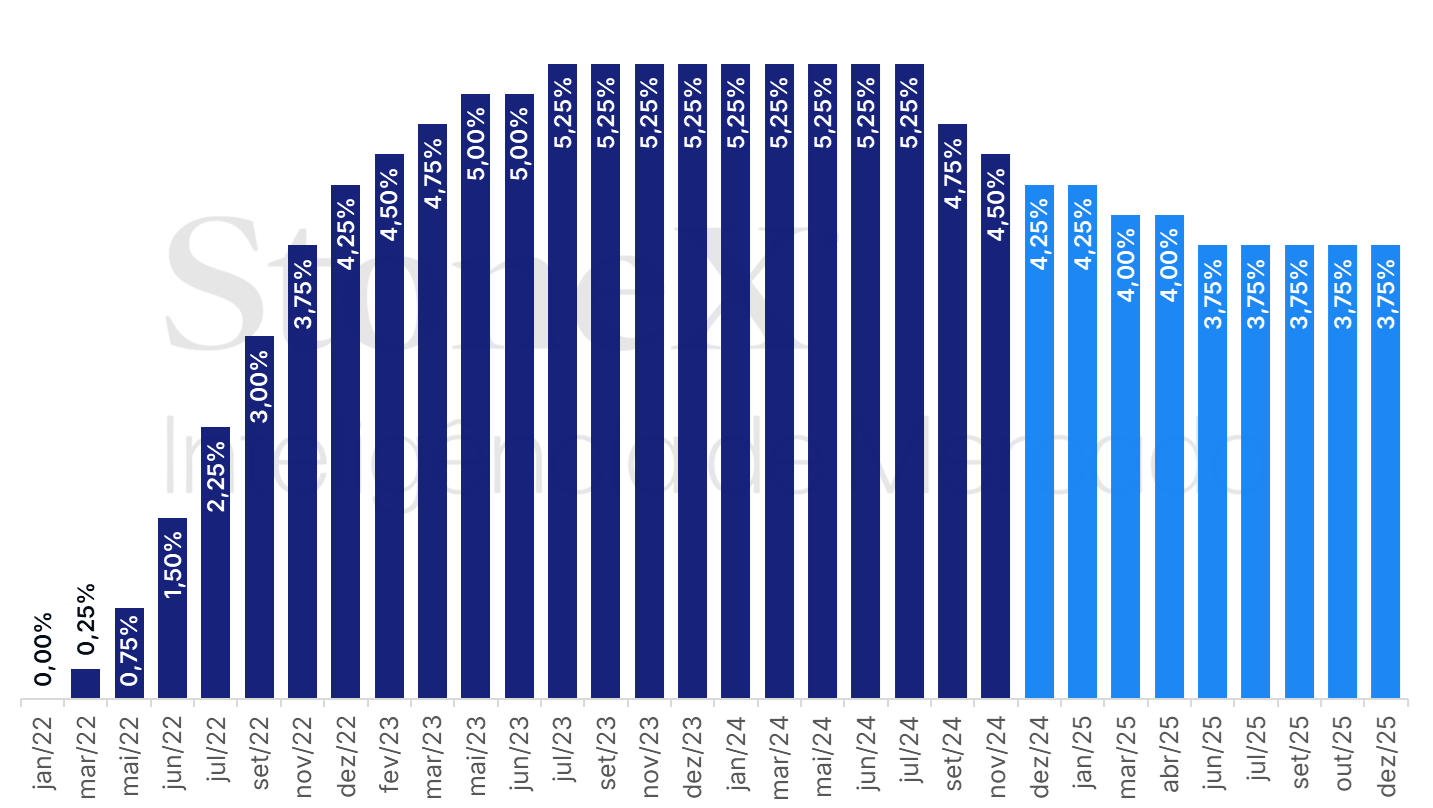

US: History and Expected Interest Rates – November 08, 2024

Source: CME FedWatch Tool. Prepared by: StoneX. Refers to the highest probability bet in the futures market on the indicated date.

US Economic Data

Expected Impact on USDBRL: bullish

The Consumer Price Index (CPI) is expected to repeat its moderate September increase in October, i.e., a 0.2% rise in the headline indicator and 0.3% in its core, which excludes volatile food and energy components, likely driven by prices for used vehicles and auto-related services, such as insurance and maintenance. US retail sales in October are also expected to rise by approximately 0.4%, indicating that consumer demand remains robust. Both retail sales growth and core inflation are expected to reinforce the perception that price stabilization in the US will be slower and more complicated than anticipated, and that the Federal Reserve will need to be more cautious in its interest rate cut cycle, which tends to benefit the dollar's performance.

Copom Meeting Minutes

Expected Impact on USDBRL: bearish

The Central Bank will release the minutes from the last Monetary Policy Committee (Copom) meeting, which unanimously raised its benchmark Selic rate by 0.50 percentage points and took a firmer stance in its statement, reiterating that the inflation risk balance remains asymmetrical and tilted to the upside, and that worsening fiscal risk perception and higher inflation expectations require tighter monetary policy. The minutes could provide more details on the decision to accelerate the Selic rate hike pace by 0.50 p.p. and the Committee's assessment of the cycle's extent, which could reinforce expectations for firm Selic rate hikes in the coming months and support domestic bond yields, attracting foreign investments and strengthening the real.

Chinese Economic Data

Expected Impact on USDBRL: bullish

Last week, China’s trade balance figures showed both higher-than-expected export growth and a sharper decline in imports. Annual export growth rose from 2.4% in September to 12.7% in October, likely driven by early purchases from countries that may impose tariff barriers on Chinese companies, such as the US and the European Union. Exports of high-tech products like cell phones, computers, chips, batteries, and electric vehicles have been one of the few positive points for the country's economy. On the other hand, the annual import variation dropped from +0.3% to -2.3% during the period, reflecting slowing domestic demand. Additionally, investors were disappointed by the Chinese authorities' announcement of a refinancing package for Chinese municipalities amounting to 10 trillion yuan (approximately US$ 1.4 trillion) over five years, with uncertain final impacts as it only replaces existing debts and does not require new spending.

This week, data on industrial production and retail sales in China for October are expected to reinforce the trends observed in the trade balance figures, i.e., faster industrial production growth driven by exports, while retail sales growth is expected to slow due to weaker domestic demand. If confirmed, this data could worsen investor expectations for Chinese economic growth, which would negatively impact currencies of primary goods-exporting countries like the real.

Fiscal Statistics

Expected Impact on USDBRL: bullish

While financial market agents await more details on measures to adjust federal expenses, the release of fiscal statistics for September is expected to show a primary deficit of about R$ 8 billion, reinforcing concerns that the primary result is evolving in a way incompatible with achieving the target set by the fiscal framework, potentially harming Brazilian asset performance and weakening the real.

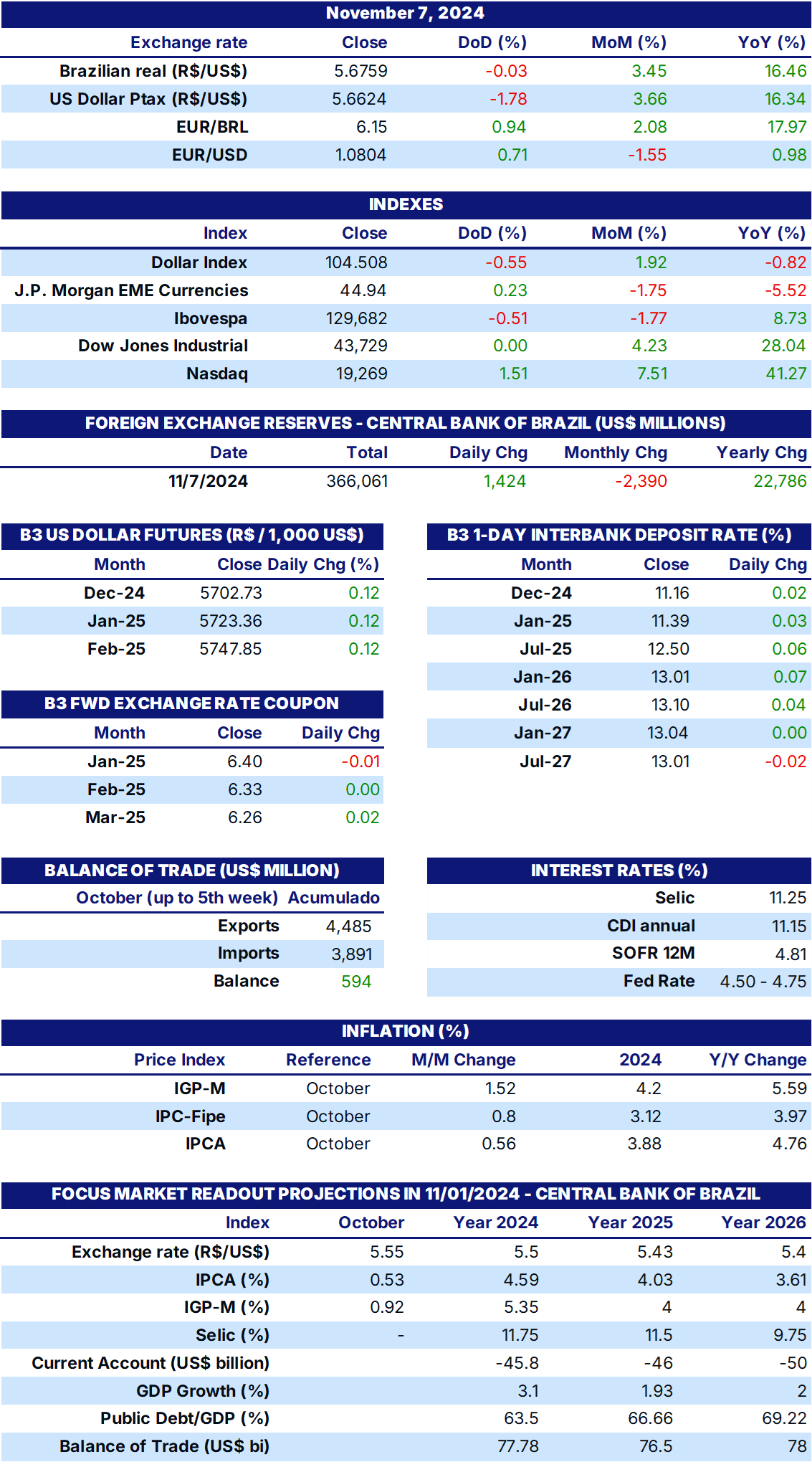

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.