FX Weekly Overview: The week's main events

- Bearish Factors

- The FOMC is expected to lower its interest rate by 0.25%, reducing the yield potential for dollar-denominated bonds, which could weaken the U.S. dollar.

- The Copom is expected to increase the Selic rate by 0.50%, improving Brazil's interest differential and attracting foreign capital, strengthening the real.

- An acceleration in October’s IPCA may boost expectations for a strict cycle of Selic rate hikes, attracting foreign investment and strengthening the real.

- Bullish Factors

- A tight and unpredictable U.S. presidential election may drive demand for safe-haven assets, boosting the dollar.

- A credibility crisis in Brazilian fiscal policy may worsen risk perception of Brazilian assets, leading investors to demand higher risk premiums and weakening the real.

- China's trade balance could reinforce concerns about slowing domestic demand, which could negatively impact risky assets like commodities and the currencies of primary product exporters, such as the real.

Last week in review

The Brazilian real weakened for the fifth consecutive week, pressured by investor pessimism and skepticism over fiscal policy management and public debt sustainability in Brazil, as well as a global risk-averse environment driven by the approaching U.S. presidential election, which remains tight and unpredictable.

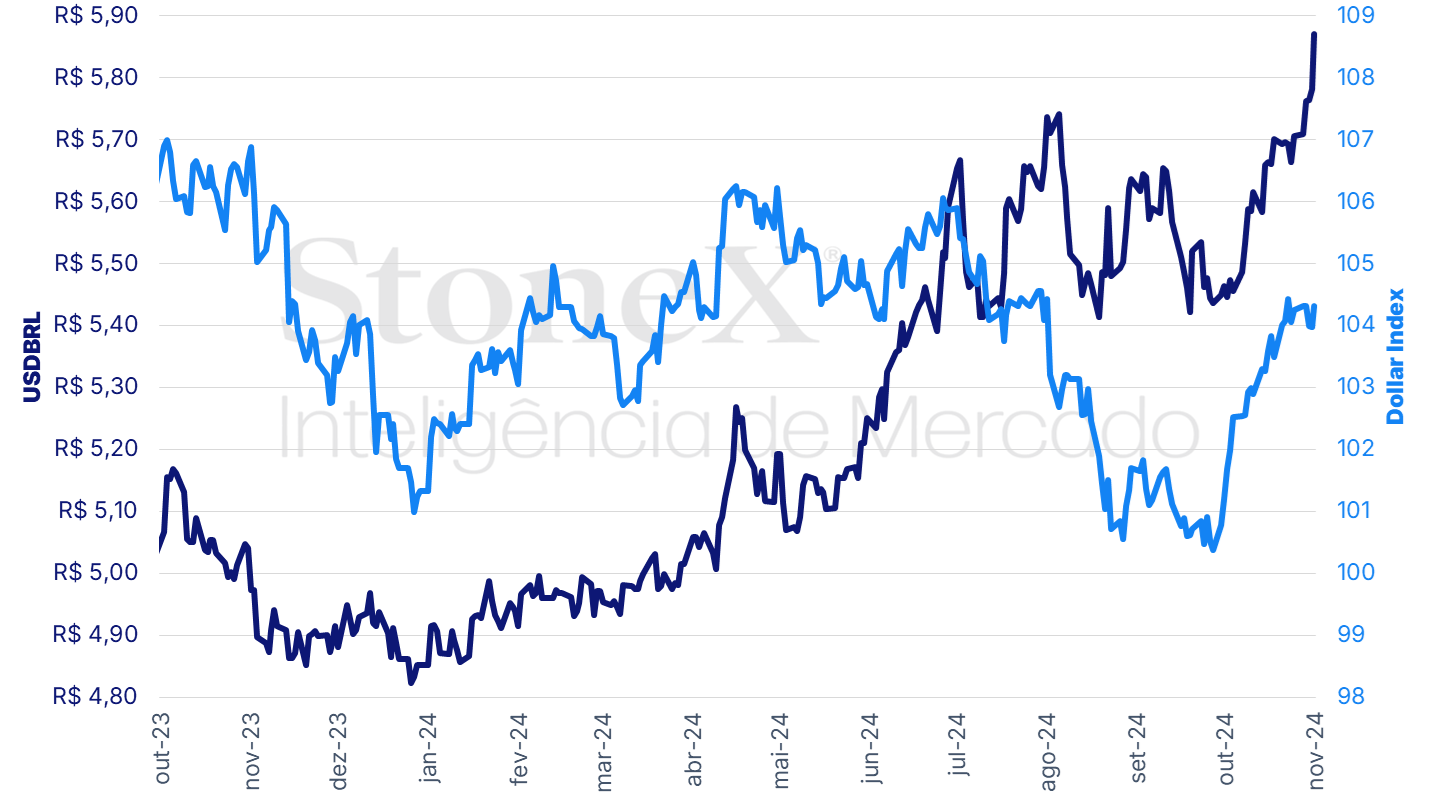

The USDBRL closed last Friday's session (01) higher at R$5.8699, marking a weekly gain of 2.9%, a monthly gain of 1.5%, and an annual gain of 21.0%. Meanwhile, the dollar index closed last Friday's session at 104.3 points, with a weekly change of +0.1%, monthly change of 0.3%, and annual change of +3.0%.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Prepared by StoneX.

Key event: U.S. Presidential Election

Expected Impact on USDBRL: Bullish

In recent weeks, global investors have maintained a reduced appetite for risk as they await the U.S. presidential election, which concludes on November 5 and is expected to be one of the closest races in decades. With only a few days remaining, polling remains nearly tied, leaving the outcome unpredictable. Six potentially decisive U.S. states show a difference in voting intentions between Donald Trump and Kamala Harris of less than two percentage points, with three of these states showing a difference of less than one percentage point. Given the anticipated narrow margin, the confirmation of the election result could take several days, as it will likely be necessary to wait for all states to finish counting and, possibly, for the results of audits and recounts in states where the vote is very close. This prolonged uncertainty about the U.S. political landscape and, consequently, the direction of the country’s economic policies over the next four years is expected to sustain a risk-averse business environment, driving demand for safe-haven assets that are less volatile and more liquid, like the U.S. dollar.

Brazilian Fiscal Policy Credibility Crisis

Expected Impact on USDBRL: Bullish

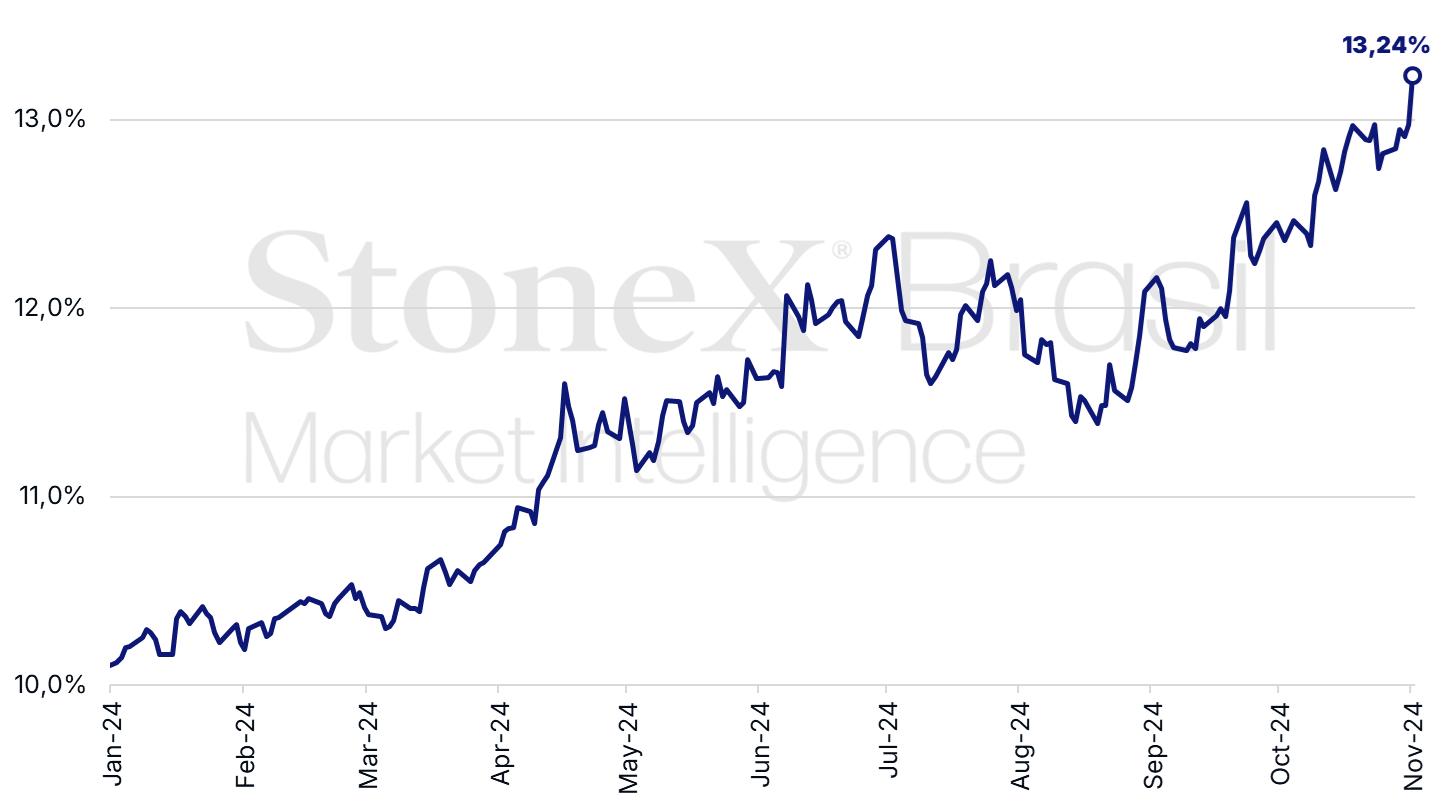

In recent weeks, a deep crisis of investor confidence regarding the management of Brazil’s fiscal policy has negatively impacted the performance of Brazilian assets, such as the exchange rate of the real and the interest rate on futures contracts (DI). Last Friday (01), the USDBRL closed at its highest level since May 13, 2020 (5.9012), while the DI rate for January 2029 broke through the 13% p.a. threshold for the first time since March 16 of last year. Although the federal government has repeatedly promised “structural adjustments” to public spending, financial market players generally perceive that the presidential office demonstrates little urgency and importance regarding this issue, fueling a growing pessimism about the Executive’s ability to adjust public spending levels. Consequently, the demand for risk premiums continues to rise, further weakening the real—a trend likely to persist without concrete federal measures to alleviate fiscal concerns, which is improbable this week due to Finance Minister Fernando Haddad’s trip abroad.

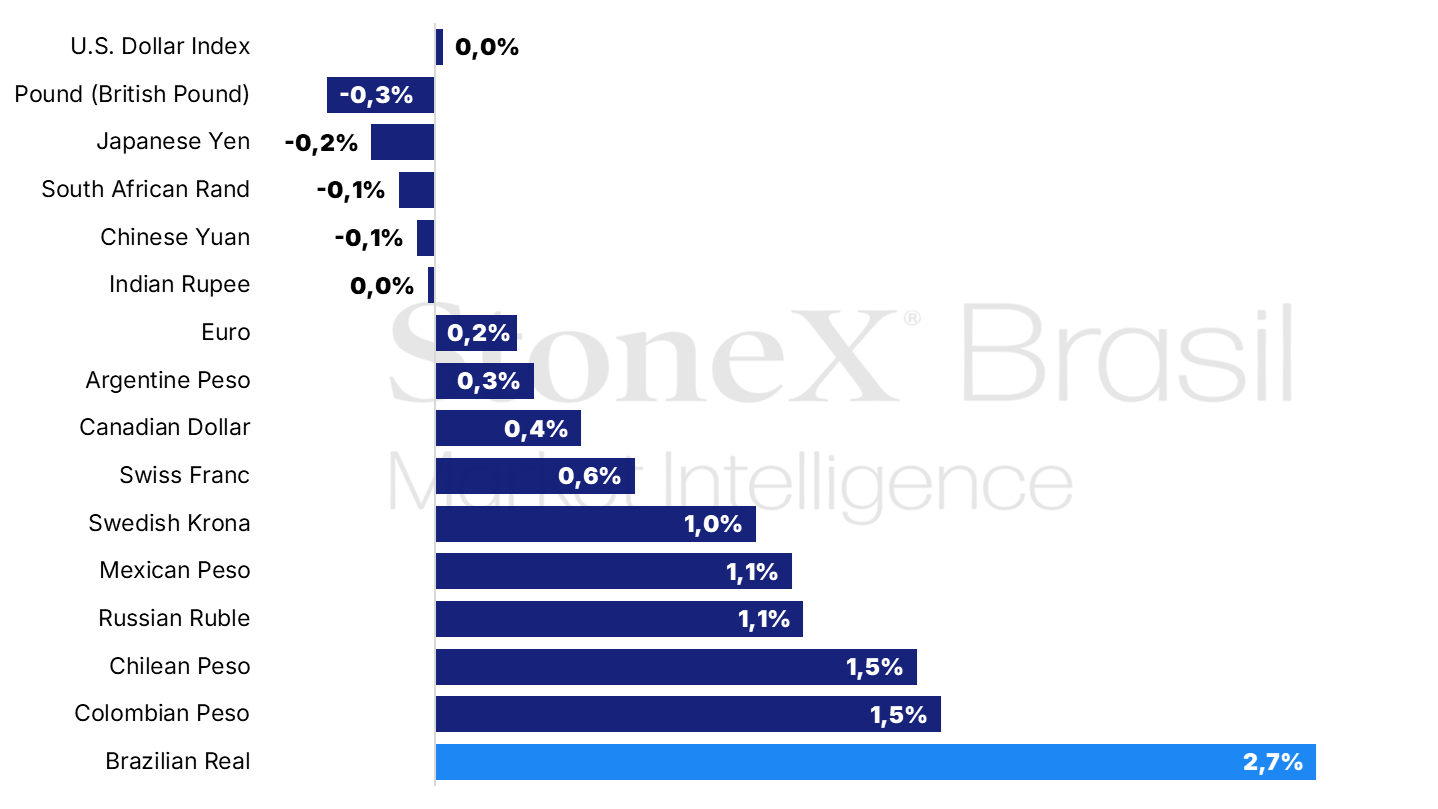

Weekly changes of selected currencies against the USD

Source: Refinitiv. Prepared by StoneX.

Brazil: Interbank Deposit Rate (DI) for January 2029 (% p.a.)

Source: Refinitiv. Prepared by StoneX.

FOMC Rate Decision

Expected Impact on USDBRL: Bearish

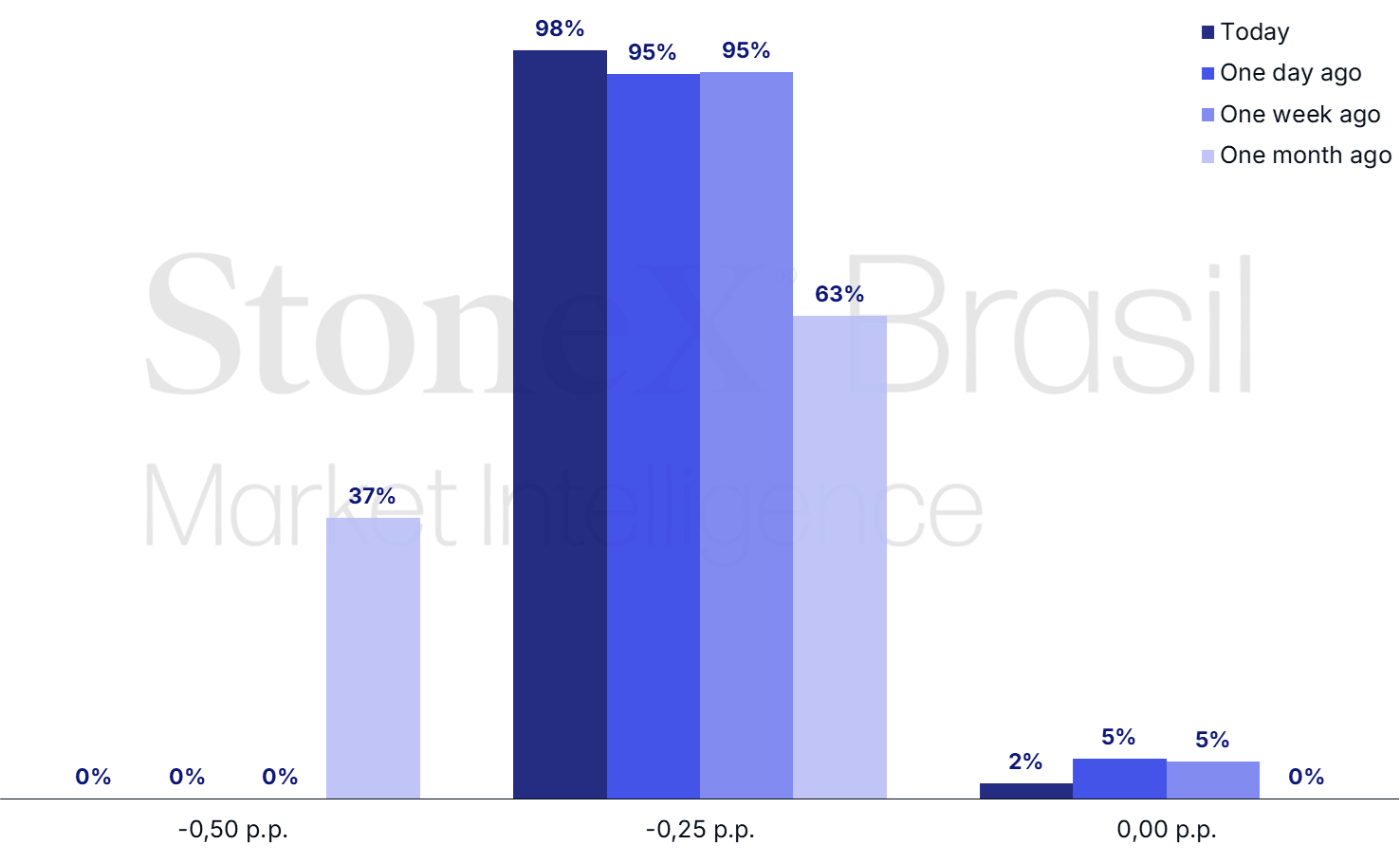

There is near consensus among analysts that the Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) is likely to reduce the U.S. benchmark interest rate by 0.25 percentage points, from the 4.75%-5.00% range to the 4.50%-4.75% range. Following the Committee’s unexpected 0.50 percentage point rate cut in September, most economic indicators in the United States have performed above expectations, suggesting that the economy remains resilient and that inflation stabilization may take longer than anticipated. Thus, there are no apparent reasons for the FOMC to repeat a more aggressive rate cut. On the other hand, there is still a perception that the country is experiencing a gradual slowdown and that the risks of a renewed inflationary acceleration appear lower than the risks of a sharp economic downturn, justifying another 0.25 percentage point rate cut. Finally, investors will focus on the statement accompanying the decision and on the press conference held by Federal Reserve Chair Jerome Powell, seeking greater clarity on the future direction of U.S. monetary policy.

Federal Reserve Rate Decision Projections for November 7

Source: CME FedWatch Tool. Prepared by StoneX.

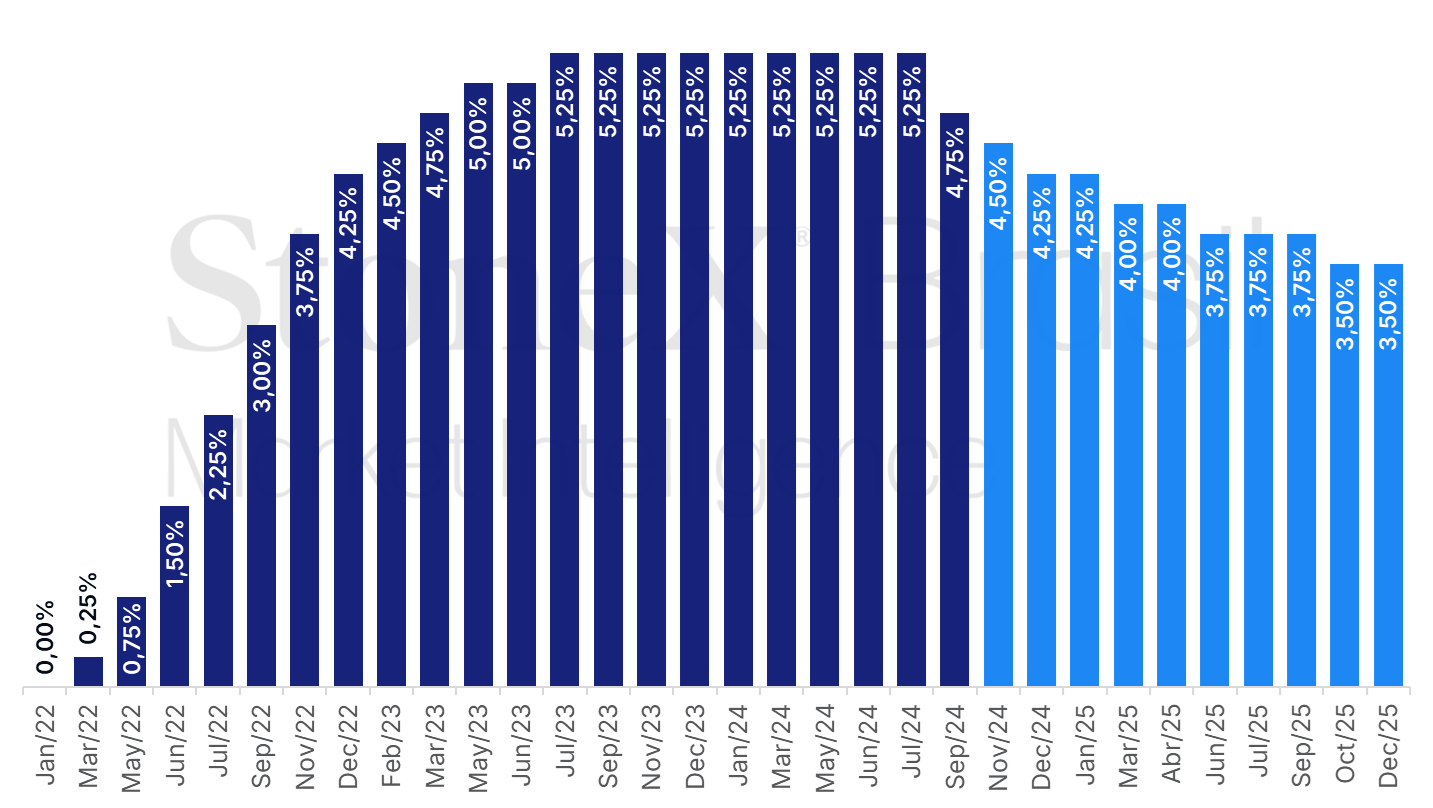

USA: History and Expected Interest Rate – November 1, 2024

Source: CME FedWatch Tool. Prepared by StoneX. Refers to the highest probability forecast in the interest rate futures market on the indicated date.

Copom Rate Decision

Expected Impact on USDBRL: Bearish

Amid a scenario of cumulative worsening in the perception of fiscal risks associated with Brazilian assets, the Central Bank’s Monetary Policy Committee (Copom) is expected to raise the benchmark interest rate (Selic) for the second consecutive decision. The median forecast indicates a 0.50 percentage point increase, from 10.75% to 11.25% per year, with additional hikes anticipated, potentially reaching 12.00% per year. In its latest decision, Copom reiterated its “firm commitment to converge inflation to the target,” adopting a stricter stance on the need for a more restrictive monetary policy to address an asymmetrical and upward-biased inflation risk balance, “characterized by economic resilience, labor market pressures, a positive output gap, rising inflation forecasts, and unanchored expectations.” The Central Bank’s firm position and the expectation of further Selic hikes, while the Federal Reserve is entering a rate-cutting cycle, increase the outlook for Brazil’s interest rate differential. This makes domestic bonds more attractive and supports foreign investment inflows, strengthening the real.

October IPCA

Expected Impact on USDBRL: Bearish

Two days after the Monetary Policy Committee's decision, October's Broad Consumer Price Index (IPCA) is expected to rise from 0.44% in September to around 0.50% in October, driven by increases in food and electricity prices. If the projection is confirmed, the index would accumulate a 4.50% increase over 12 months, reaching the upper tolerance limit of the Central Bank's inflation target. This data could heighten concerns that price stabilization in the country is weakening (the Central Bank projected a 36% risk in September that the IPCA would exceed the maximum limit this year) and reinforce expectations of a strict cycle of Selic rate hikes by Copom, which could support expectations for an expanded Brazilian interest rate differential and attract foreign capital, strengthening the real.

China's Trade Balance

Expected Impact on USDBRL: Bullish

In recent months, China’s export figures have shown stronger performance than domestic demand data, driven by the chip and electric vehicle sectors. Accordingly, the median projection for annual export growth has risen from +2.4% in September to around +5.5% in October, while the median estimate for annual import growth has declined from +0.3% to -0.3% over the same period. If confirmed, these data could worsen investor expectations for Chinese economic growth, thereby reducing prospects for commodity demand growth from the world’s second-largest economy and negatively affecting the performance of currencies from primary product-exporting countries, such as the real.

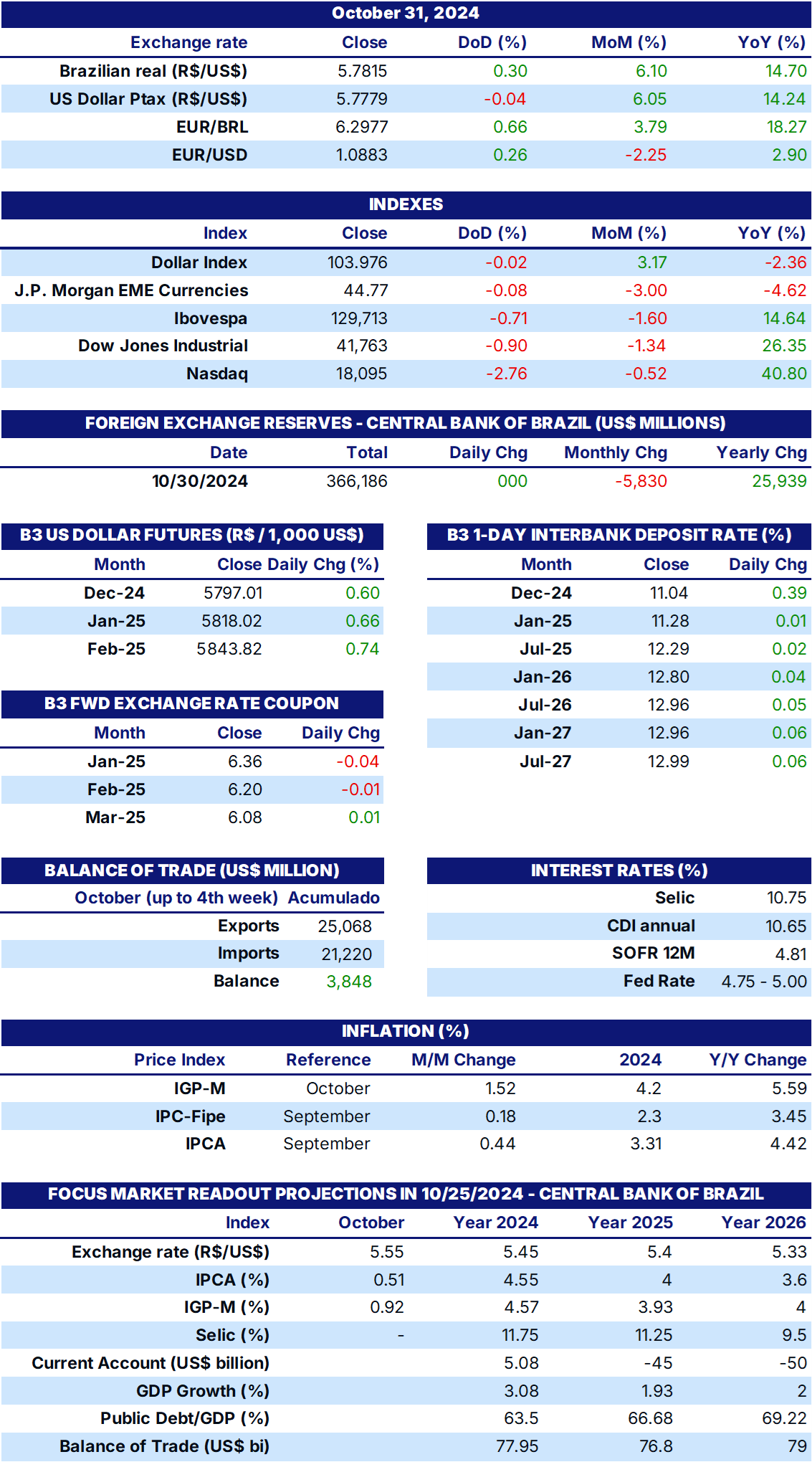

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.