FX Weekly Overview: The week's main events

- Bearish factors

- Expectations of an announcement of Chinese fiscal stimulus may improve growth projections for the country and support the performance of riskier assets such as equities, commodities, and emerging market currencies like the BRL.

- Bullish factors

- Worsening perception of Brazilian fiscal risks increases investors' demand for risk premiums, which could hinder foreign capital inflows and weaken the BRL.

- Moderate growth in US retail sales should reinforce perceptions of a "soft landing" for the US economy, reducing bets on rate cuts by the Fed, strengthening the dollar.

- Chinese economic data for September is likely to reinforce the reading of slowing momentum and worsen growth expectations for the country, harming the performance of risk assets such as equities, commodities, and emerging market currencies like the BRL.

- The ECB’s interest rate decision is expected to reduce expectations for the euro’s interest rate differential against the US, indirectly strengthening the dollar.

The week in review

The US dollar strengthened globally, driven by a hotter-than-expected US inflation reading, a more hawkish tone in the Federal Reserve's policy meeting minutes, and concerns over Chinese economic growth. The real’s losses were deepened by concerns over Brazilian fiscal policy management and increased risk perception for local assets.

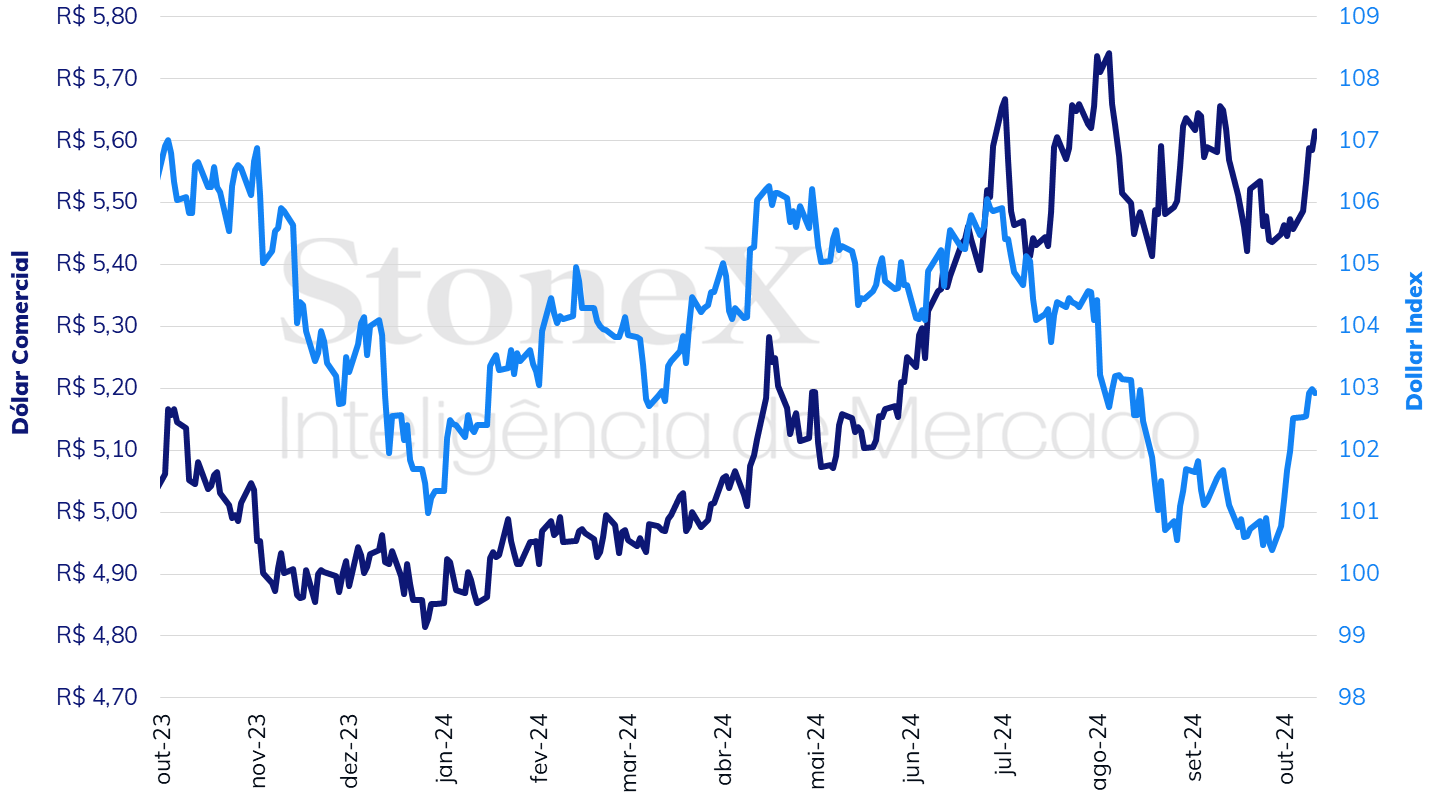

The USDBRL ended last Friday’s session (11) higher, quoted at BRL 5.4564, up 0.4% for the week, 0.1% for the month, and 12.5% for the year. Meanwhile, the dollar index closed Friday’s trading at 102.5 points, up 2.1% for the week, 1.7% for the month, and 1.1% for the year.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Prepared by: StoneX.

MOST IMPORTANT: Fiscal Concerns in Brazil

Expected Impact on USDBRL: Bullish

Last week, growing distrust in Brazil's fiscal consolidation process significantly raised the perceived risk for Brazilian assets, increasing investors’ demand for risk premiums. News that the Ministry of Finance had presented scenarios to President Luiz Inácio Lula da Silva for increasing income tax exemptions to salaries up to BRL 5,000 reinforced the view that the federal government prioritizes revenue-raising measures over alternatives that might reduce expenditures. This added stress to the real’s performance and further increased the pricing of future Brazilian interest rates — the DI contract for November 2025 pointed to a benchmark Selic rate above 13% per year. The renewed concerns of investors regarding fiscal policy, coupled with higher inflation expectations and stronger-than-expected economic activity and labor market performance in the country, cemented the outlook for a more stringent cycle of monetary tightening in Brazil. This week, with a lighter domestic economic calendar, investors are expected to follow statements from officials about the evolution of monetary and fiscal policies amid worsening risk assessments for Brazilian assets and pronounced volatility in exchange rates and interest rates.

US Retail Sales

Expected Impact on USDBRL: Bullish

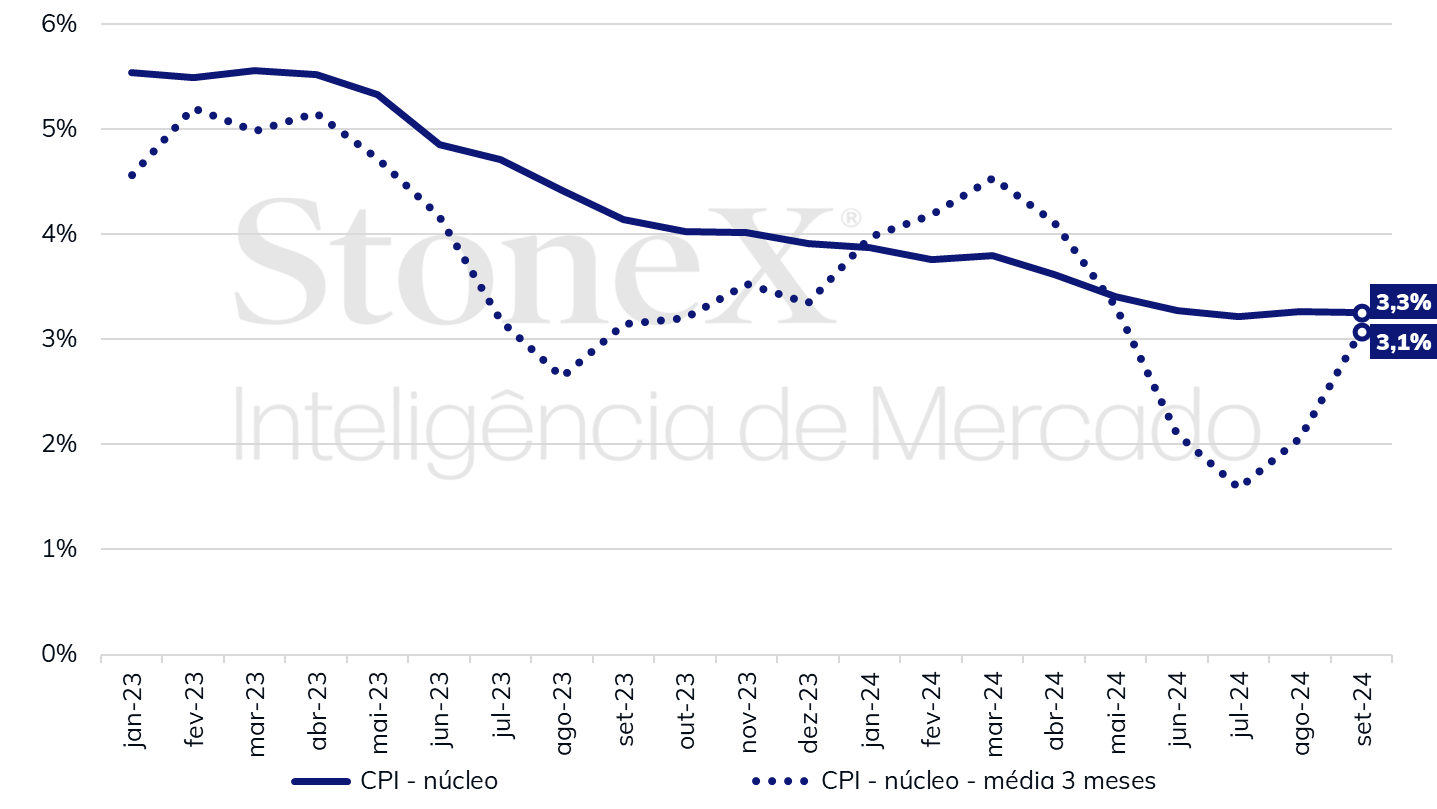

Last week, the release of the US Consumer Price Index (CPI) for September and the minutes of the Federal Reserve's Open Market Committee (FOMC) reinforced the view that the pace of interest rate cuts by the Fed will be slower than anticipated. The CPI accelerated more than expected in September, with a 0.2% rise in the headline index and a 0.3% increase in the core index, which excludes volatile food and energy components, raising doubts about the speed of price stabilization in the country. The minutes showed surprisingly greater-than-expected support, albeit minority, for a 0.25 p.p. rate cut instead of the 0.50 p.p. cut before 11 of the 12 members voted for the more aggressive cut.

US Inflation Measures (12-month cumulative)

Source: U.S. Bureau of Economic Analysis (BEA), U.S. Bureau of Labor Statistics (BLS), Federal Reserve Bank of St. Louis. Prepared by: StoneX.

This week, US retail sales are expected to continue moderate growth, with the median estimates pointing to a 0.3% increase in September, which should reinforce the view that consumer demand remains healthy. This would align with stronger-than-expected job growth in September and the higher-than-expected rise in the CPI, further supporting the perception of a “soft landing” for the US economy and reducing investors' bets on Fed rate cuts, favoring a stronger global dollar by suggesting that the decline in returns on dollar-denominated bonds will be slower than previously anticipated.

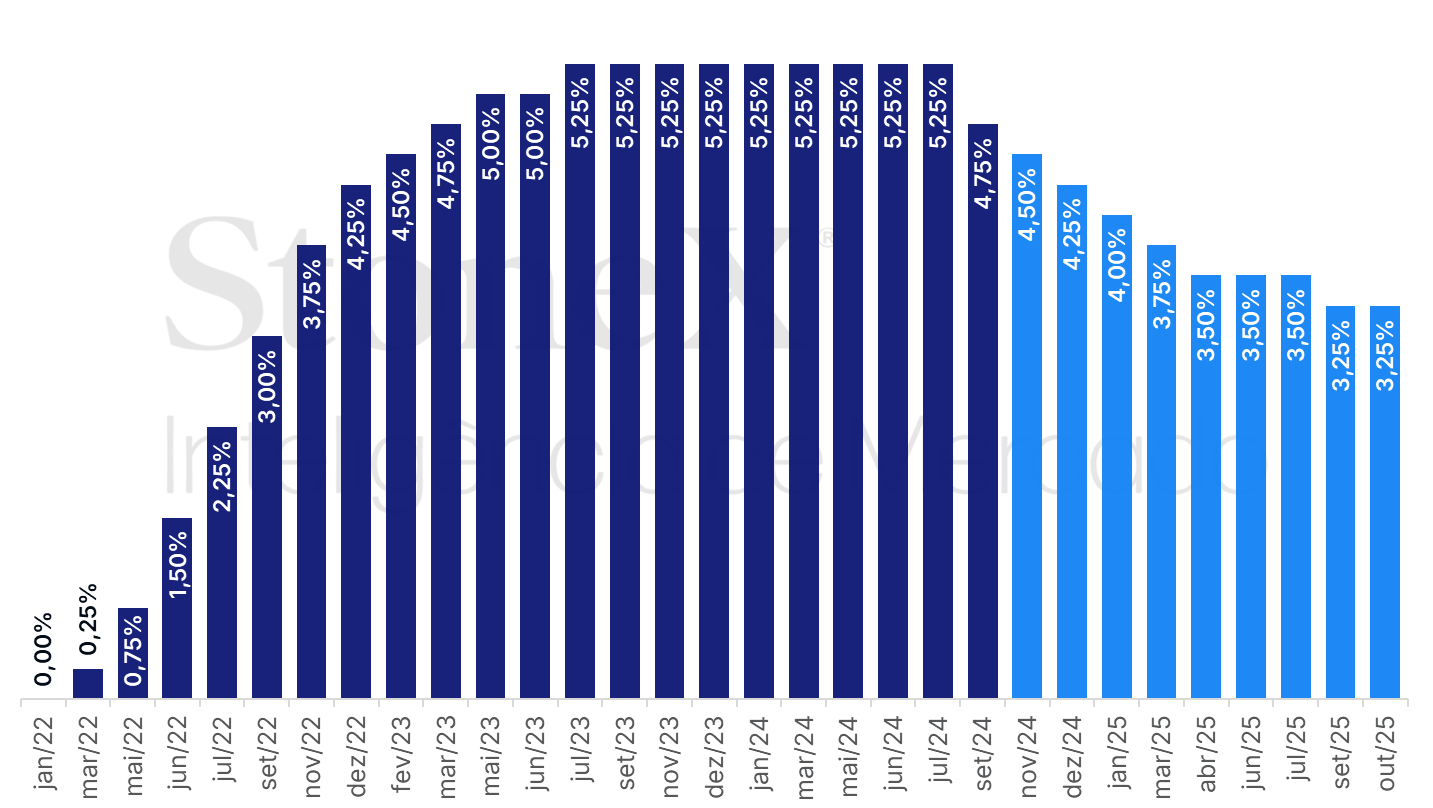

US: History and Expected Interest Rate – October 11, 2024

Source: CME FedWatch Tool. Prepared by: StoneX. Refers to the highest probability bet in the futures interest rate market on the indicated date.

Chinese Stimulus Expectations

Expected Impact on USDBRL: Bearish

Last week, Chinese authorities disappointed market participants by not mentioning the forecast or need for fiscal stimulus measures at the conclusion of the National Development and Reform Commission's conference, increasing investors' pessimism regarding the country’s economic performance. However, the Finance Minister called a press conference for Saturday (12), raising hopes that a new package of economic stimulus measures will be announced. In the absence of details about what might be communicated over the weekend, the reaction to the press conference and any measures should be observed next Monday (14). The expectation is that new measures will be unveiled, benefiting the performance of risk assets, such as equities, commodities, and currencies from primary commodity-exporting countries like the real.

Chinese Economic Data

Expected Impact on USDBRL: Bullish

This week, the release of several Chinese economic indicators is expected to influence investors' outlook on the country’s economy. Weaker domestic demand is expected to slow annual GDP growth from 4.7% in the second quarter to around 4.6% in the third quarter, while retail sales and the Consumer Price Index (CPI) are expected to remain close to flat in September, growing 2.1% and 0.6% year-on-year, respectively. Industrial activity should also remain stable in September, with annual growth of around 4.5%, hindered by a slowdown in external sales — exports are expected to reduce their annual growth from 8.7% in August to about 6.0% in September. Meanwhile, the Producer Price Index (PPI) is expected to deepen its annual deflation from 1.8% to 2.5% over the same period.

These readings are likely to reinforce the perception of a Chinese slowdown and that the country will fail to meet its official GDP growth target of 5% in 2024, due to weak domestic demand overshadowing the strong performance of exports in industrial sectors, particularly in segments related to artificial intelligence infrastructure and electric vehicles. This scenario should highlight the view that new economic stimuli are needed to revive the country’s economic growth, or else it risks prolonged stagnation, which could reduce global risk appetite and harm the performance of emerging market currencies, like the real.

ECB Rate Decision

Expected Impact on USDBRL: Bullish

This week, the European Central Bank (ECB) is expected to cut its benchmark interest rate by 0.25 percentage points, from 3.50% per year to 3.25% per year, due to progressive price stabilization and signs of weakening productive activity, as reflected in September’s Purchasing Managers' Indexes (PMI). However, more important than the decision itself will be the signals about the future trajectory of monetary policy. Despite investors anticipating a series of rate cuts by the ECB, the institution is likely to maintain a flexible stance, stating that each meeting's decisions will be data-dependent. Even so, the prospect of declining interest rates in Europe at a time when there are doubts about the speed of Fed rate cuts could harm the performance of the euro and indirectly strengthen the dollar in international markets.

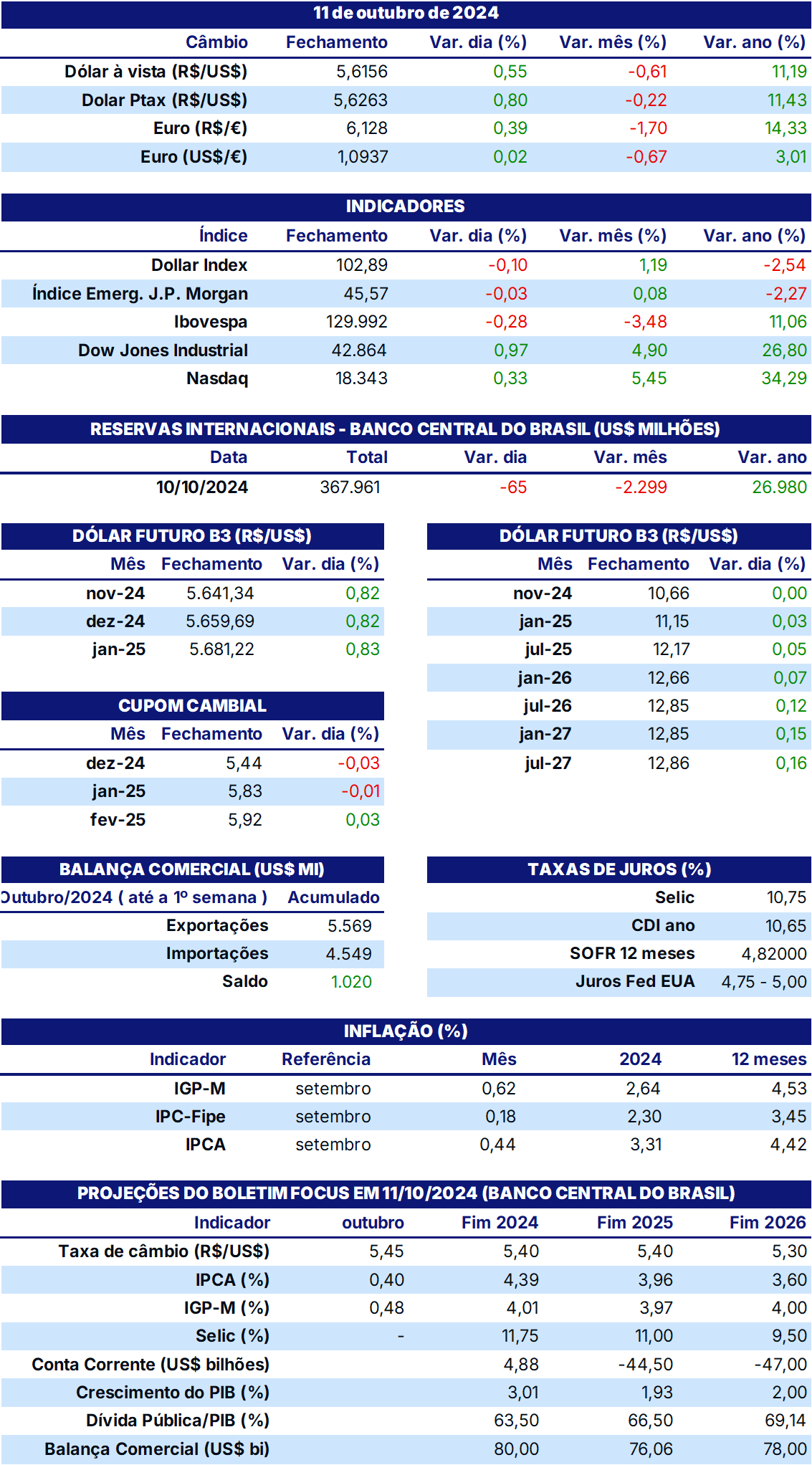

ECONOMIC INDICATORS TABLE

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA, and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.