FX Weekly Overview: The week's main events

- Bearish factors

- The FOMC will likely reduce its interest rate by 0.25 percentage points, reinforcing the perception that the American economy remains resilient and favoring the global appetite for risky assets, strengthening the BRL.

- The Copom is expected to increase the Selic rate by 0.25 p.p., improving the Brazilian interest rate differential and contributing to the attraction of foreign capital, strengthening the BRL.

- The BoJ is expected to keep its interest rate unchanged and contribute to stability in the value of the yen, which may foster the performance of the BRL.

- Bullish factors

- Bimonthly report of primary revenues and expenses should require new government spending cuts and may result in a worsening perception of fiscal risks of Brazilian assets, weakening the BRL.

The week in review

The release of figures slightly hotter than anticipated for American inflation marked the week, which helped to dispel expectations on more aggressive interest rate cuts by the Federal Reserve. In Brazil, investor pessimism regarding the conduct of economic policy maintained bets on increases in the Selic and hindered a stronger appreciation of the real.

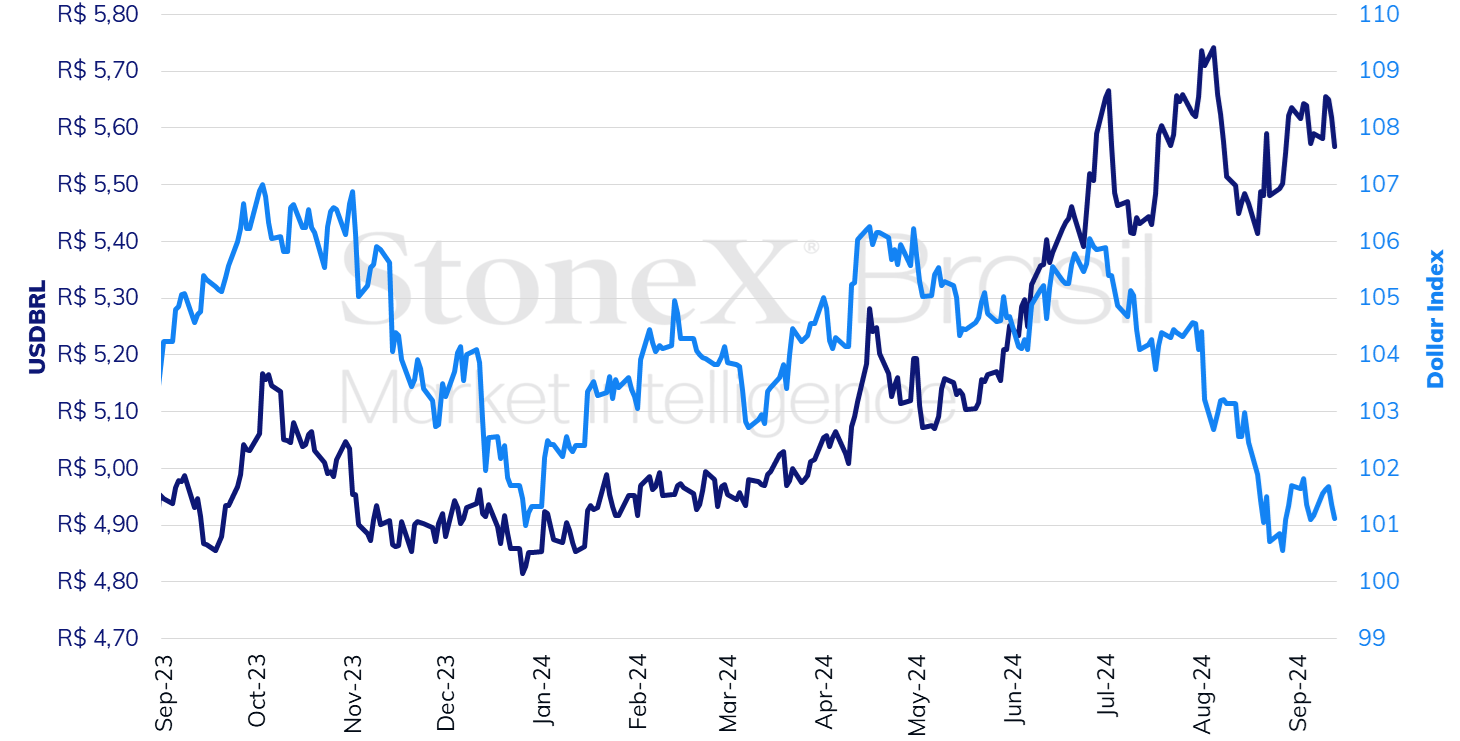

The USDBRL ended the week lower, closing Friday's session (13) at BRL 5.5675, a variation of -0.4% for the week, -1.2% for the month, and +14.7% for the year. The dollar index closed Friday's session at 101.1 points, a weekly decline of 0.1%, a monthly decline of 0.6%, and an annual decline of 0.2%.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

KEY EVENT: Fed interest rate decision

Expected impact on USDBRL: bearish

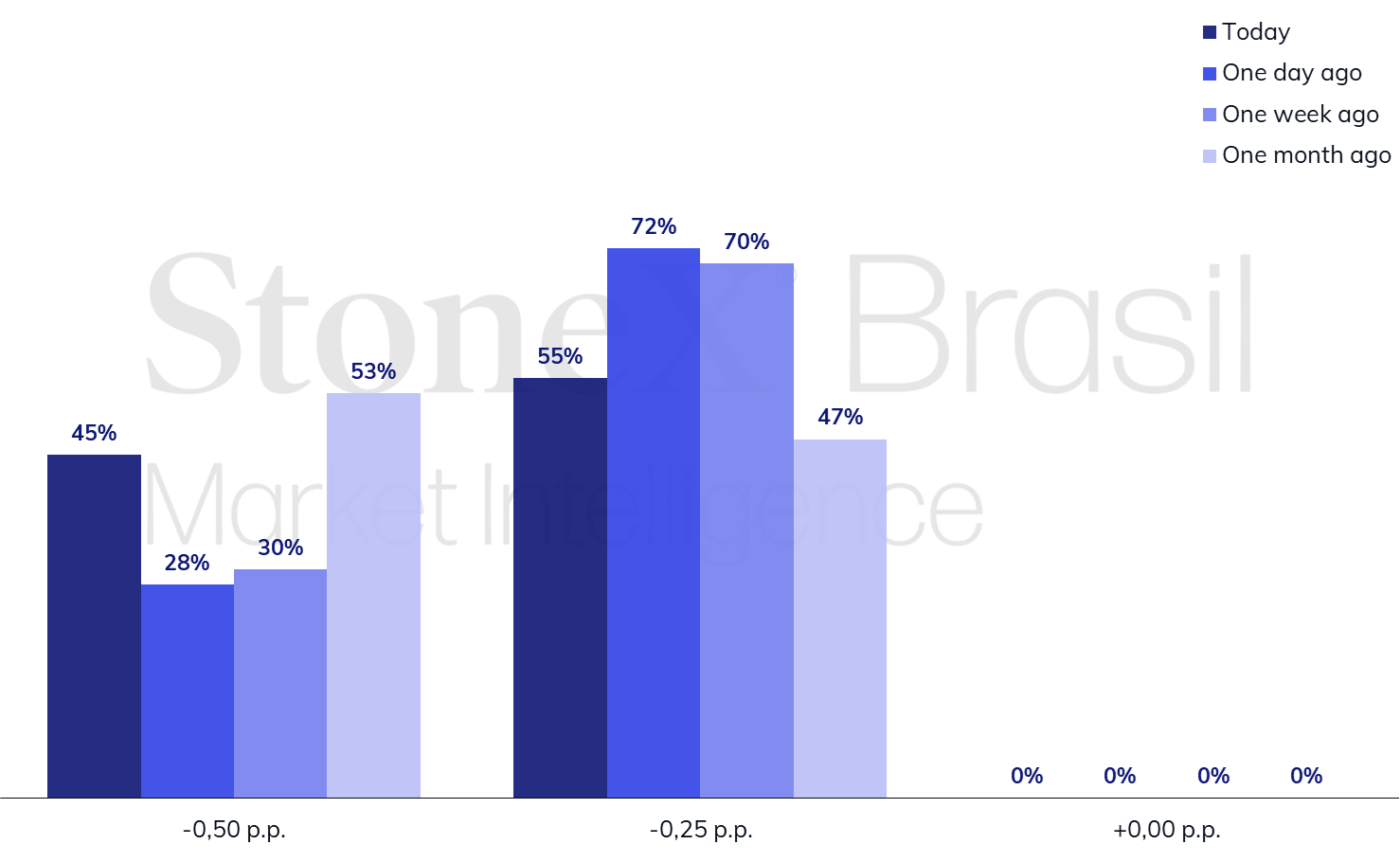

As Federal Reserve Chairman Jerome Powell said in his speech at Jackson Hole, "The time has come for policy to adjust". There is consensus among analysts that the Federal Open Market Committee (FOMC) will reduce its benchmark interest rate for the first time since March 2020. However, there are still doubts among investors about the magnitude of the cut, between 0.25 p.p. and 0.50 p.p. At this point, a reduction of 25 basis points seems more likely, moving the interest rate level from the range between 5.25% and 5.50% p.a. to the range between 5.00% and 5.25% p.a., since the most recent indicators, although ambiguous, generally seem to indicate that the American economy is slowing down gradually, and not sharply and intensely. Additionally, a 50 basis points cut could accentuate fears among investors that the institution assesses there are risks of an economic recession in the short term and, in this way, generate risk aversion and encourage a “flight to quality,” that is, demand for assets considered liquid and safe.

On the other hand, last Friday (13), there was a recovery in bets for a more aggressive cut following a report by the Wall Street Journal (WSJ) and comments from a former member of the Federal Reserve. Nick Timiraos, an influential reporter and analyst at WSJ, reported on concerns within the Fed about maintaining an excessively rigid level of monetary tightening and implied that its members might prefer a quicker start, that is, a reduction of 0.50 p.p. In turn, Will Dudley, former president of the Federal Reserve of New York for nine years, stated in a lecture "I think there's a strong case for 50, whether they're going to do it or not,” and that “logic says they should be going faster.” As a consequence, investors' bets for a more aggressive reduction increased, and the interest rate futures market was divided very closely between the two possibilities. Proponents of a 50 basis point cut argue that frontloading rate cuts is preferable and that they're more worried about a sudden U.S. economic downturn. In this sense, Powell himself pointed out, in Jackson Hole, that the FOMC should be more sensitive to the risks of a slowdown, stating that "the upside risks to inflation have diminished." And the downside risks to unemployment have increased" and that "it seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. We do not seek or welcome further cooling in labor market conditions."

Bets for the Federal Reserve interest rate decision on September 18

Source: CME FedWatch Tool. Design: StoneX. Future interest rate market probabilities as of September 13, 2024

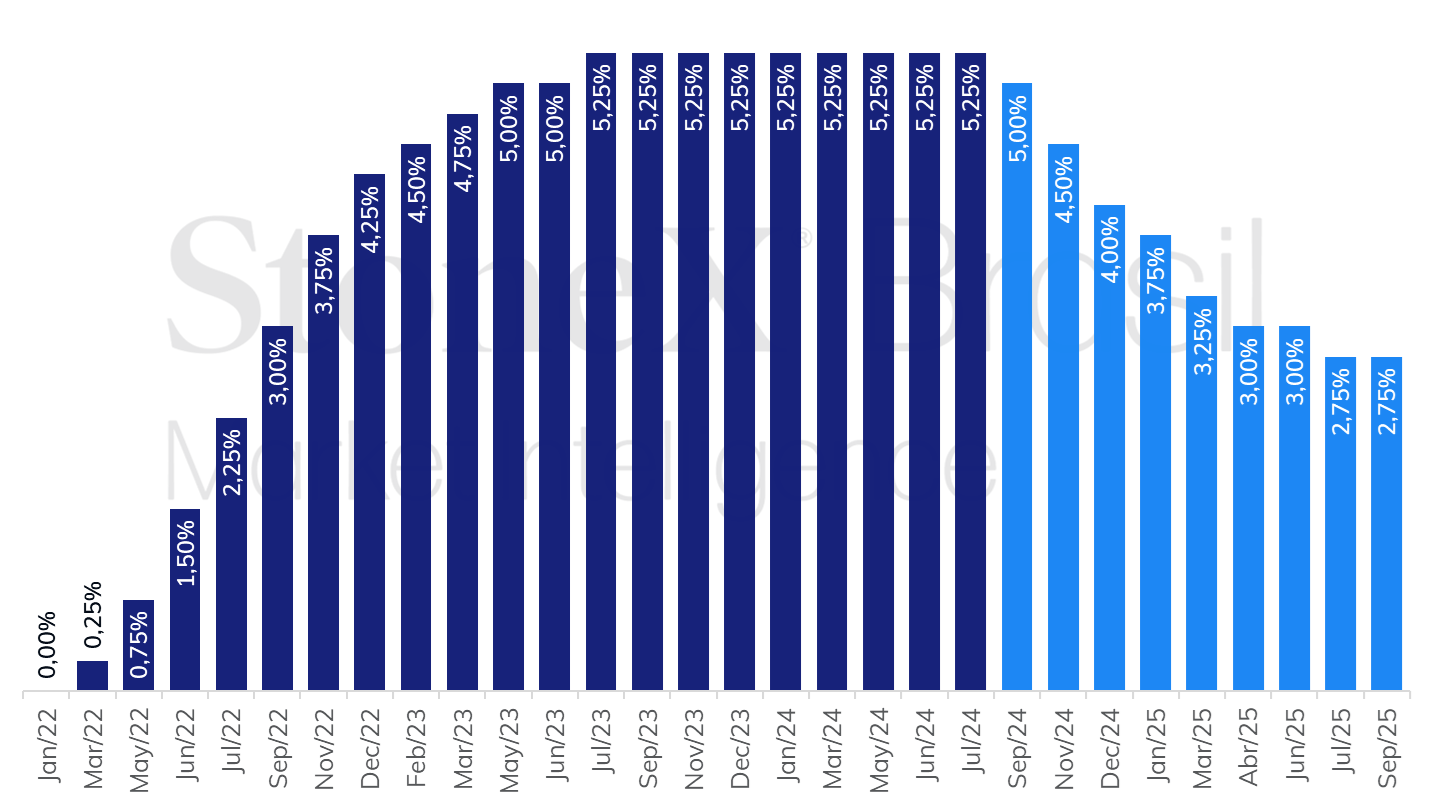

US: History and expectation for the interest rate - September 13, 2024

Source: CME FedWatch Tool. Design: StoneX. Refers to the bet with the highest probability in the future interest rate market on the indicated date.

Nonetheless, the press conference by Jerome Powell and the update of the FOMC's macroeconomic projections should be as important as the interest rate decision and its statement. First, Powell habitually complements and contextualizes the Committee's decisions and can contribute to influencing the interpretation of analysts and the mood of investors. Moreover, and most relevant at this moment, the Summary Economic Projections should act as forward guidance to signal the pace of cuts and the final interest rate level at the end of the monetary easing process, which are crucial for calibrating investors' expectations regarding the interest rate trajectory in the US. Thus, these projections may be more important in influencing risk appetite and investors' interpretation of the American economic situation than the magnitude of this Wednesday's cut.

In this sense, it is worth noting that the majority bets on the futures market seem excessive, anticipating 5 cuts (1.25 p.p.) in 2024 and another five in 2025, which seems unlikely at this time. Thus, it is likely that the Projeções Econômicas Sumarizadas will indicate a more moderate pace of declines which may reduce the expectations of a decrease in the level of American interest rates.

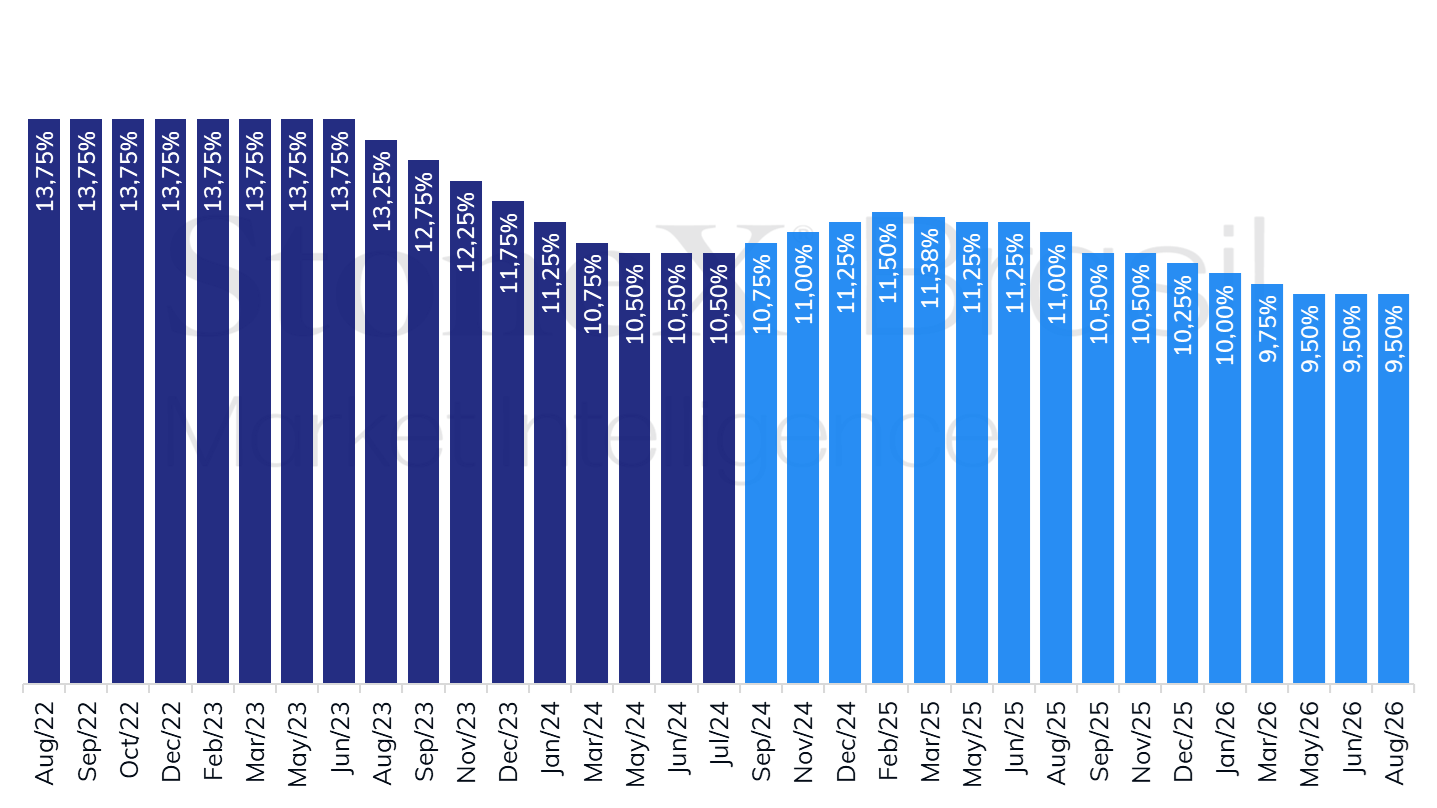

Copom interest rate decision

Expected impact on USDBRL: bearish

It is also worth highlighting the decision of the Monetary Policy Committee (Copom) of the Central Bank (BC) on Wednesday (18), which will set the new level of the basic interest rate (Selic). Although there are arguments for maintaining the basic interest rate, such as a less adverse external scenario and moderate readings for the Broad National Consumer Price Index (IPCA), almost 80% of investor bets in the futures market anticipate a 0.25 p.p. increase, from 10.50% p.a. to 10.75% p.a. The week began with a notable increase in the median projection of financial institutions published in the Focus bulletin, which stopped foreseeing stability in the Selic and started to anticipate four consecutive increases of 25 basis points.

In the last few weeks, inflation expectations have been continuously worsening among investors, driven by more robust data for economic activity and the labor market in the country and by a heightened perception of fiscal risks. "In this scenario, the Central Bank sought to signal some concern with the 'unanchoring' of expectations and the slowdown in the price stabilization process. Such a scenario of discomfort will likely result in a 0.25 percentage point increase in the Delic rate, which, in turn, should improve the outlook for the Brazilian interest rate differential compared to other economies and contribute to attracting foreign capital, strengthening the real.

Brazil: History and expectation for the interest rate | Focus - September 6, 2024

Source: Central Bank of Brazil. Design: StoneX. Refers to the median of the estimates pointed out by the Focus report on the specified date.

Fiscal risks in Brazil

Expected impact on USDBRL: bullish

The release of the Report of Revenue and Primary Expenses Assessment for the fourth first two months, on Friday (20), will likely require an increase in spending containment for 2024, from BRL 15 billion to something close to BRL 25 billion, due to the pressure of mandatory spending and reductions in the estimates for extraordinary revenues. This, in turn, can reinforce investor concerns about the balance of Brazilian public accounts and increase the perception of risks for Brazilian assets, weakening the BRL.

BoJ interest rate decision

Expected impact on USDBRL: bearish

After strengthening by 10.8% between July 3 and August 5 and negatively impacting the performance of currencies used in carry trade operations, the yen slowed its pace of appreciation, accumulating a gain of only 2.3% by September 13. Even so, investors remain alert to the risk of new unwinding of these operations if the currency appreciates rapidly again. In the decision of the Bank of Japan (BoJ) this Wednesday, most analysts believe that the authority will keep its interest rate unchanged at 0.25% per annum and repeat recent communications that it foresees a gradual tightening of financial conditions in the future if prices and wages continue to advance according to its expectations. Thus, a considerable impact of his decision on the value of the Japanese currency is not anticipated, which may contribute slightly to strengthening the real.

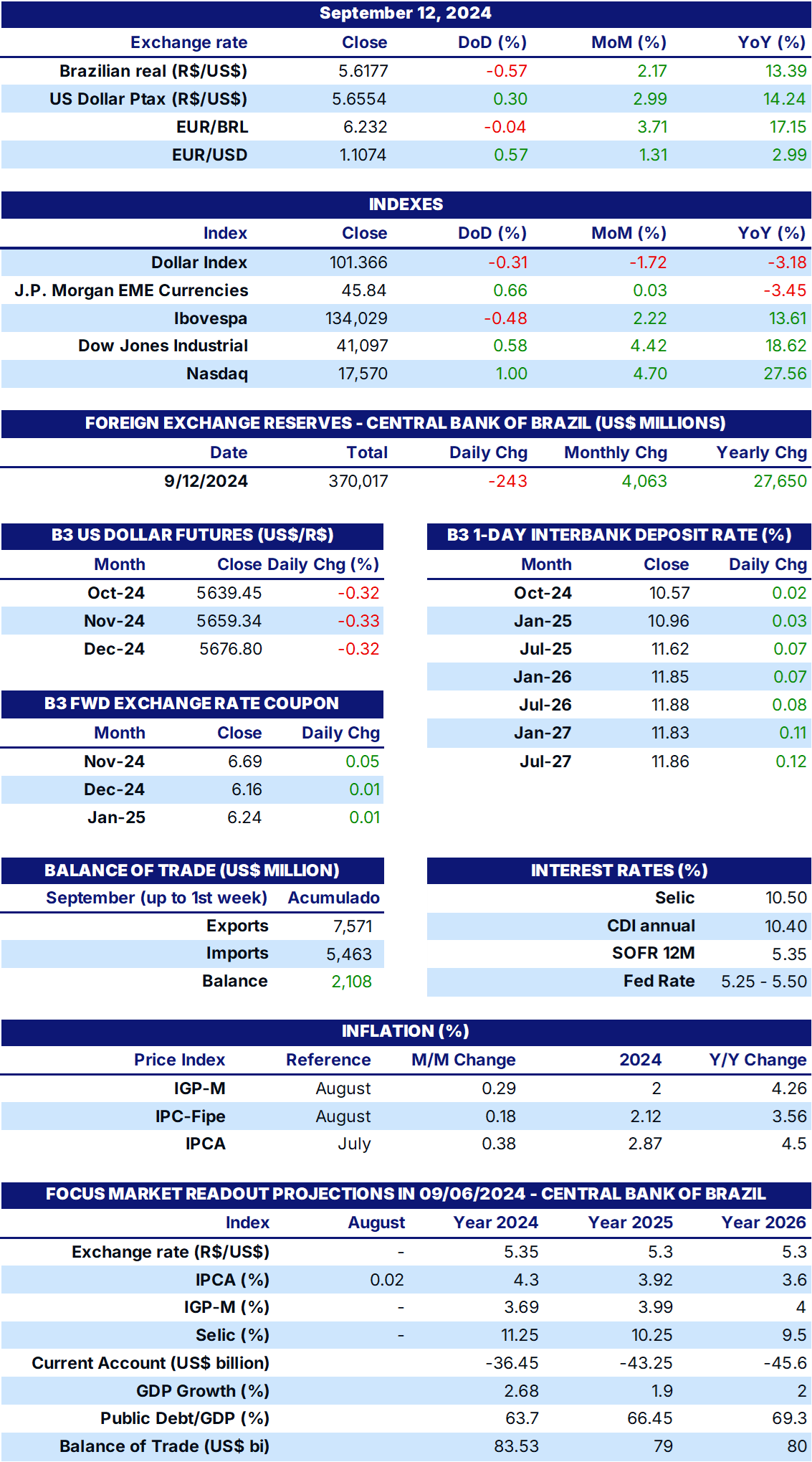

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.