FX Weekly Overview: The week's main events

- Bearish factors

- A moderate increase in the American CPI should reinforce the perception of a "soft landing" for the American economy and foster the global appetite for risky assets, strengthening the BRL.

- Bullish factors

- Moderate growth of the IPCA and the IBC-Br may reduce bets on an increase in the basic interest rate (SELIC), harming the attraction of foreign capital and weakening the BRL.

- Chinese economic data is expected to reinforce the outlook of an economic slowdown in the country and harm the performance of risky assets, such as stocks, commodities, and currencies of emerging countries, such as the BRL.

The week in review

The week was marked by the global weakening of the dollar amid a perception of weakening in the American labor market. Although the data released during the week were mixed, they helped alleviate fears of a potential recession. In Brazil, stronger-than-expected GDP growth in the second half of the year reinforced expectations of a short-term increase in the basic interest rate (Selic), adding to concerns about the Central Bank's ability to stabilize prices

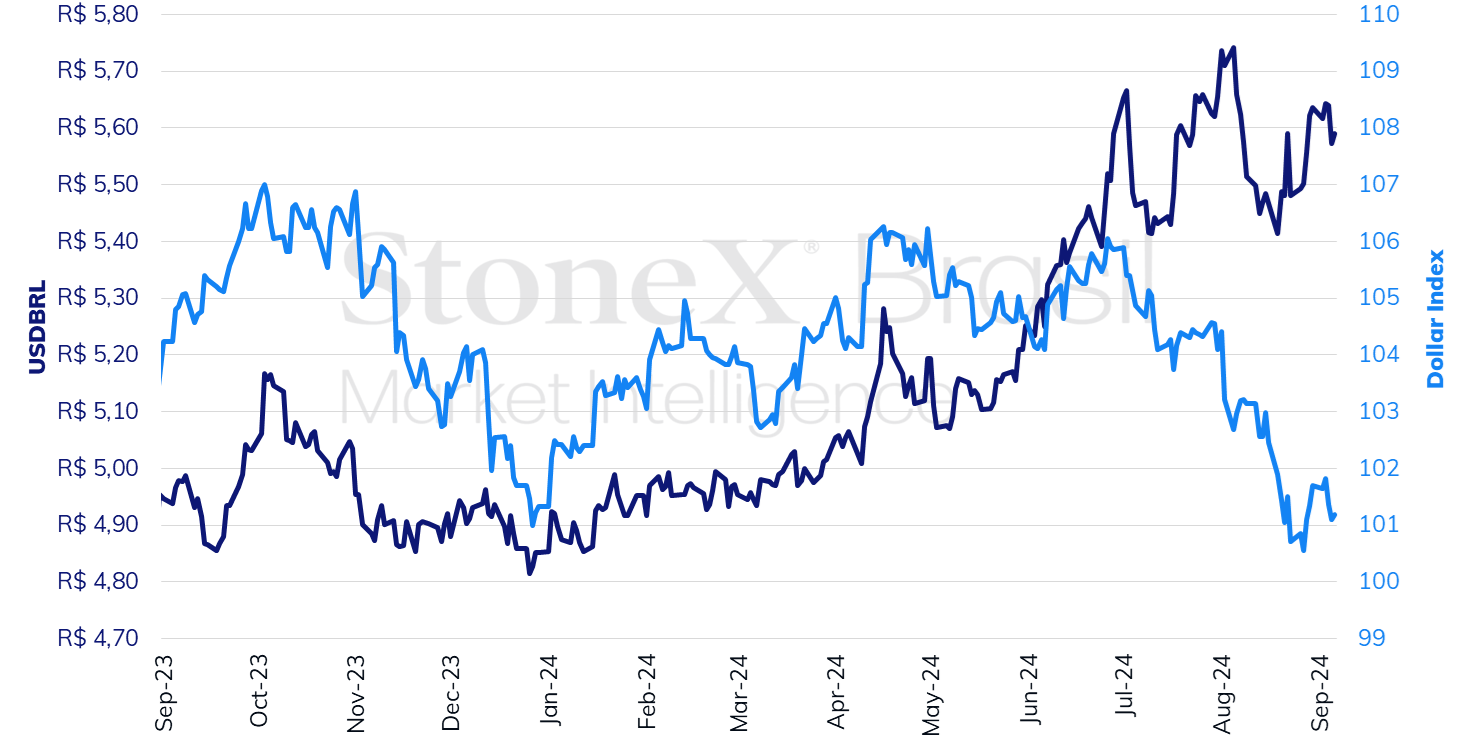

The USDBRL ended the week lower, with Friday’s session (06) closing at BRL 5.5895, a weekly variation of -0.8%, -0.8% for the month, and +15.2% for the year. The dollar index ended Friday at 101.2 points, reflecting a weekly and monthly decline of 0.5% and an annual drop of 0.2%.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

KEY EVENT: US August CPI

Expected impact on USDBRL: bearish

The median estimate for the Consumer Price Index (CPI) in August suggests an identical increase to that of July, with both the headline index and its core (excluding volatile food and energy components) rising by 0.2%. After a brief inflationary uptick in the first quarter, there is growing consensus among analysts and Federal Reserve (Fed) officials that prices are gradually stabilizing. If these projections are confirmed, the CPI reading is expected to solidify expectations that the Fed will initiate a series of interest rate cuts during its September 18 decision.

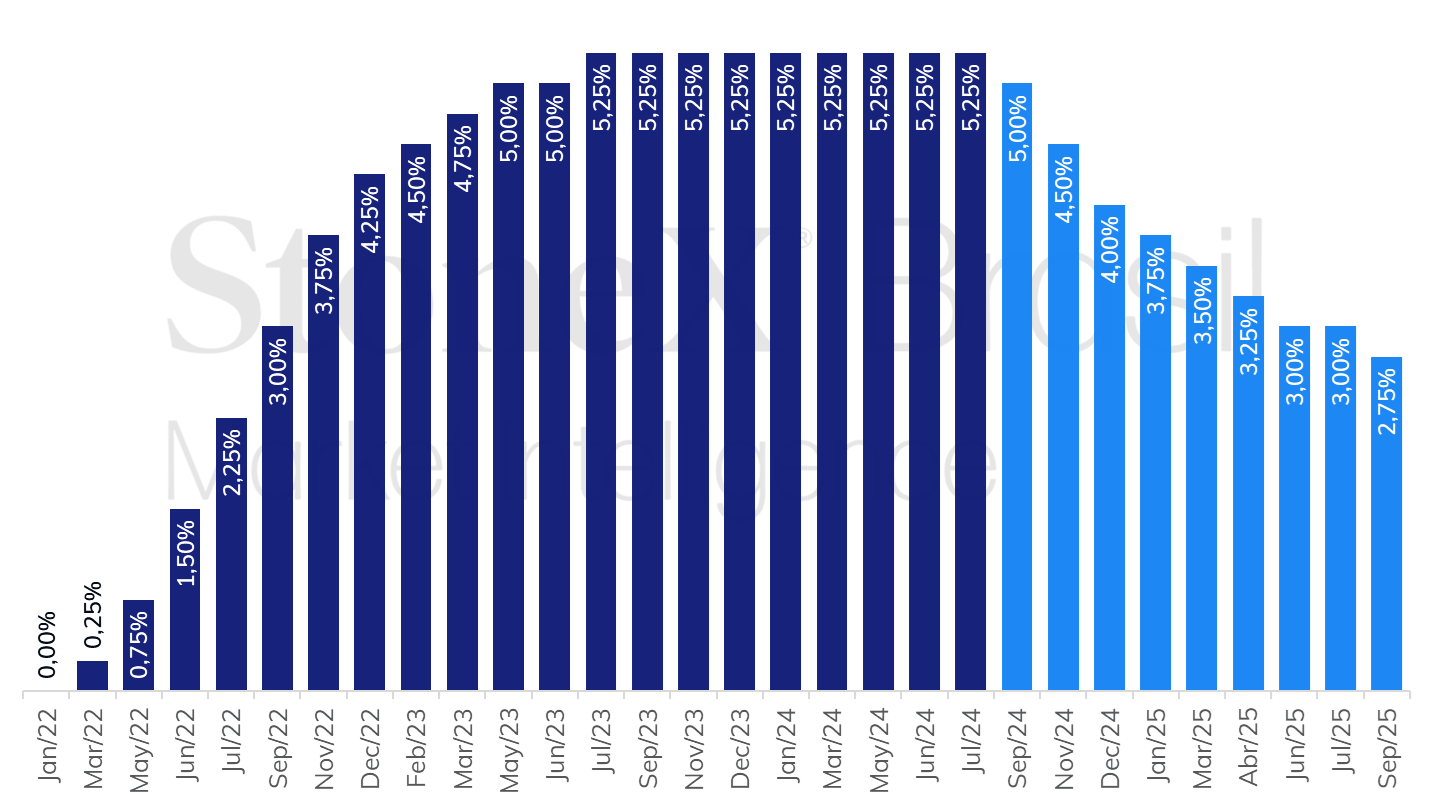

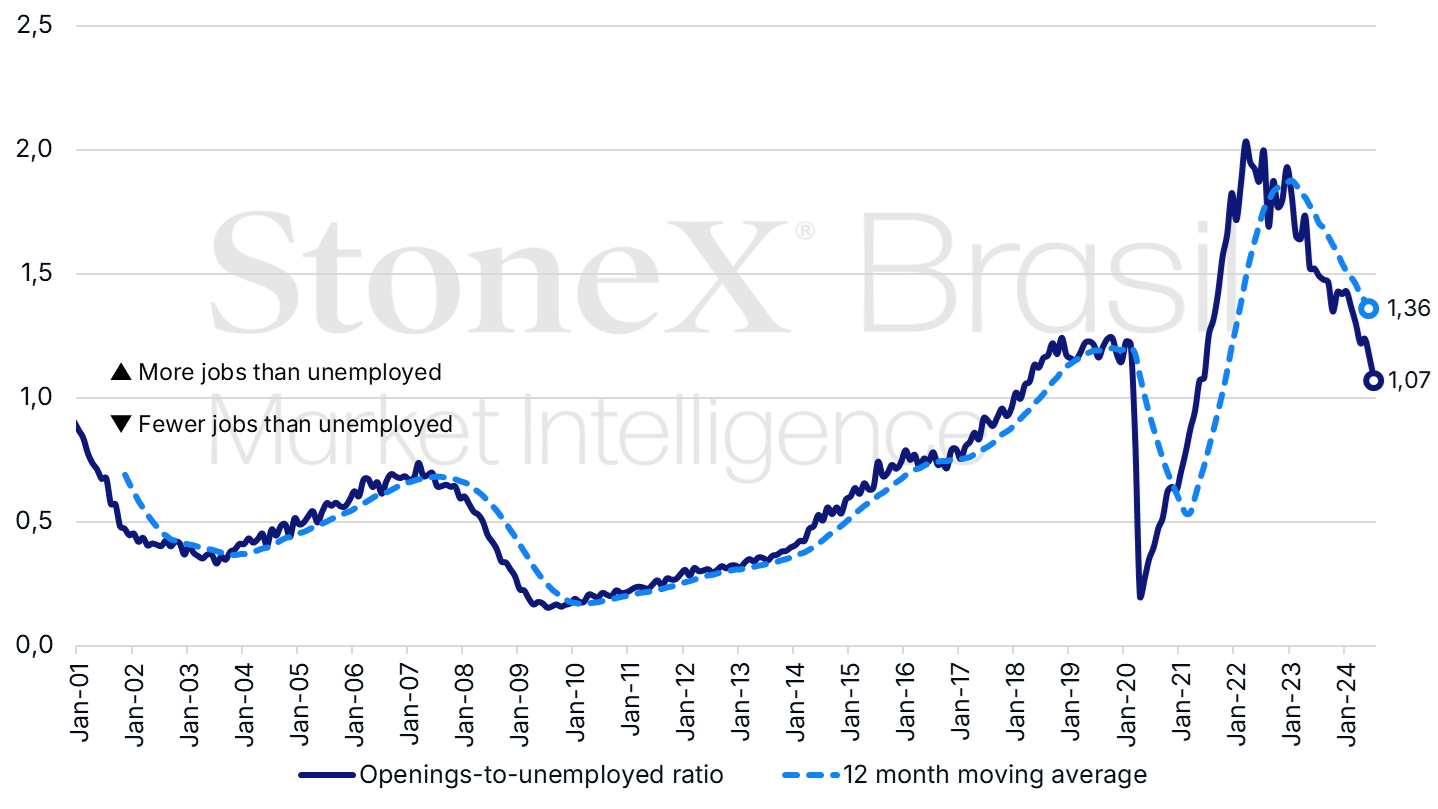

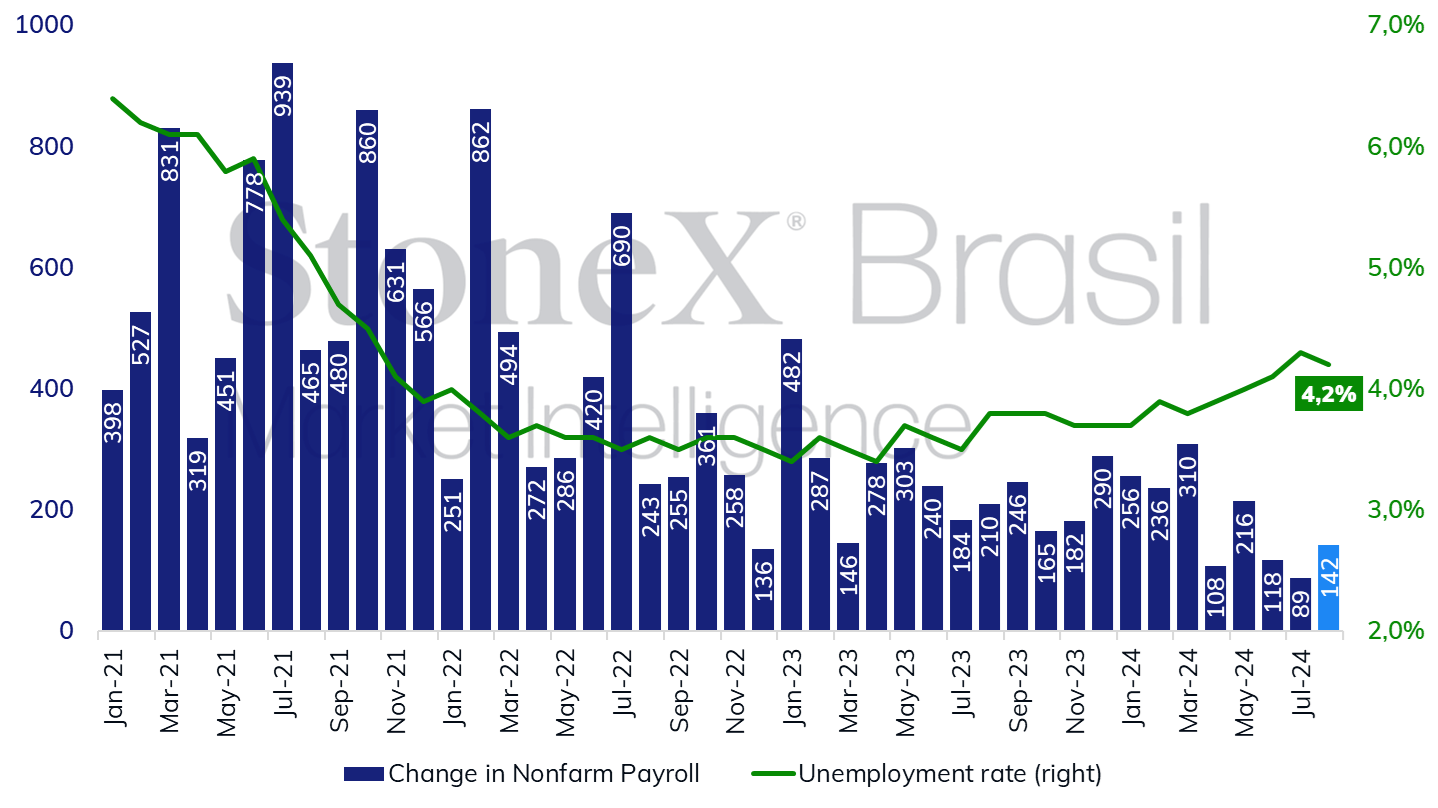

However, concerns about the strength of the labor market are increasing among investors and Fed members. For example, Fed Chair Jerome Powell stated in a recent speech that, 'it seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.' He added, 'We do not seek or welcome further cooling in labor market conditions,' and noted that 'upside risks to inflation have diminished, while downside risks of unemployment have increased.' The data released last week were mixed. On one hand, the reduction in job openings in July, the downward revision of job creation figures for July, and the lower-than-expected jobs report for August all point to a gradual slowdown. On the other hand, other indicators, such as the expansion of jobs between July and August, the decrease in the unemployment rate from 4.3% to 4.2%, and the rise in average hourly wages, suggest the labor market remains healthy and resilient. Thus, the scenario of gradual price stabilization and a soft weakening of the labor market still points to a 'soft landing' for the US economy. Given this, the current market expectations of a 2.50 percentage point reduction in interest rates over the next year—equivalent to ten traditional 0.25 percentage point cuts across eight decisions—seem overly aggressive.

US: History and expectation for the interest rate - September 6, 2024

Source: CME FedWatch Tool. Design: StoneX. Refers to the bet with the highest probability in the future interest rate market on the indicated date.

Ratio between open positions and unemployed in the US

Source: US Bureau of Labor Statistics (BLS). Design: StoneX.

Change in total urban employment (in thousand people) and unemployment rate (%) in the United States

Source: US Bureau of Labor Statistics (BLS). Design: StoneX.

Inflation and growth in Brazil

Expected impact on USDBRL: bullish

In Brazil, the key event this week will be the release of the Broad National Consumer Price Index (IPCA) for August, as investors reassess their expectations for the country’s monetary policy trajectory. Following a significant increase of 0.38% in July for the overall index and 0.44% for its core, the IPCA is anticipated to ease to around 0.30%, driven by the rare likely combination of declining food and fuel prices. If confirmed, this result could alleviate some of the pressure on the Central Bank (BC) to raise the basic interest rate (SELIC) at its September 18 meeting. However, the 'discomfort' surrounding monetary policy is expected to persist, as economic activity and labor market data continue to surpass expectations, while inflation expectations among financial market participants rise. Central Bank President Roberto Campos Neto recently noted that the price stabilization process 'has lost some momentum.' In this context, the economic indicators to be released this week, including the Monthly Services and Trade Surveys by IBGE and the Central Bank’s Economic Activity Index (IBC-Br), gain heightened significance. The IBC-Br, which is used to gauge the country’s economic performance, is expected to show 0.6% growth in July, following a stronger-than-expected 1.4% expansion in June. Such figures could gently lower expectations for a SELIC hike, which in turn might narrow Brazil’s interest rate differential with the U.S., potentially reducing foreign capital inflows and weakening the BRL.

Economic data in China

Expected impact on USDBRL: bullish

This week will be packed with key economic indicators from China, including new data on inflation, the trade balance, manufacturing, and retail sales. Overall, these figures are likely to reinforce the perception of a slower growth trajectory for the country, driven by weakening domestic demand, while foreign sales are expected to show stronger results. However, even with better performance in exports and the industrial sector, it is unlikely to fully counterbalance the sluggishness in domestic activity. The continued slowdown in Chinese economic growth is expected to dampen expectations for commodity demand, which could negatively impact the currencies of major commodity-exporting countries, such as the BRL.

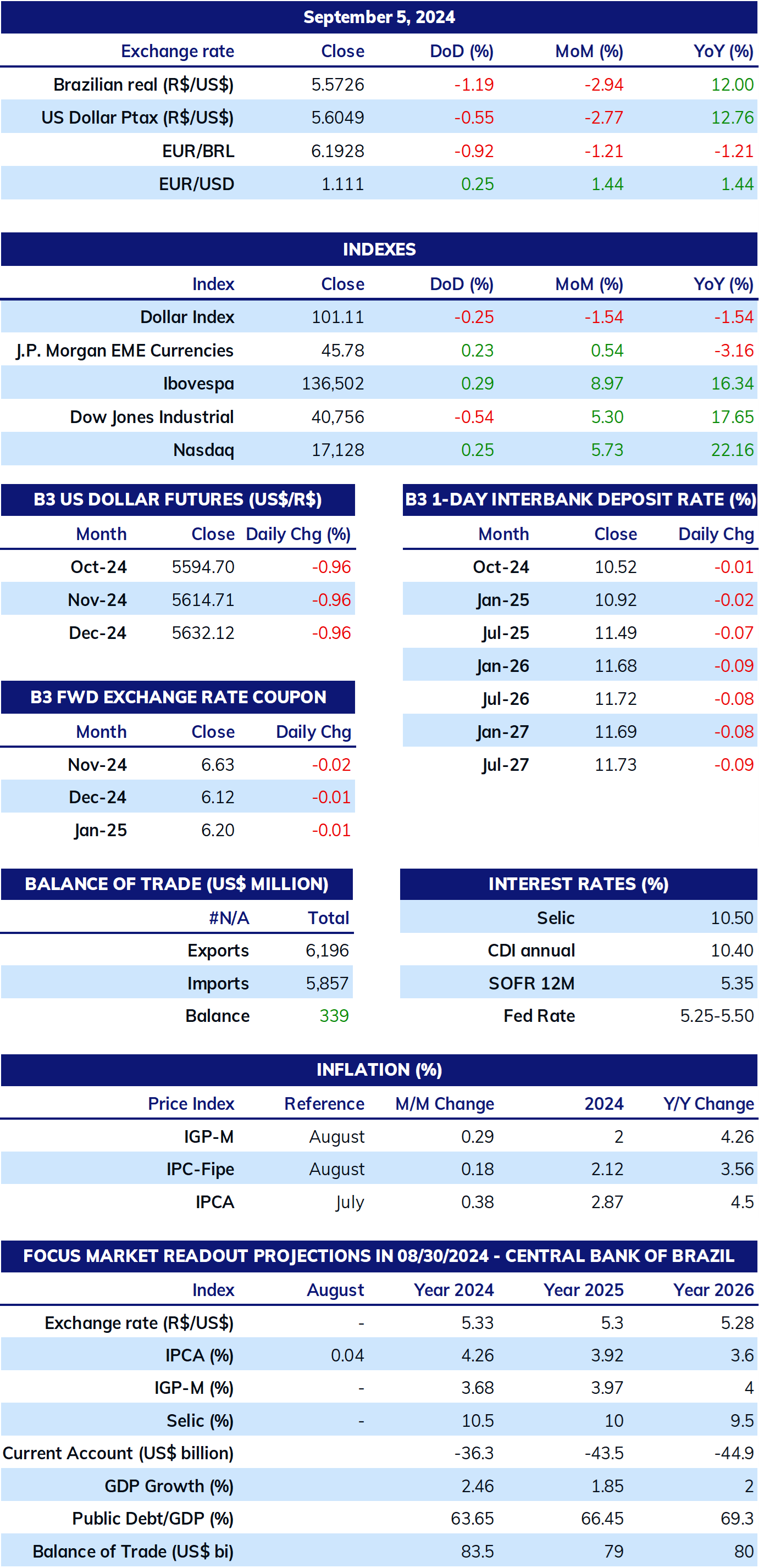

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.