FX Weekly Overview: The week's main events

- Bearish drivers

- Moderate rise in US employment may reinforce perception of “soft landing” of its economy and contribute to global appetite for risk, which would favor the Brazilian real.

- Brazilian GDP growth in the second quarter should maintain a scenario of “discomfort” for the Central Bank and consolidate bets of a rise in the basic interest rate (Selic), strengthening the BRL.

- Bullish drivers

- An environment of stress and skepticism among investors about the conduct of fiscal and monetary policies in Brazil could keep the demand for risk premiums high and contribute to the weakening of the Brazilian real.

- The breakdown of the 2025 budget could fuel fears that the Executive Branch will tighten control of public accounts, which would result in a greater perception of fiscal risks and weaken the BRL.

Last week in review

The week was marked by a notable weakening of the Brazilian real, which led to two consecutive interventions by the Central Bank on Friday (30). The currency's performance was influenced by investor fears over the conduct of Brazilian monetary and fiscal policies and by technical factors, such as a larger outflow following a rebalancing of the EWZ iShares MSCI Brazil index. Abroad, the dollar also strengthened after US GDP and inflation data reinforced the perception of a “soft landing” in the economy.

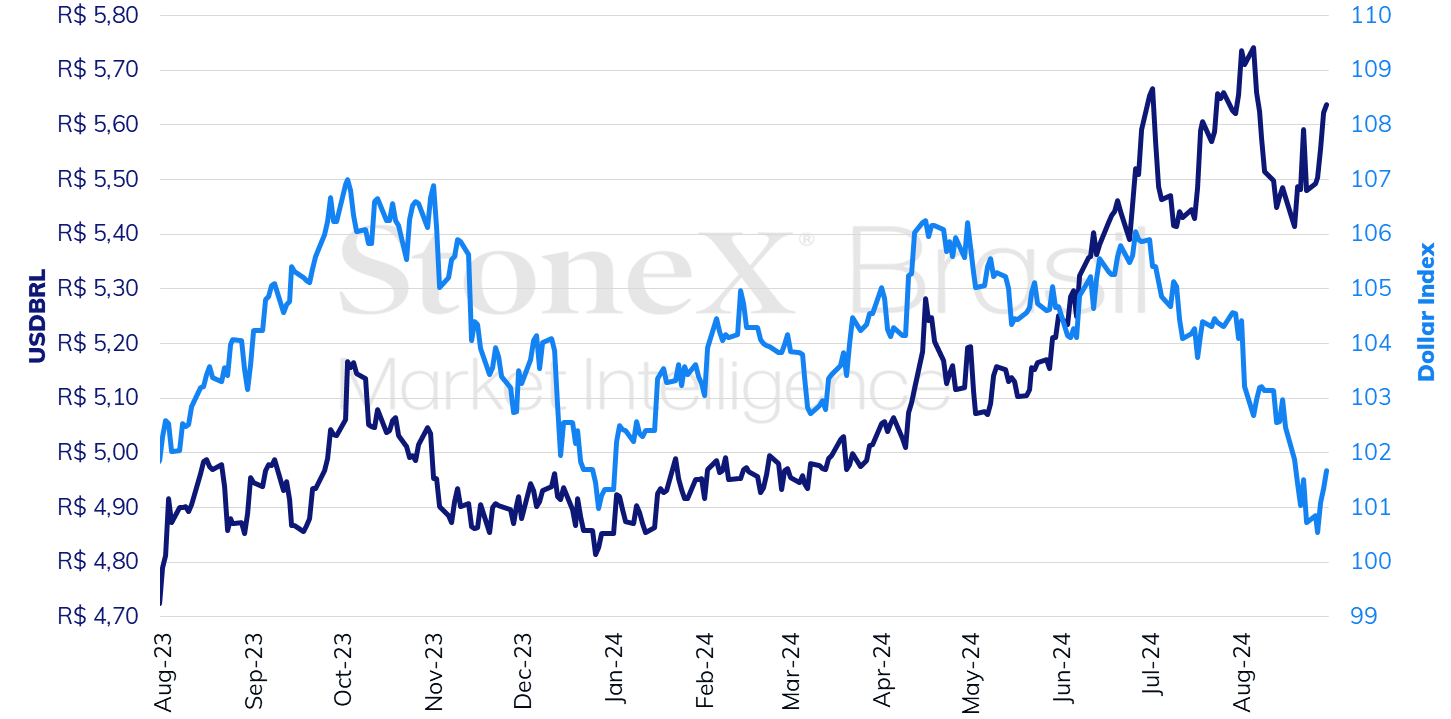

The dollar ended the week higher, closing Friday's (30) session quoted at BRL 5.6363, a change of +2.8% for the week, -0.3% for the month and +16.2% for the year. The dollar index closed Friday's trading session at 101.7 points, up 1.0% for the week and 0.3% for the year, but down 2.3% for the month.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

KEY EVENT: Volatility of the BRL and the Central Bank's actions

Expected impact on USDBRL: bullish

The focus of attention in the coming week should remain on the performance of the exchange rate, which rose consistently over the past week. Last Friday (30), the Brazilian currency showed strong volatility, fluctuating between BRL 5.5756 and BRL 5.6926, and ended the trading session with the Brazilian real weakening even after two interventions in a row by the Central Bank, something that is fairly rare. The Central Bank sold USD 1.5 billion on the spot market and then issued another USD 765 million in currency swap contracts (15,300 contracts). On that day, before the announcement of the second intervention, the president of the Central Bank, Roberto Campos Neto, had said at an event that the monetary authority had identified an “atypical” currency flow during the week, probably influenced by the rebalancing of the EWZ iShares MSCI Brazil index, the main Brazilian ETF (Exchange Traded Fund) traded on the US capital market. Campos Neto had also warned that the Central Bank's aim was to act only in the event of “dysfunctionality”, i.e. when there is a disproportionate imbalance between offers to buy and offers to sell (bid and ask) and that “if we need to intervene further, we will do so”. As such, amid the sudden stress in the business environment and the worsening of future expectations, investors should remain attentive to communications from members of the agency and continue to monitor the possibility of new interventions in the foreign exchange market.

August Payroll

Expected impact on USDBRL: bearish

The release of lower-than-expected job creation figures for July, an unexpected rise in the unemployment rate, and a significant reduction in the number of people employed in the US after the annual periodic review showed that the US labor market is slowing down and losing momentum, which in turn generated fears that the US economy could be weakening faster than expected and led to a global decrease in risk appetite. These fears were reduced after data for production and inflation in the US suggested that the country's economy still remains healthy and resilient. As a result, investors will follow the release of labor market data in August in order to calibrate expectations for the country's economic performance and, consequently, for the trajectory of the US interest rate. The median estimate points to the creation of 165,000 jobs in the month, which would reinforce the interpretation of a “soft landing” for the country and favor the behavior of risky assets, such as stocks, commodities and currencies of emerging countries, like the Brazilian real.

Fiscal risks in Brazil

Expected impact on the USDBRL: bullish

Fears about Brazil's fiscal performance hampered the BRL's performance last week, and the issue may resurface again on Monday (02). The Ministry of Planning and Budget is expected to send the 2025 Annual Budget Bill (PLOA) only on the evening of the 30th (the legal deadline is midnight on Saturday the 31st), postponing the press conference until 11am (Brasília time) on Monday the 2nd. Despite several statements by authorities seeking to emphasize that the 2025 Budget will be “compatible” with meeting the targets stipulated by the fiscal framework, investor concern about the details and projections of expenses, revenues and public debt remained high throughout the week and worsened after the announcement that the public sector's primary deficit in July was worse than anticipated, at BRL 21.3 billion. Also on Friday (31), the Executive Branch sent bills to Congress proposing an increase in income tax rates levied upon interest on own capital (JCP) and the Social Contribution on Net Profits (CSLL), measures that should form part of the federal government's legislative effort to raise revenue by 2025.

2nd quarter GDP

Expected impact on USDBRL: bearish

Brazil's Gross Domestic Product (GDP) is expected to have accelerated its growth rate slightly, from a quarterly rise of 0.8% in the first quarter of 2024 to around 1.0% in the second quarter. If confirmed, the data should reinforce the perception of the economy's robust performance for the second consecutive quarter, surpassing initial expectations, with a boost from all categories of demand, such as personal consumption, business investment, and exports. Although most of the worsening in inflationary expectations can be attributed to a higher level of distrust among investors regarding the conduct of fiscal and monetary policies, the higher-than-expected dynamism of productive activity and the labor market contribute to keeping inflationary expectations higher in Brazil, as they represent the possibility of greater pressure on prices in the future. This, in turn, could contribute to the Monetary Policy Committee's “discomfort” and help to solidify bets of an increase in the basic interest rate (Selic) in its next decision, on September 18.

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.