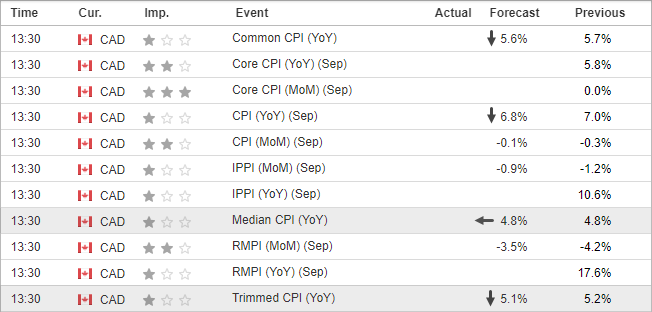

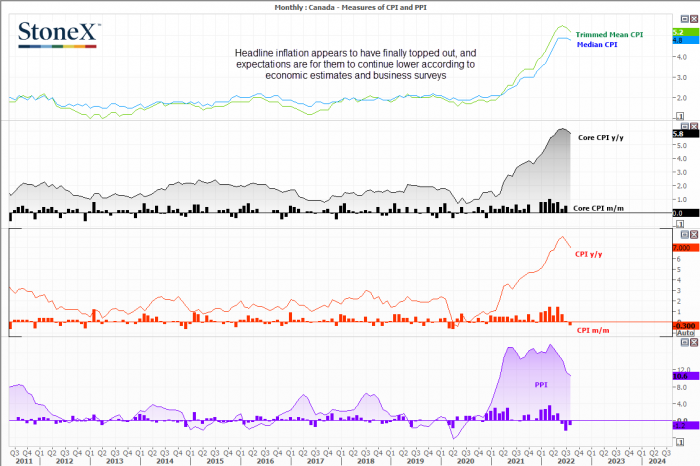

Today’s estimates are for Trimmed Mean to drop to 5.1% (5.2% prior) and Median to stay flat at 4.8%. As much as we’d like to see the data drop, the BOC also pay very close attention to the business outlook survey which was released earlier this week.

• Business sentiment is trending lower.

• Most businesses think a recession is likely (due to rising interest rates and high prices).

• Labour and supply chain bottlenecks may have peaked.

• Businesses expect price increases to moderate due to lower commodity prices and other input goods.

• Wage growth also expected to soften.

• Short-term inflation expectations have edged down but remain elevated (and above the BOC’s target).

• Sales outlook has softened.

• Rising interest rates are weighing on business sales linked to housing activity and household consumption.

• Other firms expect healthier sales but below pre-pandemic levels.

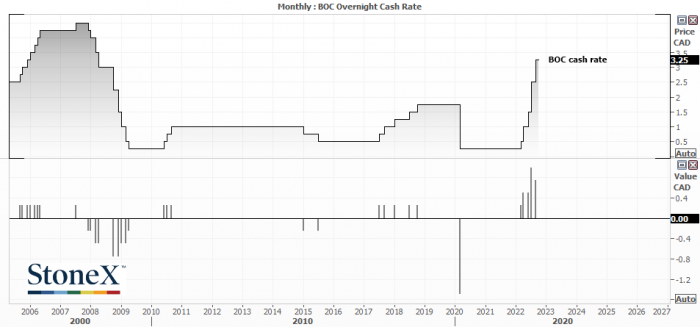

Irrespective of the Canadian economy, BOC Governor Macklem said that the central bank may be forced to continue hiking rates due to the stronger dollar. USD/CAD has risen over 9% from the August low, and the dollar’s strength is showing little signs of softening amidst hawkish talk from Fed members. So whilst today’s inflation report is unlikely to prevent the BOC from tightening further, it could begin to build a case for smaller increments as we enter 2023.

Economists currently expect the BOC to hike rates by 50bps next week to take rates to 3.75%, and to raise by another 25bp in December to take rates to 4% by the year end. The 1-month OIS places an 86% probability of a 50bp hike, and a 90% chance of a 25bp hike in December.

CAD/JPY remains within a strong uptrend on the 4-hour chart despite weaker oil prices, supported by higher equity prices and of course the weaker yen. Prices are now consolidating around the monthly R1 and weekly R2 pivot, as break above which assumes bullish continuation. Should prices initially retrace then we’d consider bullish setups above the 107.78 low, a break beneath which switches to a near-term bearish bias.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.