StoneX: USDA Reduces Brazilian Coffee Production Estimate for 2024/25

With a reduction of 3.5 million bags, USDA's estimate aligns closely with StoneX's projection

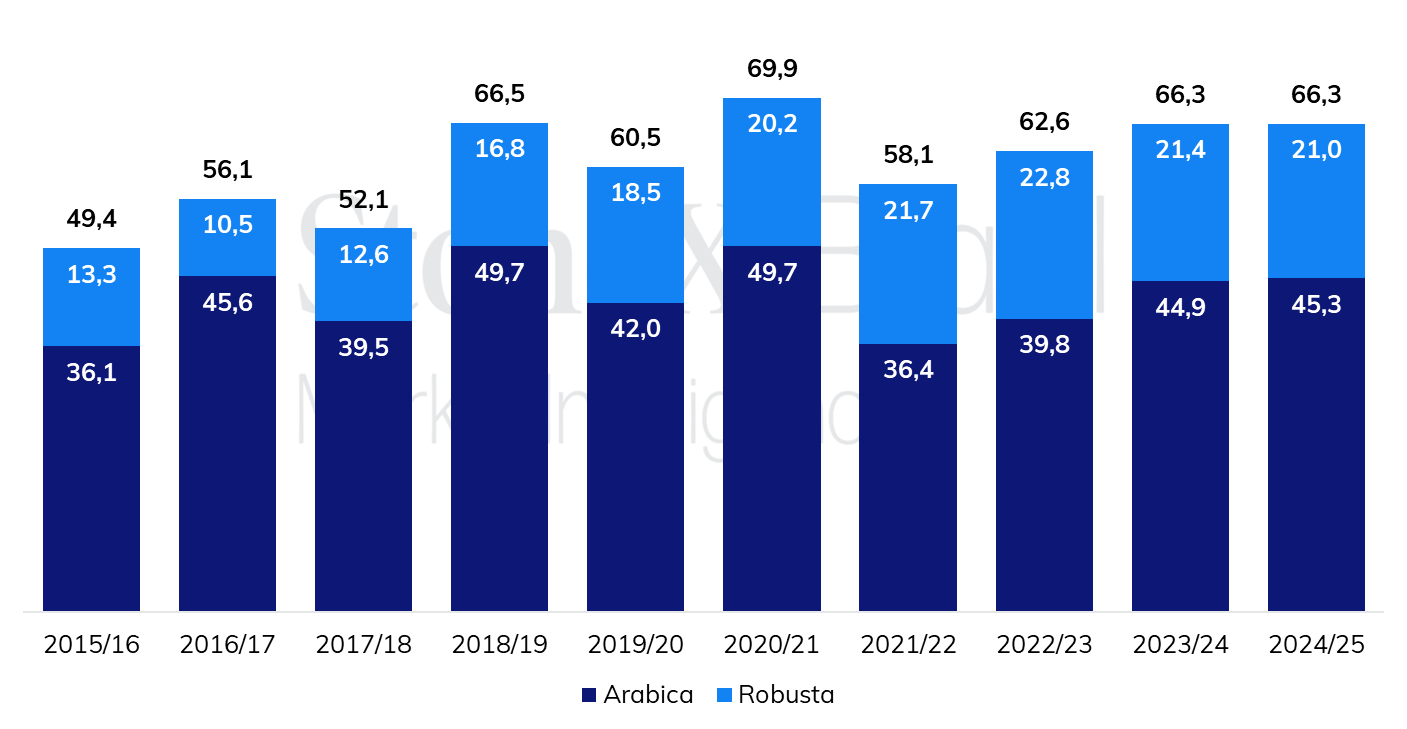

In its latest report, the USDA reduced its estimate for the Brazilian coffee crop by 3.5 million bags (-5.0%) for the 2024/25 season, decreasing from 69.9 to 66.4 million bags. For robusta coffee, the reduction was 700,000 bags (-3.2%), totaling 21 million bags. Meanwhile, for arabica coffee, the department lowered its estimate by 2.8 million bags (-5.8%). According to the report, this production decline was caused by adverse weather impacts. As a result, with the new estimate, Brazilian coffee production is expected to show a 0.15% annual increase, with a 1.9% drop in robusta production and a 1.1% increase in arabica production.

The USDA’s update places its projection close to StoneX’s estimate for 2024/25 production, which was revised on August 1st this year. Following a crop survey published in February, StoneX initially estimated production at 67 million bags, consisting of 44.3 million arabica bags and 22.7 million robusta bags. During the coffee harvest, StoneX conducted a new survey and revised its production estimate for the season in early August, lowering it from 67 to 65.9 million bags (-1.7%). In the updated projection, robusta production was reduced by 6.8%, totaling 21.2 million bags, while arabica production saw a 1% adjustment, reaching 44.7 million bags. The difference between the USDA’s new estimate and StoneX’s is only 500,000 bags (0.7%).

Brazilian coffee production (millions of bags)

Source: USDA. Design: StoneX.

According to the USDA, Brazilian green coffee exports for the season are expected to total 40.5 million bags, representing a 4.7% decline compared to the previous estimate and a 6% drop compared to the previous season. Soluble coffee exports are projected to total 3.7 million bags, 9.8% lower than the previous estimate but 2.8% higher than the last season. The report also highlights that stocks are 65% lower compared to the previous estimate and 26.4% below last season. The department maintained its estimates for coffee consumption in Brazil unchanged, both for soluble coffee and roasted and ground coffee.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.