US Trade Tariffs & Their Impact on the Base Metal Market – Quick Take 3rd February

05.01GMT on 4th February is the deadline for US tariffs on Canada, Mexico and China to go into play; however, President Trump announced at 15:41GMT that tariffs on Mexico will be delayed by one month. President Trump is also set to talk to Canadian Prime Minister at 20:00 GMT today, while less is known about any upcoming phone conversations with China. Therefore; as it stands, market expectations for lower or no tariffs on Canada and Mexico are building, removing with it supply-side concerns for key base metals like copper and aluminum. Please see below our outlook for the impact to base metals from tariffs (from 30th January) and intra-day key charts.

Key Intra-Day Charts

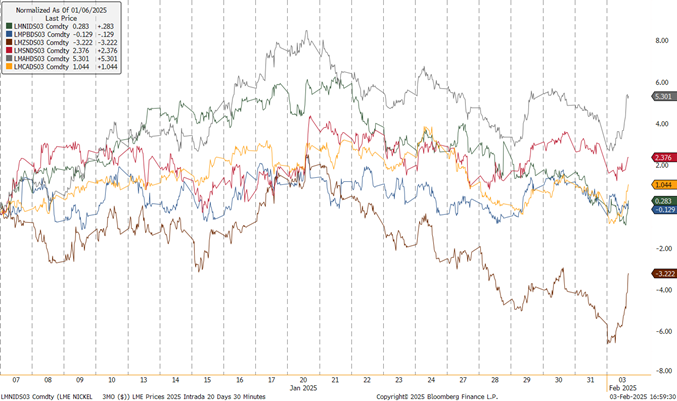

Intra-Day Price Performance LME 3M Base Metals (1M)

Source: Bloomberg

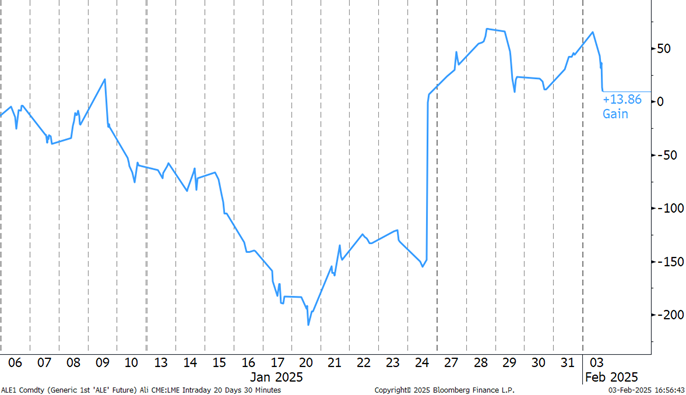

CME-LME Aluminum Spread 1M

Source: Bloomberg

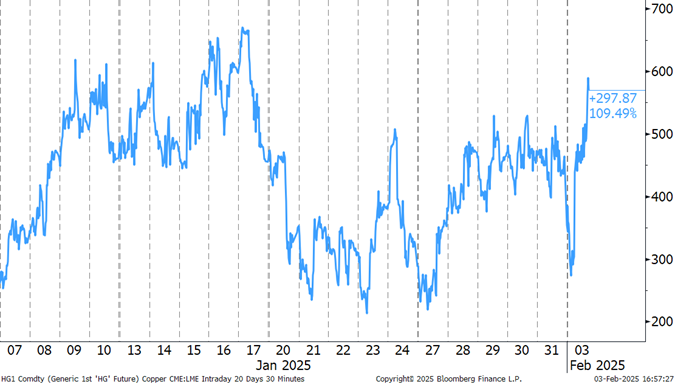

CME-LME Copper Spread 1M

Source: Bloomberg

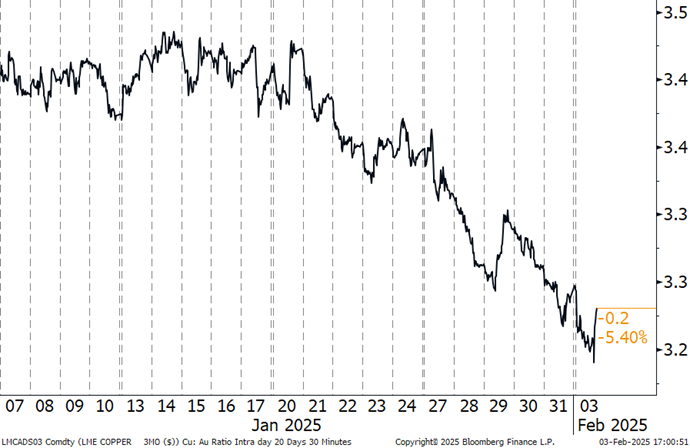

Copper : Gold Ratio Intra-Day

Source: Bloomberg

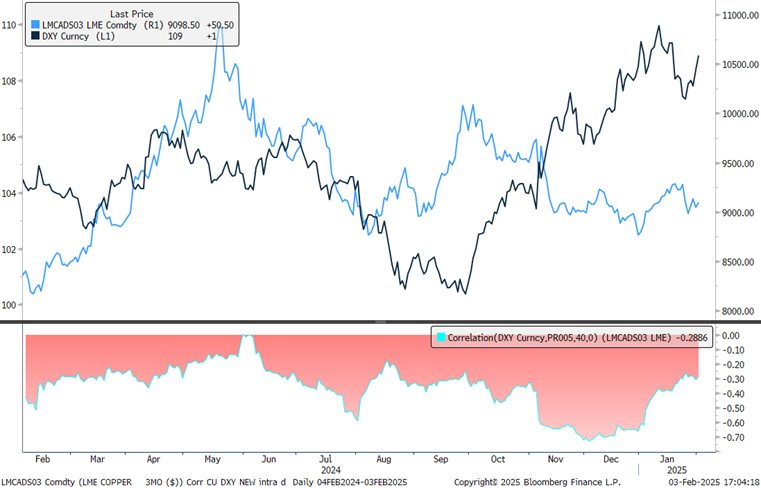

US Dollar Versus LME 3M Copper Correlation

Source: Bloomberg

Impact to the Base Metal Market – Base Case

Taking in these latest developments, we expect targeted tariffs on Canada and Mexico as growing more unlikely, while we see the risk of tariffs coming at or near 10% on China as still possible. In addition, the timeline for ‘universal’ tariffs will be a longer drawn-out process with Treasury Secretary Scott Bessant comments for these tariffs to start at 2.5% (and then gradually rise by the same amount each month), set to tie in with Trump’s stance on creating new trade deals.

In this scenario, base metal prices are open to volatility depending on whether Canada and Mexico can avoid tariffs going into play. With this in mind, we expect the aluminium and copper COMEX-LME arbs to begin to unwind from their elevated levels.

Meanwhile, the other key factor on prices will be tariffs on China. In the scenario above, with Canadian and Mexican tariffs avoided but Chinese tariffs remaining, we forecast that market participants will then focus on demand concerns with a potential reduction in global trade and/or shock to global economic growth creating uncertainty in investment and consumption.

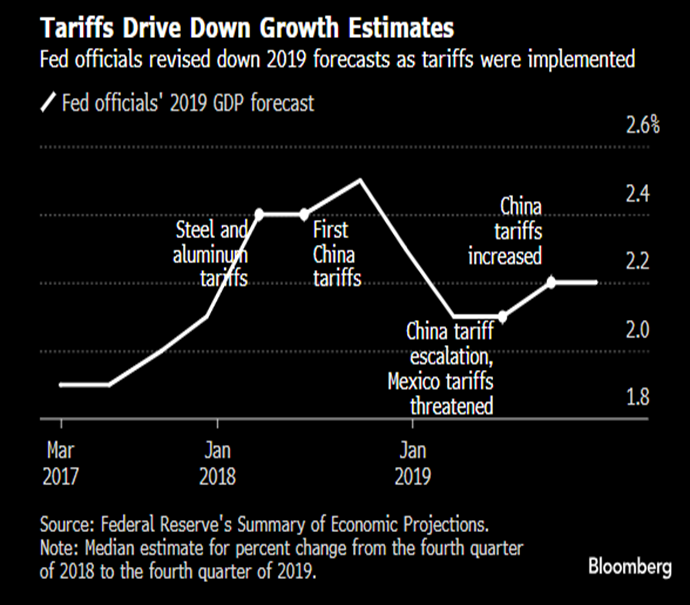

In addition to Chinese tariffs, the wider outlook for ‘universal tariffs’ is growing more unfavorable for the US economy, especially if we base it on verbatim reports of Federal Reserve deliberations back in 2019. (Note, the verbatim accounts of closed-door meetings are released with a five-year lag).

““In 2019, the first full year after Trump began imposing the levies — which were much more carefully targeted versus the broad ones he’s threatening now — the US lost 43,000 factory jobs, industrial production contracted, business investment stalled and real median household incomes fell for the first time in five years. By one estimate, the hit to consumer earnings was $8 billion” - Bloomberg

From the FOMC Meetings 2019:

March: “Your last slide looks for tariff effects on prices and activity. There is growing evidence, from both tariff data and the careful study of import prices paid at the dock, that foreign producers are not cutting their prices to offset the effects of the tariffs— rather, U.S. importers are paying the bulk of the tariffs and boosting consumer prices in some cases, including for household appliances…”,

October: “Several retailers headquartered in the District are concerned about their profitability in light of the tariffs on apparel and footwear that took effect on September 1. Most plan to absorb this cost increase in the near term, but one retailer was selectively increasing prices of some goods in response to new tariffs. “On the very negative side are manufacturing and investment, which continue to be held back by slowing foreign demand, higher tariffs, and trade uncertainty, and the fallout from these headwinds continues to spread, at least in the 12th District. Several contacts reported on a recent sharp slowdown in overseas sales and leasing of heavy equipment—cranes, to be exact—which is now spilling over into various supporting industries not just related to the cranes themselves, but all of the people who manufacture the parts for those cranes. Weak growth and pessimism resulting from trade tensions are also starting to materially affect or alter business planning. My contacts in business services noted that their clients with a global presence have started to cancel discretionary investment spending. They had just been delaying and delaying, hoping for an end to the trade disputes. For them, the Rubicon on trade has now been crossed”.

BBG Chart on Impact of Tariffs on US GDP

Source: Bloomberg

As far as the tariffs imposed in 2018 on aluminum, steel and other Chinese goods are concerned, the net effect was higher prices and job losses and causing a calculated fall of $8.2Bn in real income and a cost of $14Bn on domestic consumers and importers in payments to the government.

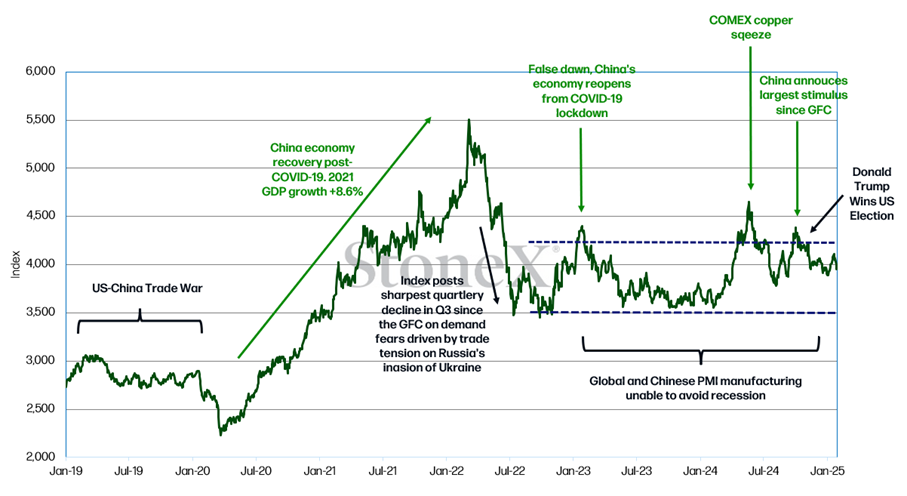

LME 3M Base Metal Price Performance Versus Key Macro Drivers

Source: Bloomberg

The outlook is growing more precarious for base metals, with concerns over global demand likely to become a focus point. The suite has been unable to successful hold over its two-year sideways trading channel, with little in the way of positive price drives coming from the macro-outlook in the near-term.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.