President Trump’s Inaugural Policy Speech – Base Metal Market Response – Quick Take

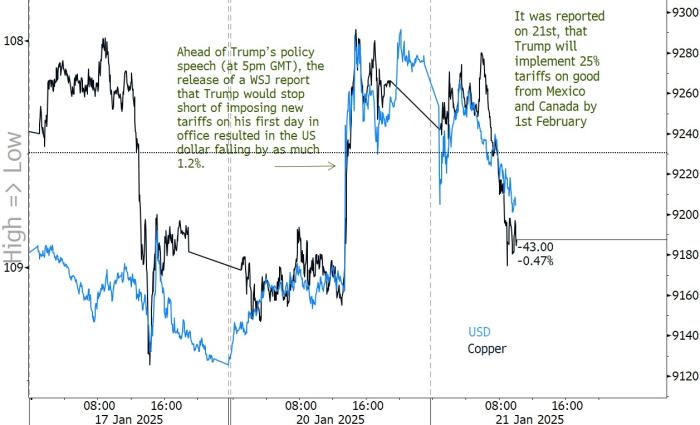

LME 3M Copper Versus US$ Intra-Day

Source: Bloomberg

Moves in the US dollar have been at the heart of base metal price direction over the last 48 hours, something we expect to remain in place in the days and/or weeks ahead as the markets try to absorb and anticipate what policy actions are to come.

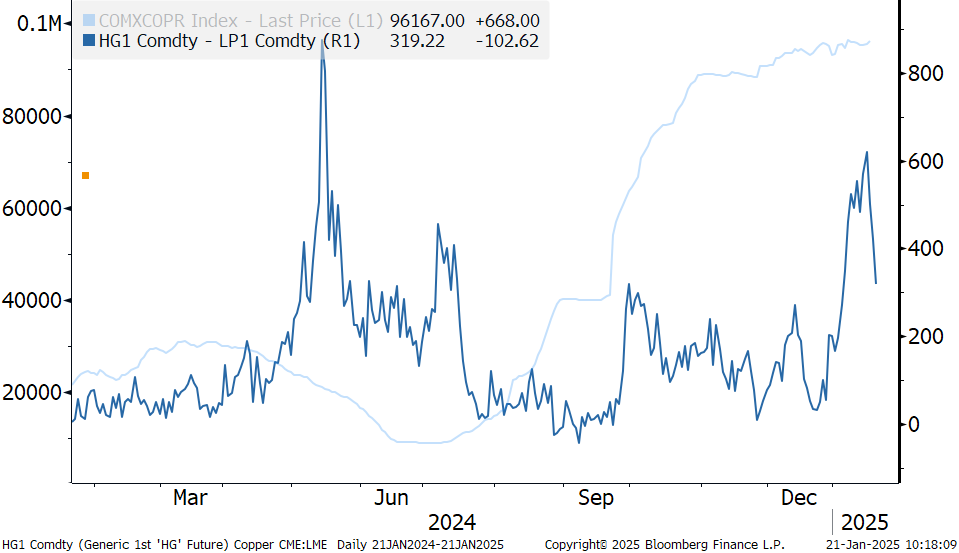

Copper CME-LME Arb Versus CME Copper Stocks

Source: Bloomberg

What Where the Key Takeaways from the Policy Speech?

Immigration to Be a Key Focus Area

- Trump to sign on day one, a ‘national emergency’ on its Southern Boarder.

- Drug cartels will be known as terrorists.

- Enact the Alien Enemies Act of 1978 to eliminate all foreign gangs and criminals in the US.

Inflation to Be Tackled by Lowering Domestic Energy Prices

- Trump stated that the US will defeat record inflation, in part by reducing overspending, while also lowering the cost of energy products, “drill, baby drill”.

- Trump to sign a ‘National Emergency on Energy’ on day one.

Domestic Manufacturing to Be Supported: Automotives, Oil & Gas and Strategic Reserves a Focus Area

- The US will return to being a manufacturing nation again, the automotive industry to be built out

- Strategic reserves will be filled to the top, with oil and gas exported all over the world

Climate Policy to be Rolled Back

- Leave the Paris Agreement

- Revoke the US EV mandate

Trade Tariffs and Tax to Come In

- The US will overhaul the current trade system and implement tariffs and taxes on other countries to enrich domestic citizens. (An external revenue service will be put in place to collect all tariffs).

- Note, it was reported on 21st January that 25% tariffs will be implemented on Canada and Mexico by 1st February

USGS US % Import By Country

| Refined Imports | Canada | Mexico |

| Copper | 17% | 2% |

| Nickel | 49% | n/a |

| Lead | 30% | 12% |

| Zinc | 51% | 15% |

| Tin | n/a | n/a |

| Aluminium | 59% | 5% |

Source: USGS

Military Forces to Be Built Out

- To build the strongest military force the world has ever seen

- Military might would be used to end war, prevent war and win war. (Note, Trump mentioned ‘ending war’ twice over his speech).

The Gulf of Mexico to be renamed the Gulf of America

Supply Chain Ownership

- The US will ‘take back’ the Panama Canal from Chinese operation

Space Exploration

• The US to put its “stars and stripes” on Mars

Our View

The policy speech did not reveal any shocks to the market, with the delayed implementation of tariffs on Mexico and Canada being seen as a softer start than expected. When it comes to China, there too has been little in the way mentioned on the implementation of 60% tariffs, however, Bloomberg reported that staff have been ordered to investigate whether Beijing has complied with the trade deal signed during his first term, and that “meeting and calls” with Chinese President Xi will be taking place.

What Can We Expect Ahead?

The market is likely to remain firmly in risk-off mode in the near-term, with dollar movements at the centre of base metal price direction. However, looking to the months ahead, attention will shift to the impact that potential tariffs will play on the base metal market. In our view, tariffs (either phased or not) on key producing countries like Canada will likely provide short-term price support to the suite on supply concerns. However, in the longer-term, altered trade routes and any retaliation on tariffs could lead to economic shocks, uncertainty in investment and ultimately headwinds for the suite, especially if we see tensions rise between the US and China. Having said this, there is a lot of unpack from Trump policy speech with metal-intensive sectors forecast to be underpinned (driven by a renewal in domestic manufacturing, build out on military might, artificial intelligence and space exploration). However, this does come at the cost of support for the green transition, which has been the fastest growing area of demand for the base metals this decade.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.