A Trump Victory - What Implications for the Base Metal Market?

Donald Trump’s victory in the US election was confirmed just after 10:30am GMT, with 277 electoral colleges votes (and 271 required to win). At the time of writing, the Financial Times has reported 54 out of the 56 races called, with Harris holding 226 votes versus Trump at 295. With a four-year Trump term ahead for the market, this article does a quick take at what this means for base metals?

At the time of writing, Trump holds control of the presidency, the Senate and potentially the House (with 397 districts of 435 counted, with Trump holding 206 votes over 191 for Harris).

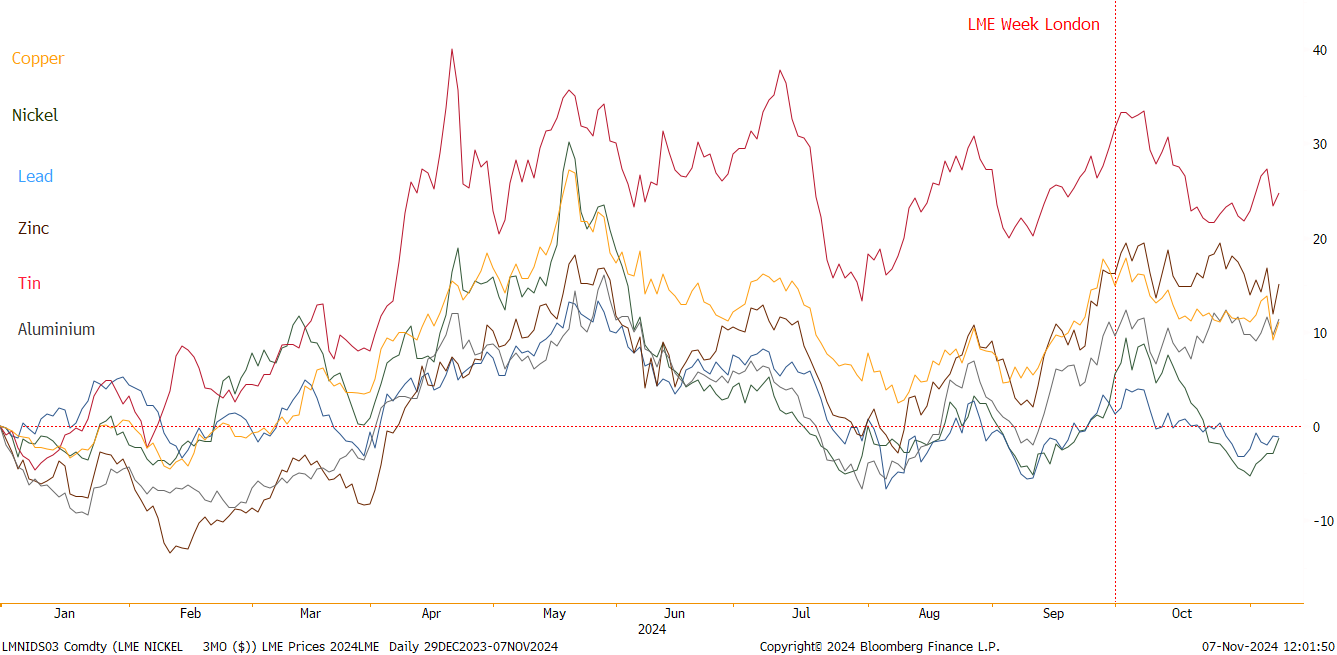

LME 3M Base Metal Price Performance

Source: Bloomberg, StoneX

What Could a Second Trump Term Look Like?

“Investors shouldn't assume that Trump's second term will look just like his first, a point that could come to the forefront after immediate post-election market action plays out. Trump’s first term was heavy on tax cuts and light on tariffs; his second term could be a mirror image — a different policy mix with unique market implications” – StoneX Strategy Team

Lighter Tax Cuts?

- Trump has proposed smaller cuts than in his first-term, including tax-free treatment for tip income and overtime pay; modest, targeted reductions of the corporate rate; and — most important to him — extension of 2025-expiring individual income tax cuts. That isn't the same "big bang" as happened in 2017.

- In addition to resistance from Democrats, the federal budget deficit, now near $2 trillion (6% of GDP), may restrain Trump's desire to cut taxes much further.

Heavier Tariffs?

- Trump’s tariff proposals are more aggressive than they were during his first term, with stated plans for a 10% across-the-board tariff and a special 60% tariff on Chinese imports. Unlike tax policies, tariffs do not require Congressional approval, offering him greater flexibility to pursue these measures. Trump has argued they're a better way to generate government revenue. During his first term, average U.S. tariffs rose only modestly, from 2% to 3%; his new proposals would bring tariffs to heights unseen since the 1930s.

Trump tariffs - What Implications for the Base Metal Market?

Trump has previously mentioned he would:

- Implement 10-20% tariffs across the board on all imports into the U

- Implement a 60% tariff on Chinese goods imports

- Under the scenario that China invades Taiwan, Trump stated in a WSJ interview

“I would say: if you go into Taiwan, I’m sorry to do this, I’m going to tax you at 150% to 200%”.

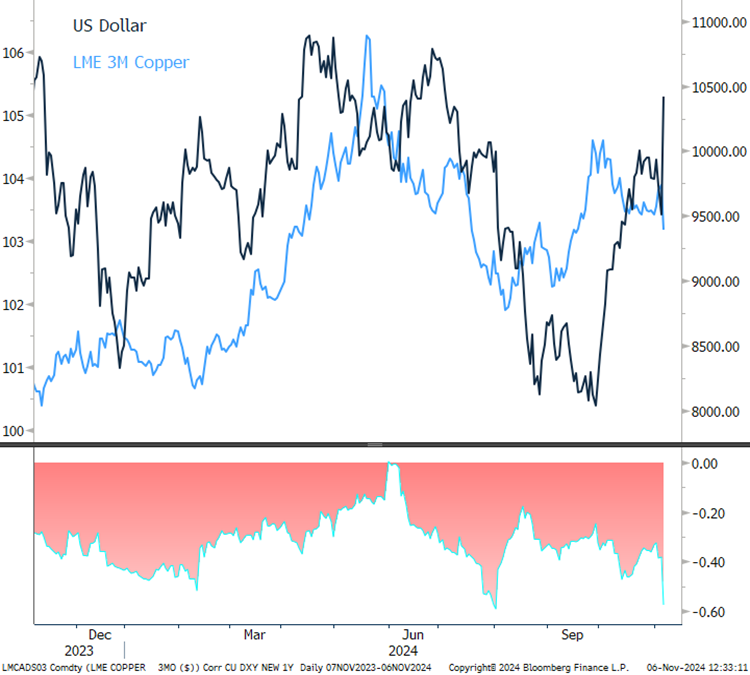

Stronger USD & Potential Slowing Global Growth = Net Negative for Base Metals

A follow through of these tariffs (which do not require approval by Congress), would be a shock to the market, resulting in (based on economic theory from 2018 tariff increases), a stronger US dollar, slowing growth and labour productivity. Furthermore, in the scenario of retaliation by US trade partners, the outlook may become more unfavourable for industrial metals.

Correlation of US Dollar and LME 3M Copper

Source: Bloomberg, StoneX

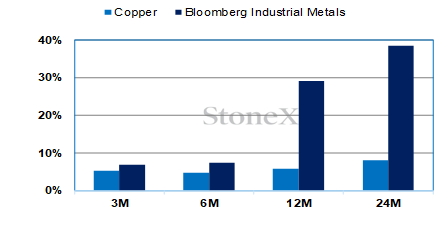

Base Metal Index & Copper Prices Post 100bps Decline in US 2Y Yields

Source: Bloomberg, StoneX

An Escalation in Geopolitical Tensions = Net Negative for Base Metals

Geopolitical tensions can impact a commodity market in two ways:

- A risk channel: Financial markets overestimate the impact on supply resulting in higher prices

- An economic activity channel: Shocks to economic growth, creating uncertainty in investment and demand, leading to lower prices.

We forecast (on average) the economic activity channel as having a longer lasting impact on base metals.

Copper : Gold Ratio

Source: Bloomberg, StoneX

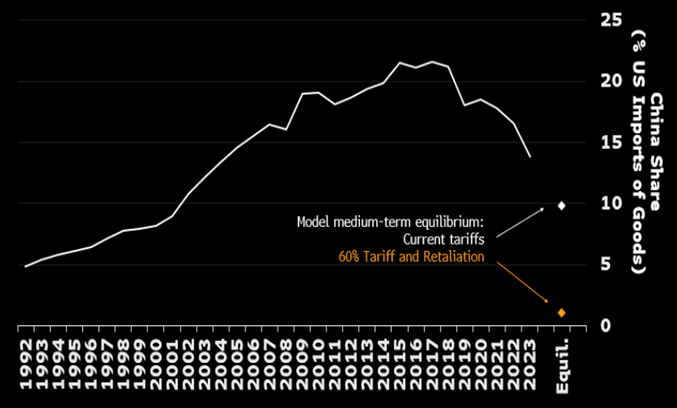

Chinese Reliance on Exports for Domestic Growth to Reduce = Net Negative for Base Metals

StoneX Ivy Li reports: “an additional 30-60% tariffs on Chinese exports goods to the US could slash China’s foreign trade growth ratio by 4-8%”. The US share of China’s foreign trade could fall to close to zero (it currently stands at 15%, down from 20% pre-2019 trade war). However, it is likely in this scenario China would move to increase business with the global south and emerging markets, in part offsetting the negative impact.

BBG Impact on Chinese Exports On 60% Tariff Increase

Source: Bloomberg, StoneX

China May Have to Lean on Fiscal Stimulus Harder = A Double-Edged Sword

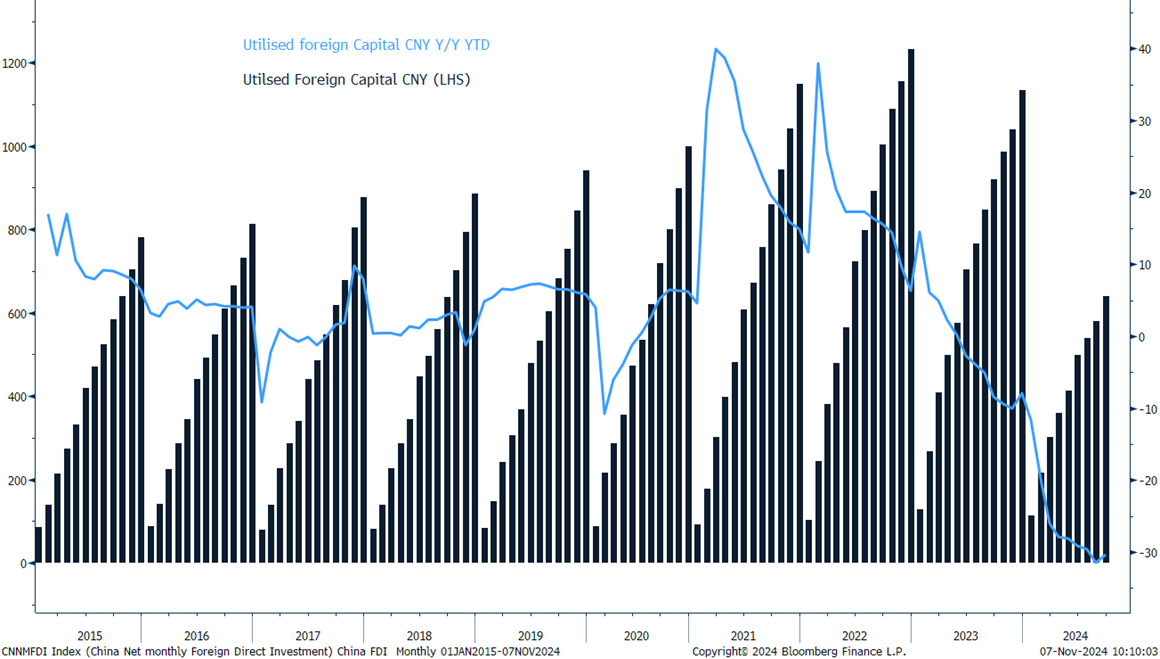

While the Chinese Government has previously alluded to the fact that they may need to increase the overall level of fiscal stimulus in the country on a Trump victory in the US elections (with the NPCSC meeting usually being moved to an odd numbered month, post the election). Higher stimulus in China is not an outright bullish parameter, given that this move will be taken in light of the negative impact from tariffs and the PBoC’s limited freedom to lower interest rates (given a potential increase in central bank policy divergence). Furthermore, with Foreign Direct Investment (FDI) in China having already fallen to historically low levels in 2024 (down 30.4%Q1-Q3), the outlook for higher tariffs will likely result in an acceleration of foreign investment away from China.

Foreign Direct Investment into China

Source: Bloomberg, StoneX

Our View

Overall, we foresee a second Trump term with an economic policy lever heavy on tariffs and lighter on tax cuts, creating upward pressure on short- and long-term interest rates. Base metals to move lower in the medium-term due to potential inflationary policies (corporation tax cuts, tariffs), heightened geopolitical tensions and building concerns over China recovery.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.