Morning Copper Markets

Copper Stockpiles Hit 21-Month High Amid Rare China Exports

Copper stockpiles on the London Metal Exchange have reached a 21-month high, marking the highest level since October 2021, currently standing at 195,475 tons. This increase, which saw a 2.3% rise on a single day, is attributed to deliveries from Korea and Taiwan, key points for metal flowing from China. Despite traditionally being a significant importer, China has seen a surge in copper exports this year due to a mismatch between its smelter output and weakened demand from its manufacturing and construction sectors. This shift has contributed to a 90% increase in LME copper inventories since early May. Concurrently, stockpiles on the Shanghai Futures Exchange have also risen, with no significant drawdown in Chinese inventories during the peak demand period. This accumulation of stockpiles poses a challenge to the market, despite a significant price rally this year. Copper prices have recently seen a decline, with a 0.5% drop to $9,824 per ton on the LME, though they remain 15% higher year-to-date, ranking copper as the second-best performer after tin on the LME.

European Miners Drop for a Fourth Day as Iron Ore, Copper Slip

European mining stocks experienced a decline for the fourth consecutive day, marking the longest losing streak since January, as reflected in the Stoxx 600 Basic Resources Index which dropped by 0.3% early in the London session. Leading the downturn were significant players such as Rio Tinto, which fell by 0.5%, making it the most substantial negative influence on the index. Other notable declines were recorded by Glencore, BHP Group, KGHM, Boliden, and Antofagasta. The sector's slump was driven by negative developments in China, where ongoing losses among steel mills and developers, coupled with discouraging inflation data, signal persistent economic challenges. This environment has particularly impacted iron ore, which saw a significant reduction of 3.6% in its futures, settling at $105.45 a ton. Similarly, copper prices decreased by 0.2% to $9,850.50 a ton after the release of data indicating continued deflationary pressures in China, dampening the demand outlook in the world's largest copper market.

BHP Entrusts Rising Star with Its Copper Mines

Anna Wiley has recently been appointed as BHP's asset president for copper in South Australia, a significant leadership role tasked with integrating and expanding the copper mines acquired from OZ Minerals. This role is critical in increasing production by 50%, aiming to achieve over 500,000 tonnes annually. Wiley's career trajectory includes strategic positions at Rio Tinto and significant involvement in BHP's decarbonization strategy, emphasizing the importance of copper in reducing emissions. Her recent efforts focus on integrating operations across BHP's South Australian mines, enhancing copper concentrate delivery from Carrapateena and Prominent Hill to Olympic Dam. Wiley is also exploring the potential development of the Oak Dam prospect into a new mine. Beyond her professional accomplishments, Wiley is actively involved in promoting a culture of collaboration and inclusivity within her teams.

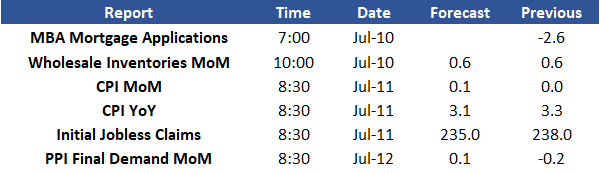

Macroeconomic Data

![]()

![]()

Sources: Bloomberg, StoneX

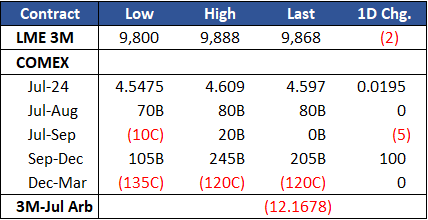

Copper Prices and Spreads

![]()

Sources: Bloomberg, StoneX

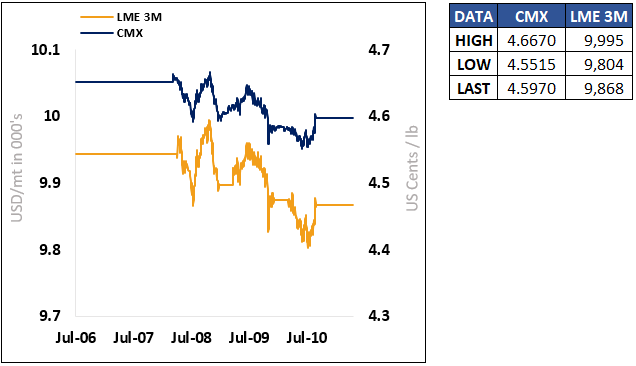

Comex Active & LME 3M – 3 Day Price Trend

![]()

Sources: Bloomberg, StoneX

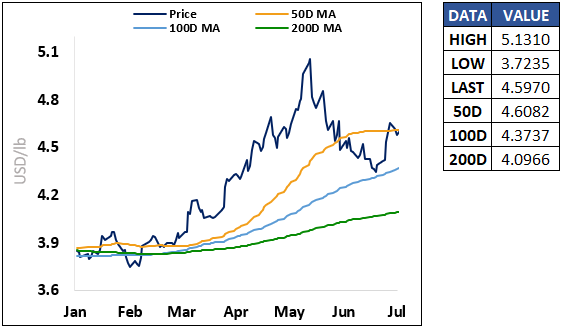

Comex Active Month – 6 Month Price Trend

![]()

Sources: Bloomberg, StoneX

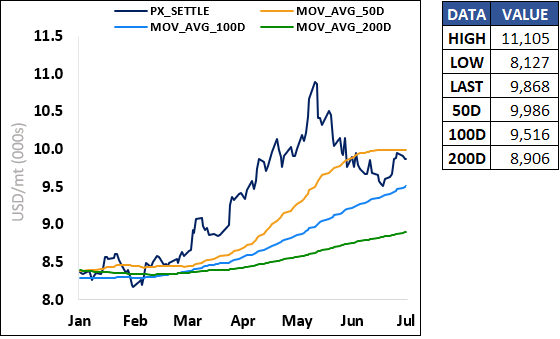

LME Rolling 3M – 6 Month Trend

![]()

Sources: Bloomberg, StoneX

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.