What are vanilla options?

Vanilla options

Article reviewed by Kevin Choi – Vice President - Quantitative Trading – SXM /FXPB Team

Vanilla options are financial instruments that give holders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) within a specific time period. There are two main types of vanilla options: call options, which give the right to buy the asset at the strike price, and put options, which give the right to sell at the strike price.

Companies may use vanilla options to manage exposure to price movements in particular assets. For example, a business might use a call option to secure a purchase price for raw materials if they expect prices to rise, while another might use a put option to protect against a potential decline in an asset they hold.

How vanilla options provide the right but not the obligation

Vanilla options differ from other contracts, like futures, in that there's no obligation to fulfill the contract terms. Instead, holders have the right, but not the obligation, to buy or sell the underlying asset at a set price. This unique feature is what gives an option its value (premium). Here's how that works.

Options involve two main players:

The holder (or buyer), who pays the premium for the right, but not obligation, to make the optimal decision at expiration.

The writer (or seller), who collects the premium but must fulfill the holder if the option is exercised.

If the underlying asset moves favorably, the holder could be inclined to exercise and profit from the favorable move. In this scenario, the writer must either sell (in a call option) or buy (in a put option) the asset at the strike price, even if it's disadvantageous for them. Conversely, if the market moves unfavorably, the holder can simply let the option expire and limit any losses to the amount paid. In this scenario, the writer would keep the premium with no other obligations.

Understanding the strike price in vanilla options

The strike price in vanilla options is the agreed-upon price at which the holder can buy or sell the asset before the option expires. It’s set at the time of the transaction and remains fixed for its entire duration. Here’s how strike price works for call options and put options.

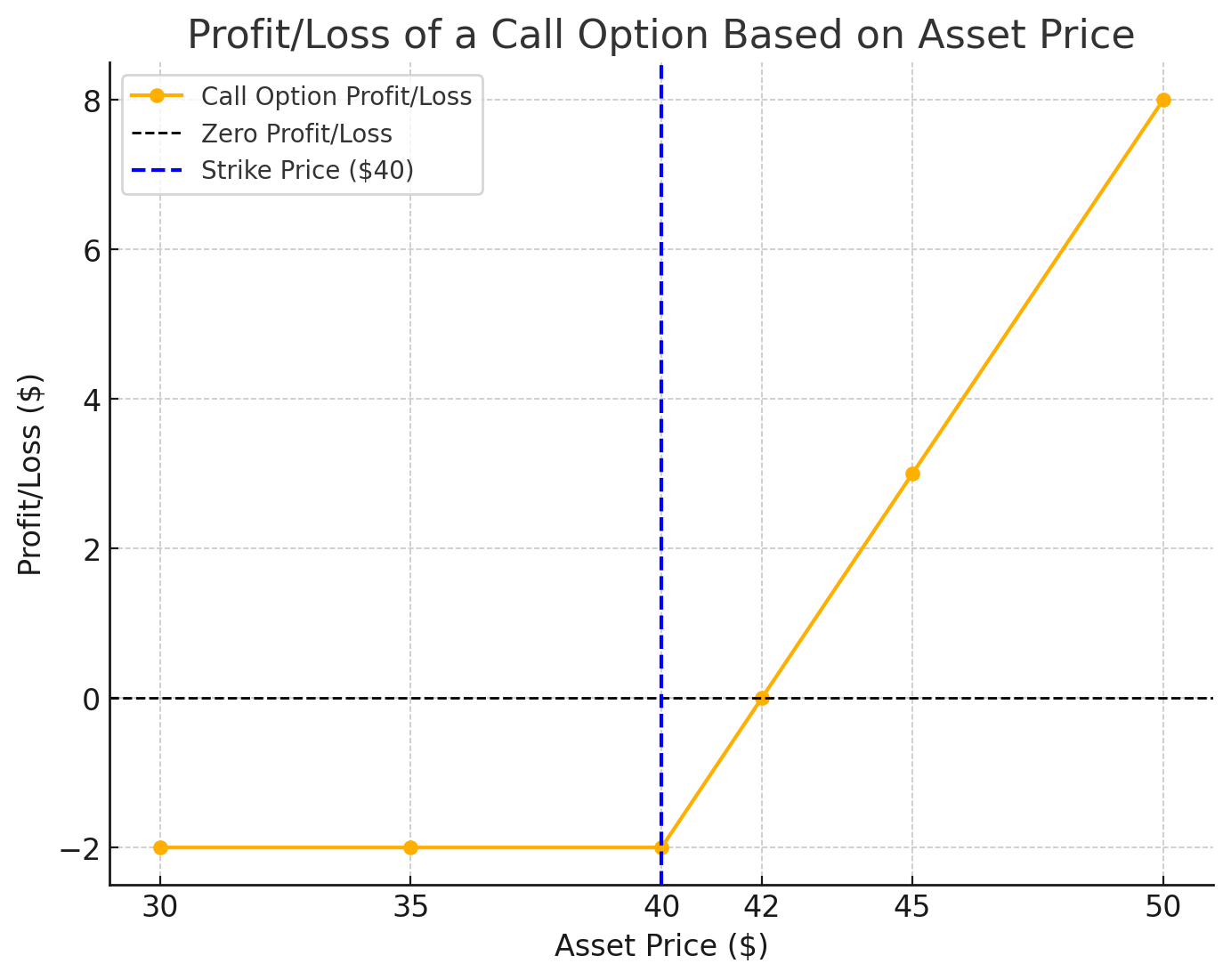

Call options

The strike price for call options is the price at which the holder can buy the asset. For call options to lead to a potential positive outcome, the underlying asset’s price must exceed the strike price by more than the premium paid.

For example, if an investor buys a call option with a strike price of $40 and a premium of $2, the asset’s price must rise above $42 for the option to be considered profitable.

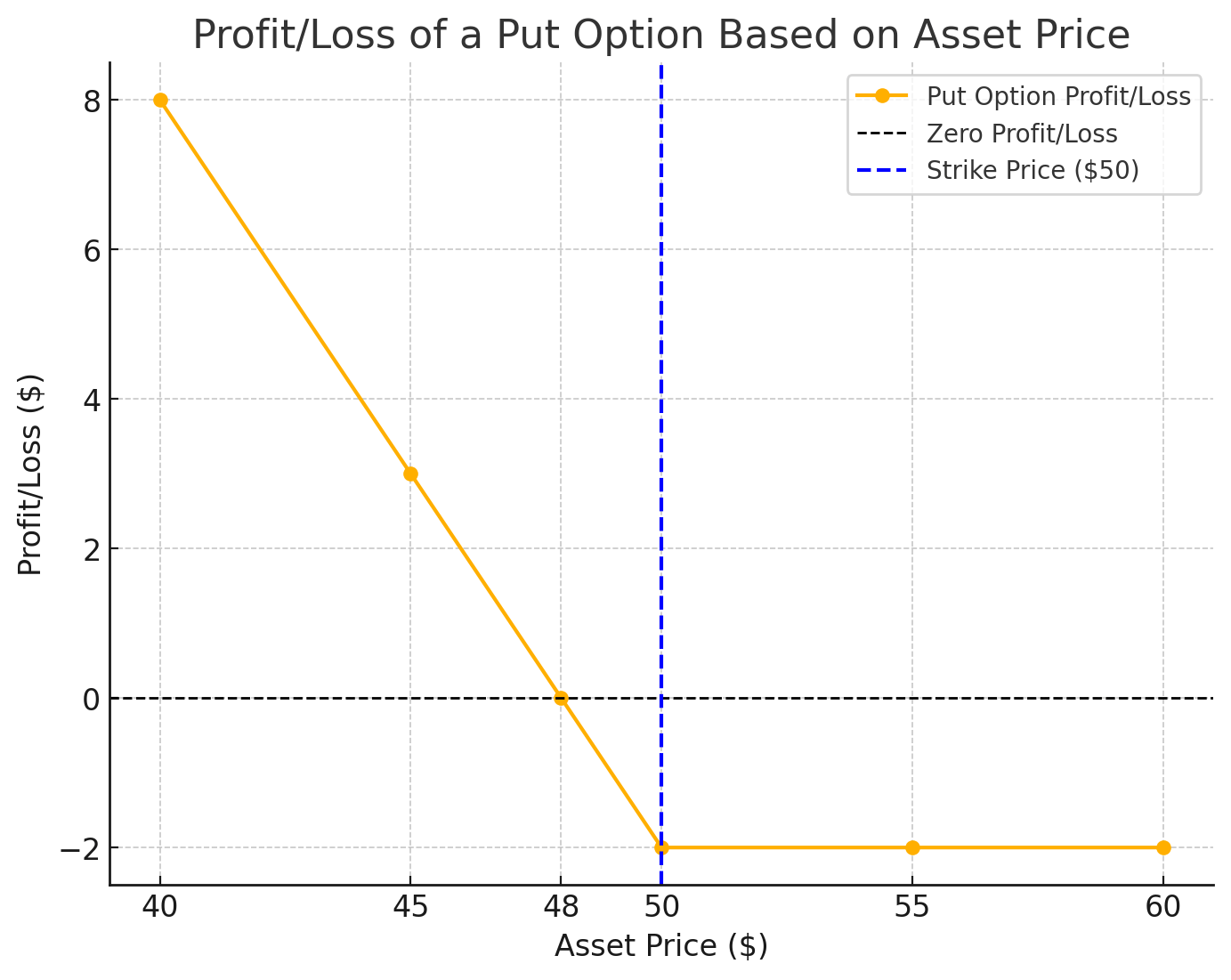

Put options

The strike price for put options is the price at which the holder can sell the asset. For put options to be profitable, the asset’s price must fall below the strike price. For example, if an investor buys a put option with a strike price of $50 and a premium of $2, the option will be profitable if the asset’s market price falls below $48. This allows the holder to sell the asset at a higher-than-market price and secure a profit.

How the underlying asset affects vanilla option value

A vanilla option’s value is influenced by the odds of it being profitable before expiration. There are three key contributing factors to that probability: The price of the underlying asset, the implied volatility of the underlying asset, and the time to expiration.

Price: When the market price of the underlying asset rises, a call option becomes more valuable because the odds and profitability of an exercise increases. On the other hand, a put option loses value, because the odds and profitability of an exercise decreases.

Implied Volatility: Assets with more volatile prices carry higher premiums as there’s a greater chance of the option reaching profitable levels before the expiration date.

Time to Expiration: All things being equal, a vanilla option with longer time to expiration is more expensive, as more time means higher probability to profitability.

Differences between vanilla options and exotic options

There are three main differences between vanilla options and ‘exotic’ options: complexity, market, and customization.

Complexity: Vanilla options are simple and straightforward, with terms that are easy to understand. Exotic options, on the other hand, have more complex features with special conditions, like variable expiration dates or payout structures.

Market: Vanilla options are often traded on exchanges, making them accessible and standardized. Exotic options, however, are usually managed through OTC hedging solutions. This allows for more flexibility but also increases counterparty risk.

Customization: Vanilla options have fixed features that aren’t customizable, like the strike price, expiration date, and underlying asset. Exotic options, however, are more customizable and can be tailored to specific risk exposures or market conditions.

Examples of exotic options include barrier options, digital options, and Asian options.

Why businesses use vanilla options for hedging

Businesses can use vanilla options as a strategy to try to manage exposure to price fluctuations in assets.

Offset potential losses

Businesses may use vanilla options to help manage the impact of price fluctuations in assets like commodities or foreign currencies. For example, a company that relies on oil for its operations could use vanilla options to manage the risk of rising oil prices. If oil prices increase, outcomes from the options might help mitigate the impact of increased costs.

Create opportunities for returns

Vanilla options provide businesses a means to engage with price movements as part of a broader risk management approach. For example, if a company expects the value of a particular asset to rise, they can buy a call option to benefit from the price increase while limiting their exposure and initial investment.

How vanilla options are priced in OTC markets

In OTC markets, the price (or premium) of a vanilla option is based on its intrinsic value, market volatility, and time value.

Intrinsic value: This is the difference between the asset’s current market price and the option's strike price, only when the difference benefits the option holder. If the option would lead to a profit if exercised immediately, then it has intrinsic value.

Volatility value: This is the premium attributed to how volatile the underlying asset’s price is. Higher volatility means better odds for the option to be profitable, and therefore, commands a higher premium.

Time value: This is the remaining time until the option’s expiration date. The longer the option has until expiration, the more opportunity it has to move in the buyer's favor. As the expiration date approaches, the time value decreases (known as time decay).

The role of strike price and expiration in vanilla options

Strike price and expiration date both play important roles in vanilla options.

Strike price

The strike price is the price at which the holder can buy (for call options) or sell (for put options) the underlying asset. It’s set when the option is created and directly affects whether the option is profitable, in other words, if it’s ‘in the money’, ‘at the money’, or ‘out of the money’:

In the Money (ITM): A call option is in the money if the asset’s market price is above the strike price, while a put option is in the money if the asset’s price is below the strike price. These options have intrinsic value.

At the Money (ATM): Options are at the money when the market price is equal to the strike price. These options have no intrinsic value but have time and volatility value.

Out of the Money (OTM): A call option is out of the money if the market price is below the strike price, and a put option is out of the money if the market price is above the strike price. These options have no intrinsic value and are unlikely to be exercised unless the market price moves favorably. While they have less time and volatility value than ATM options, they still have value.

Expiration date

The expiration date is when the option expires. If it’s not exercised by this date, the option becomes worthless. Options generally lose value as they near expiration, especially if they are out of the money.

Most vanilla options use one of two expiration rules. They are referred to as American and European options, despite having no relation to the geography of trade executions.

American options: Can be exercised at any time before expiration, giving more flexibility if the option is in the money before expiration and the holder has cash-flow or inventory preferences.

European options: Can only be exercised on the expiration date, meaning the delivery of the underlying asset can only happen at the end of the options’ life.

How vanilla options can be applied in risk management strategies

Vanilla options can be used by companies and institutional investors as part of broader risk management practices. Here are some ways they may be applied:

Manage downside risk

Vanilla options can provide a way for companies to manage downside risk. For example, a company holding a substantial position in a particular stock or commodity can use put options to establish a minimum selling price. If the asset's market value falls below the strike price, the option can be exercised at the predetermined price, potentially offsetting losses.

Access additional return opportunities

Companies may use call options to gain exposure to an asset's price movements without having to purchase it outright. If the asset's market value increases, the company can sell the option and participate in market gains without ever owning or taking delivery of the asset itself.

Manage currency exposure

Vanilla options can also serve as a way to manage exposure to currency fluctuations. For example, if a company expects future expenses in a foreign currency, call options on that currency can set a rate in advance. This may help manage the impact of depreciation and allow companies to more accurately forecast their financial performance. Another way a company can hedge against foreign exchange risk is through OTC derivatives products.

Key benefits of vanilla options for institutional investors

Below are some ways vanilla options may be applied in institutional investment strategies:

Manage risk exposure: Vanilla options can provide an alternative to directly purchasing assets. Since investors only pay for the option and aren't required to buy or sell the asset, they may use options as one way to manage exposure to market movements.

Lower capital outlay: Vanilla options generally require a lower initial capital commitment compared to purchasing the underlying asset. This means investors have the opportunity to control a larger position with a smaller upfront investment.

Flexibility without obligation: Vanilla options give buyers the flexibility to choose whether to exercise the option. This gives them the opportunity to potentially benefit from favorable market conditions while deciding to let the option expire if conditions are unfavorable.

Defined downside exposure: With vanilla options, the maximum potential loss is limited to the premium paid, while gains depend on market movements. This can help manage downside exposure while maintaining the opportunity for gains.

Portfolio diversification: Vanilla options can provide different types of exposure in a portfolio, which may help investors diversify by including assets that behave differently to other holdings, like spots and futures.

This material is for informational purposes only and should not be considered as an investment recommendation or a personal recommendation.

© 2025 StoneX Group Inc. all rights reserved.

The subsidiaries of StoneX Group Inc. provide financial products and services, including, but not limited to, physical commodities, securities, clearing, global payments, risk management, asset management, foreign exchange, and exchange-traded and over-the-counter derivatives. These financial products and services are offered in accordance with the applicable laws in the jurisdictions in which they are provided and are subject to specific terms, conditions, and restrictions contained in the terms of business applicable to each such offering. Not all products and services are available in all countries. The products and services offered by the StoneX Group of companies involve risk of loss and may not be suitable for all investors. Full Disclaimer.

This website is not intended for residents of any particular country, and the information herein is not advice nor a recommendation to trade nor does it constitute an offer or solicitation to buy or sell any financial product or service, by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please refer to the Regulatory Disclosure section for entity-specific disclosures.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The information herein is provided for informational purposes only. This information is provided on an ‘as-is’ basis and may contain statements and opinions of the StoneX Group of companies as well as excerpts and/or information from public sources and third parties and no warranty, whether express or implied, is given as to its completeness or accuracy. Each company within the StoneX Group of companies (on its own behalf and on behalf of its directors, employees and agents) disclaims any and all liability as well as any third-party claim that may arise from the accuracy and/or completeness of the information detailed herein, as well as the use of or reliance on this information by the recipient, any member of its group or any third party.