Managing risk in soybeans

Explore our services

-

Soybean hedgingWe design and execute hedging programs built on proven commodity risk management principles for soybean producers, consumers and merchandisers, and are not speculatively oriented. Futures and options activities are used to assist grain marketing by providing opportunities to retain margins and manage risk.

Soybean hedgingWe design and execute hedging programs built on proven commodity risk management principles for soybean producers, consumers and merchandisers, and are not speculatively oriented. Futures and options activities are used to assist grain marketing by providing opportunities to retain margins and manage risk. -

Equities market makingOur award-winning consultants know the futures and the physical markets. To limit risk and improve margins and bottom-line results all along the entire lumber supply chain, we’ll construct a risk-management program tailored to your needs, then work closely with you to execute it.

Equities market makingOur award-winning consultants know the futures and the physical markets. To limit risk and improve margins and bottom-line results all along the entire lumber supply chain, we’ll construct a risk-management program tailored to your needs, then work closely with you to execute it. -

StoneHedge Merchandising SystemStreamline origination. Automate offers. Simplify hedging. Our web-based merchandising system allows commercial soybean customers to automate hedging and incorporate cash bids, stream quotes, offer/order initiation and manage hedges through one easy-to-use platform.

StoneHedge Merchandising SystemStreamline origination. Automate offers. Simplify hedging. Our web-based merchandising system allows commercial soybean customers to automate hedging and incorporate cash bids, stream quotes, offer/order initiation and manage hedges through one easy-to-use platform. -

Futures clearing & executionOur robust back-office infrastructure enables us to manage futures clearing and allocation needs with expertise and efficiency. We offer clients 24-hour trade support and execution desks, direct market access via FIX and exchange-specific interfaces to suit your business needs.

Futures clearing & executionOur robust back-office infrastructure enables us to manage futures clearing and allocation needs with expertise and efficiency. We offer clients 24-hour trade support and execution desks, direct market access via FIX and exchange-specific interfaces to suit your business needs. -

OTC productsOver the counter (OTC) products offer benefits just like exchange-traded futures. From swaps and structured products to customized and exotic options, all our OTC offerings help farmers/producers, grain elevators/originators, and food and beverage manufacturers hedge against grain market volatility.

OTC productsOver the counter (OTC) products offer benefits just like exchange-traded futures. From swaps and structured products to customized and exotic options, all our OTC offerings help farmers/producers, grain elevators/originators, and food and beverage manufacturers hedge against grain market volatility. -

Managed futuresOur managers have extensive trading and market experience, but also years spent engaged in the commodities they represent, many as farmers, growers and producers. We scrutinize statistical data to fit the right managers to a portfolio and provide reports for clients to evaluate these traders daily. Selecting a manager is ultimately the client’s choice.

Managed futuresOur managers have extensive trading and market experience, but also years spent engaged in the commodities they represent, many as farmers, growers and producers. We scrutinize statistical data to fit the right managers to a portfolio and provide reports for clients to evaluate these traders daily. Selecting a manager is ultimately the client’s choice. -

Physically traded productsStoneX offers clients financing and trade facilitation to provide working capital for commodity inventory and hedge margin. Our physical trades provide forward pricing and supply chain management services, allowing clients to manage their commodity commerce without tying up valuable resources.

Physically traded productsStoneX offers clients financing and trade facilitation to provide working capital for commodity inventory and hedge margin. Our physical trades provide forward pricing and supply chain management services, allowing clients to manage their commodity commerce without tying up valuable resources. -

Inventory financingWe offer inventory sales/repurchase, transactional finance, processing, and tolling arrangements for clients. We can also provide financing that is incremental to your established banking relationships. We aim to help clients optimize their fixed assets, such as storage facilities, terminals, pipelines, and processing facilities.

Inventory financingWe offer inventory sales/repurchase, transactional finance, processing, and tolling arrangements for clients. We can also provide financing that is incremental to your established banking relationships. We aim to help clients optimize their fixed assets, such as storage facilities, terminals, pipelines, and processing facilities.

Soybeans solutions

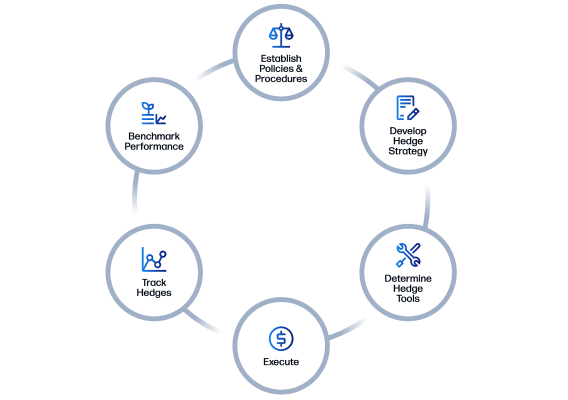

Commodity risk management

Our soybeans team offers innovative risk-management tools to mitigate risk including exchange-traded futures and options, cash and forward-market contracts, and customized over-the-counter products. Let our seasoned consultants build a risk-management program tailored to your needs, and then work closely with you to execute it.

Technology & clearing

We work with investors, trading advisors, custodians, portfolio accounting groups, and fund administrators to provide customized reports and files for all activity, open positions, and money balances. Dedicated Customer Service groups allow 24-hour account access via our MyStoneX web-based portal.

Trade Allocation

Automated Average Price System

My.StoneX.com portal

Specialized foreign exchange

Our capacity includes foreign exchange services to international aid and development organizations, UN agencies, NGOs, religious entities, governmental agencies, multinational corporations, and financial institutions in over 175 countries, with expertise in exotic currency payments and payments to the developing world.

StoneX risk management consultants have in-depth expertise in the supply-and-demand situation for specific commodities, access to our extensive proprietary database and detailed historical knowledge, and substantial experience creating and using innovative risk-management tools.

We've spent decades developing and designing financial solutions, tools, and platforms to help companies manage risk, meet budget restrictions and reduce market volatility. Let our specialist help you grow your bottom line.

Our clients

Our Grains and Oilseeds Group is here to advise and provide soybean clients the tools and services necessary to understand risk and the risk management process. After assessing your needs and risk tolerance, we'll design a program that reflects your objectives.

Soybean producers

Food and beverage industry

Corporations & cooperatives

We work with companies worldwide that originate and process soybeans, corn and wheat; grow or process sugar, coffee, dairy, lumber, and cotton; and produce energy products from crude oil or ethanol. We provide risk management, hedging, and complete marketing services to traders, processors, manufacturers' elevators, and end-users.

Cultivating Connections: Corn, Wheat & Soybeans

Join us in Ohio, where agriculture isn't just an occupation; it's a way of life for StoneX Regional Director Bailey Elchinger as she navigates the fields that have shaped her family for generations, turning her agricultural insights into your strategic advantage in the commodity markets.

Perspective: Morning Commentary for January 17

Friday 2:39 PM

Perspective: Morning Commentary for January 17

Friday 2:39 PM

Top Third Opening Audio Comments

Friday 2:22 PM

Top Third Opening Audio Comments

Friday 2:22 PM

Brazil Weather Forecast

Friday 11:30 AM

Brazil Weather Forecast

Friday 11:30 AM

Upcoming events

FAQ

For what are soybeans used?

How are soybeans traded?

What is soybean crushing?

What are soybeans?

Where are soybeans commonly grown?

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

-

Globality

With access to 40+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

-

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

-

Expertise

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

© 2025 StoneX Group Inc. all rights reserved.

The subsidiaries of StoneX Group Inc. provide financial products and services, including, but not limited to, physical commodities, securities, clearing, global payments, risk management, asset management, foreign exchange, and exchange-traded and over-the-counter derivatives. These financial products and services are offered in accordance with the applicable laws in the jurisdictions in which they are provided and are subject to specific terms, conditions, and restrictions contained in the terms of business applicable to each such offering. Not all products and services are available in all countries. The products and services offered by the StoneX Group of companies involve risk of loss and may not be suitable for all investors. Full Disclaimer.

This website is not intended for residents of any particular country, and the information herein is not advice nor a recommendation to trade nor does it constitute an offer or solicitation to buy or sell any financial product or service, by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please refer to the Regulatory Disclosure section for entity-specific disclosures.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The information herein is provided for informational purposes only. This information is provided on an ‘as-is’ basis and may contain statements and opinions of the StoneX Group of companies as well as excerpts and/or information from public sources and third parties and no warranty, whether express or implied, is given as to its completeness or accuracy. Each company within the StoneX Group of companies (on its own behalf and on behalf of its directors, employees and agents) disclaims any and all liability as well as any third-party claim that may arise from the accuracy and/or completeness of the information detailed herein, as well as the use of or reliance on this information by the recipient, any member of its group or any third party.

The trading of commodities and derivatives such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Advisory services as well as the trading of futures and options is available through various subsidiaries of StoneX Group Inc. including but not limited to the FCM Division of StoneX Financial Inc. Public Disclosures for the FCM Division of StoneX Financial Inc. The trading of over-the-counter products or swaps is available through subsidiary StoneX Markets LLC to individuals or firms who qualify under CFTC rules as an eligible contract participant. Please click here for the full disclaimer.

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.